Let’s listen in as a stock broker at a Wall Street investment bank advises a skittish high-net-worth client to stay fully invested in stocks.

Client: Over the past six years I’ve had a good run. I stayed long, as you recommended, and have seen many of my positions double or triple over that time period. In addition, I have received some very nice dividends. My total return has been fantastic, but this market is getting long in the tooth. All good things eventually come to end.

Broker: That’s a true statement, but it doesn’t apply in this case. This market is a gimme. It’s the gift that keeps giving. Don’t look a gift horse in the face.

Client: But market analysts are saying that technical indicators are flashing red and that a downturn—a significant one—is close at hand.

Broker: Analysts have been calling for the market to crater for years and they have been wrong every single time. And they are still wrong.

Client: But this time the Federal Reserve is saying that they will raise interest rates and, if they do, the market will tank.

Broker: No, they won’t and this is why.

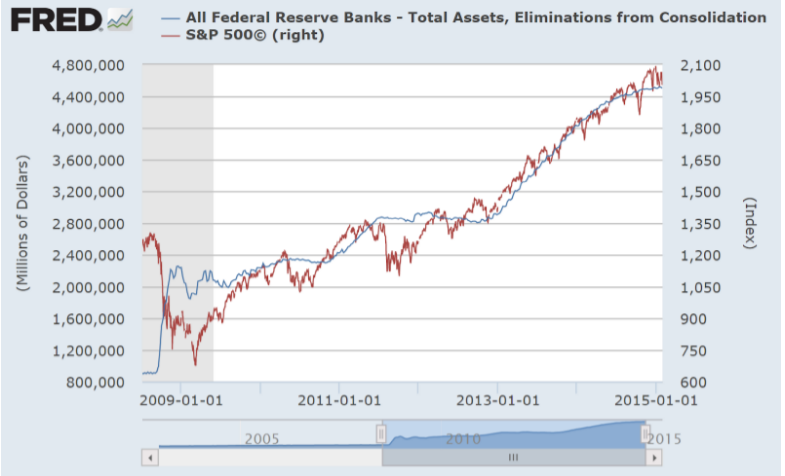

(At this point, the broker slides a sheet of paper across the desk toward his client. On it is the chart below.)

Client: What does this mean?

Broker: It means you have nothing to worry about as far as the Fed is concerned. The Federal Reserve was created one hundred years ago by bankers for the benefit of bankers. We are a major investment bank and we know.

Client: So, why is the Fed talking about raising interest rates, which, in turn, could result in a market collapse? Which, in turn, would result in great losses for your firm and your clients.

Broker: Don’t pay attention to what the Fed says. Watch what it does.

Client: Well, so far, the Fed hasn’t done anything. The federal funds rate has been near zero for six years and counting. After several bouts of Quantitative Easing, the Fed’s balance sheet has grown to well over four trillion dollars, just like the chart shows.

Broker: And the market has grown along with it. That’s why rates will stay where they are. At zero.

Client: How do you know?

Broker: Because the Fed has painted itself in a corner with no place to go. The monetary control system is now on autopilot. If the Fed alters course at this point, it will cause the train wreck that you fear. Let’s say hypothetically that the Fed decides to raise interest rates and it spooks the market. The Fed will be forced to reverse course in short order when it hears the angry outcry from investors and the general public. So any market pullback will be short lived. Such a move on the Fed’s part will simply present another buying opportunity. The Fed realizes this and is wise enough not to put its credibility on the line.

Client: But isn’t the Fed more concerned about the general economy than how its monetary decisions impact the stock market?

Broker: The two are one and the same as far as the Fed is concerned. Everyone knows, if the Fed raises rates, it will crowd out government spending because interest rate payments on the enormous national debt will skyrocket. But a more selfish factor will really cause the Fed to stay its hand. As I mentioned earlier, the Fed works for the benefit of bankers. Bankers and their clients do not like to lose money. If the Fed raises rates and the market collapses as a result, investors like yourself and banks like this one, which trade for their own account, will lose a lot of money. This, of course, is a big no-no. To make matters worse, the federal government will undoubtedly continue to spend money on various programs, even if payments on the national debt balloon. This means the richest Americans would see their taxes increase significantly to pay the bill. Losing money in the market and paying higher taxes are not things our partners at the Fed want to inflict upon us and our esteemed clients. And that is precisely why you should stay long. You should add to your positions. Buy the dips or buy the all-time high. It doesn’t make a difference. You will keep making money either way. Only an act of God will derail this bull market and that is something no one can predict.

Client: Didn’t we have this same exact conversation last year and isn’t this the same exact chart you showed me back then?

Broker: Yes and yes. And ditto for the year before that and the year before that.

Client: Sorry to trouble you.

Broker: No problem. It’s good to talk things through every once in a while. Sanity is doing the same thing over and over again and expecting the same result.

– LV