SPX/VIX Ratio Is Telling A Shocking Truth About Extremes pic.twitter.com/ZHHKcVkNN8

— Alastair Williamson (@StockBoardAsset) November 7, 2017

Scariest Chart Of The Day h/t WolfStreet pic.twitter.com/GM0UAlK2s6

— Alastair Williamson (@StockBoardAsset) November 7, 2017

The Last Time 2s10s Curve Death Cross Occurred It Was 2007 pic.twitter.com/BuCZAbNrmm

— Alastair Williamson (@StockBoardAsset) November 7, 2017

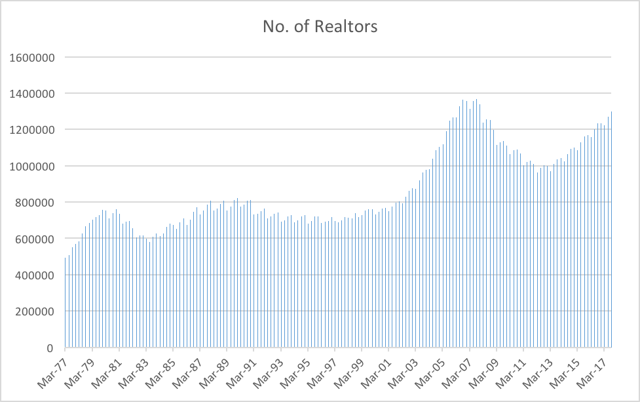

A Growing Number Of Realtors May Signal A Real Estate Bubble

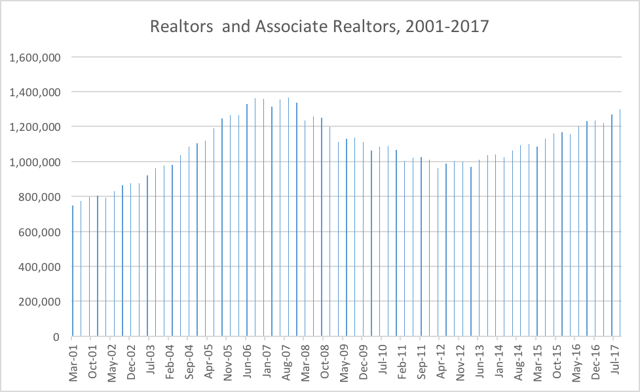

To visualize the growth and decline of the number of registered realtors and associate realtors, see Chart 1 below:

Chart 1: Number of licensed realtors and associate realtors, 1977-2017

Chart 1: Number of licensed realtors and associate realtors, 1977-2017

There is a relatively stable number of realtors and associate realtors between 1985 and 2000, followed by a sustained rise until 2008, when the financial crisis crushed house prices and buried many of the dilettante realtors who had entered the market when it seemed as if perpetual, rapid house price growth would continue forever.

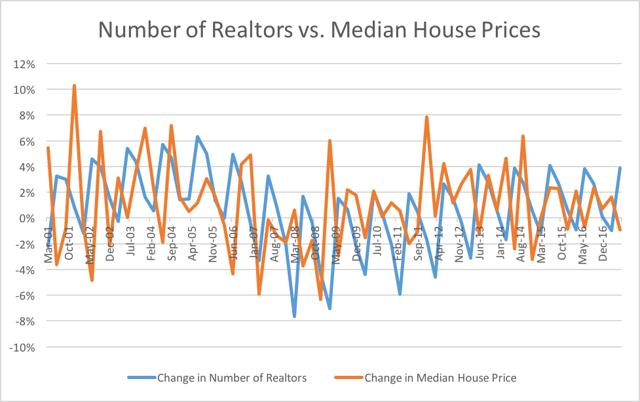

Taking a narrower timeframe, the collapse during the financial crisis is readily apparent.

Chart 2: Number of licensed realtors and associate realtors, 2001-2017

The rapid and irrational rise of house prices and its role as an essential component of the financial crisis is well known. But can we use the number of practicing realtors as a means of determining when a crisis is building?

DILLETANTES, GREED, CHAOS, AND PREDICTION

Let us next attempt to create a usable visualization of the increase in licensed realtors and the proximate cause of new entrants: house prices.

Chart 3: Number of licensed realtors and associate realtors over time compared to median US house prices over time

stockboardasset.com/insights-and-research/growing-number-realtors-may-signal-real-estate-bubble/

Large timeframe view of Small Caps <RUT> signals stall but not confirmed.. pic.twitter.com/1tZlXftFcb

— Alastair Williamson (@StockBoardAsset) November 7, 2017

US Banks ignore 2s10s curve produced by buybacks. pic.twitter.com/9kCGHqZmEu

— Alastair Williamson (@StockBoardAsset) November 8, 2017

Dow Theory Signals Warning pic.twitter.com/DoD1ultDlT

— Alastair Williamson (@StockBoardAsset) November 8, 2017

twitter.com/NorthmanTrader/status/928003052698832896

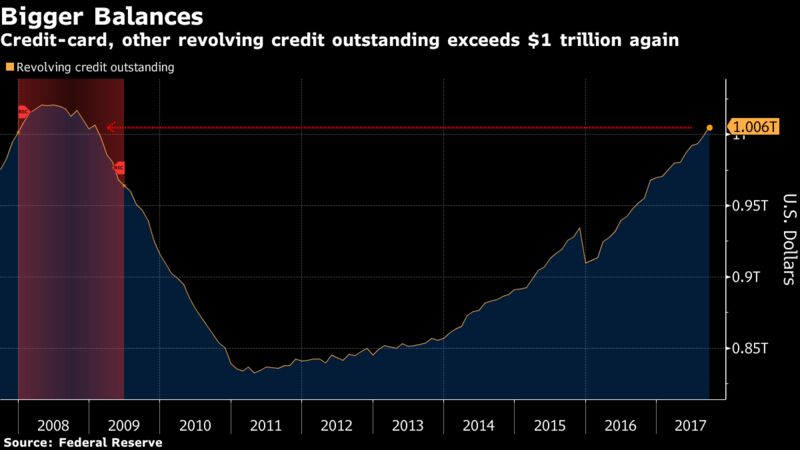

Consumer Credit Card Debt Has Exceeded $1 Trillion

The pickup in September consumer credit capped a quarter in which debt outstanding grew at an annualized 5.5 percent, the fastest quarterly pace this year.

www.bloomberg.com/news/articles/2017-11-07/consumer-credit-in-u-s-increases-by-most-since-november-2016

Momentum Hasn’t Been This Extreme Since The Peak Of The Dot.Com Bubble

The last month or so has seen ‘momentum’ dramatically outperform the market as retail flows chase ‘what is working’…

In fact this has very much been a year of momo…

But, as Bloomberg notes, U.S. stocks with the fastest-rising prices are showing the kind of strength they did in the 1990s, according to Jonathan Krinsky, chief market technician at MKM Partners LLC.

He cited this year’s swings in the MSCI USA Momentum and MSCI USA indexes in a report Sunday. The gap between them stands at 15 percent, a threshold that the momentum index only crossed on a full-year basis in 1999.

www.zerohedge.com/news/2017-11-07/momentum-hasnt-been-extreme-peak-dotcom-bubble