h/t @StockBoardAsset

Market momentum has never been higher but the risk of a crash is high

I wouldn’t want to scare you but have you seen a chart of the Dow Jones or the S&P 500 index recently? The RSI or Relative Strength Index, a technical indicator used by chartists to measure the speed and change of price movements, is at record highs.

In the technical world the RSI goes from zero to 100 and if a stock has an RSI below 30 it is described as “oversold”, and if the RSI is over 70, it is described as “overbought”.

While individual stocks are quite volatile and can regularly appear as oversold and overbought, an index like the S&P 500 index, which represents the average of 500 stock prices, is, by definition, not volatile and rarely becomes either oversold or overbought.

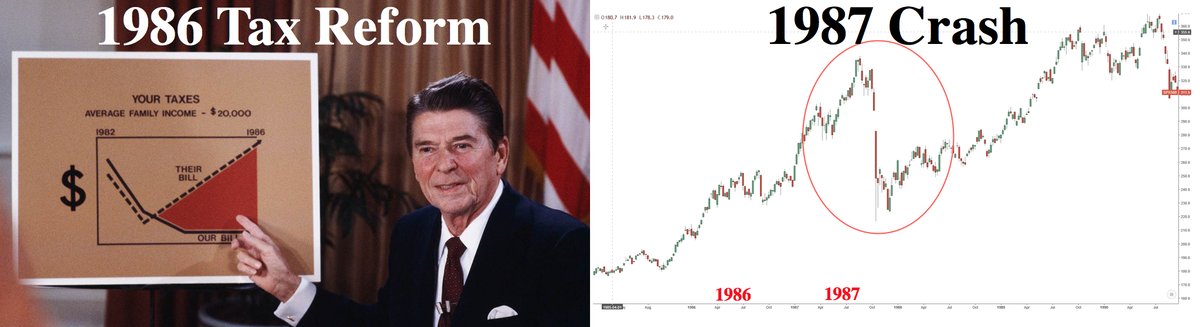

At the moment the RSI for the S&P 500 index is trading at 87.9. The Dow Jones RSI is currently 90.5. That means they are both overbought, which is rare enough, but more significantly, I can’t see that they have ever seen an RSI number this high, even in the tech boom, ahead of the 1987 crash, or before the global financial crisis. The momentum behind the US markets has never been higher than now.

On top of that, the S&P 500 price earnings ratio is now at 24.87x; that is the highest since the tech boom and higher than pre-GFC. I own a couple of businesses and I have to tell you, if someone wanted to come and pay me 24.87x post tax earnings for either of them I would retire a gazillionaire. Yet this is the average, repeat, average, valuation of $US25.12 trillion, repeat, trillion, dollars worth of US stocks in the S&P 500.

There has rarely been such positive sentiment. Trump-inspired of course although there are a myriad of other factors you could list to justify it in the short term, anything from economic recovery to anticipation of a solid results season which is ongoing in the US.

I made the mistake in October last year of getting cautious about the US market having a correction. That was 1000 points ago (idiot!), the fastest 1000 point rise in the Dow Jones ever.

Americans are running out of money! Savings rate at near all time lows (2.4)

This stock market drop is about one thing: Fear of rising interest rates

- Stocks could be in for a 3 to 5 percent correction before dip buyers jump in to put a floor in the market, strategists say.

- Stocks sold off on a jump in interest rates and a health-care deal between Amazon, J.P. Morgan and Berkshire Hathaway that analysts say could threaten margins of traditional health-care providers.

- A 5 percent correction would be the biggest since the 5.3 percent decline around Brexit in June 2016.

more bullishness pic.twitter.com/lu0thSt8oE

— Alastair Williamson (@StockBoardAsset) January 30, 2018

$SPX (weekly), Will a bearish engulfing be confirmed? pic.twitter.com/INNZ7Rm0RW

— Alastair Williamson (@StockBoardAsset) February 2, 2018

China’s HNA may face $2.4 billion cash shortfall in first quarter