by Umar Farooq

China bears haven’t been dissuaded by its 6.7 percent full-year growth as there are so many clouds circulating around this high growth indicator.

“The good news is that Chinese growth has stabilized and I expect this to continue for 2017,” said Tao Dong, senior advisor of private banking for Asia at Credit Suisse AG in Hong Kong “The bad news is that this is not organic growth. China needs to re-engage the investment interest from the private sector instead of relying on stimulus.”

Here are five charts that show the risks lurking in China’s economic stabilization.

- Increasing debt levels

Overall debt risks surged, according to a Bloomberg Intelligence gauge comparing outstanding aggregate financing and GDP.

“Stimulus worked and China hit its growth target for another year,” Bloomberg Intelligence chief Asia economist Tom Orlik wrote in a note. “The greater focus for the markets though, is the price that was paid in unsustainable credit creation.” Orlik estimates outstanding credit rose to about 264 percent of GDP last year.

Here are five charts that show the risks lurking in China’s economic stabilization.

1.Increasing debt levels

Overall debt risks surged, according to a Bloomberg Intelligence gauge comparing outstanding aggregate financing and GDP.

“Stimulus worked and China hit its growth target for another year,” Bloomberg Intelligence chief Asia economist Tom Orlik wrote in a note. “The greater focus for the markets though, is the price that was paid in unsustainable credit creation.” Orlik estimates outstanding credit rose to about 264 percent of GDP last year.

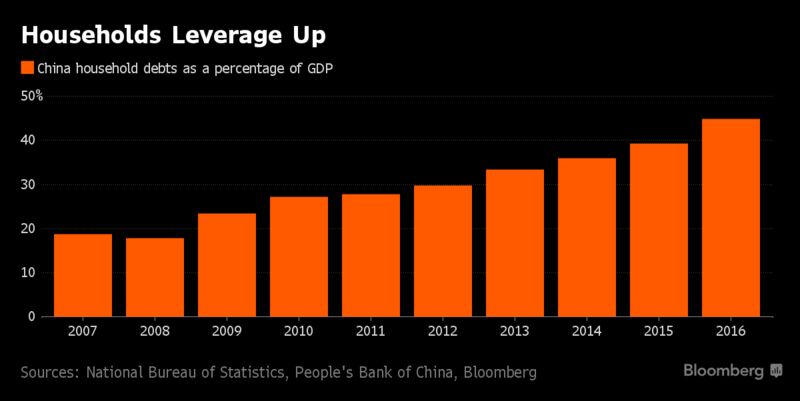

2.Household leverage up

The nation’s residents — famous for working diligently and saving judiciously — are learning to embrace credit. The ratio of domestic loans to households relative to GDP surged to 44.8 percent, almost double the 2009 level.

While that level pales in comparison with many developed nations, the speed of the increase is ringing alarm bells. Long-term new loans issued to households — mostly mortgages — almost doubled last year, spurring a housing boom that saw prices surge in major cities.

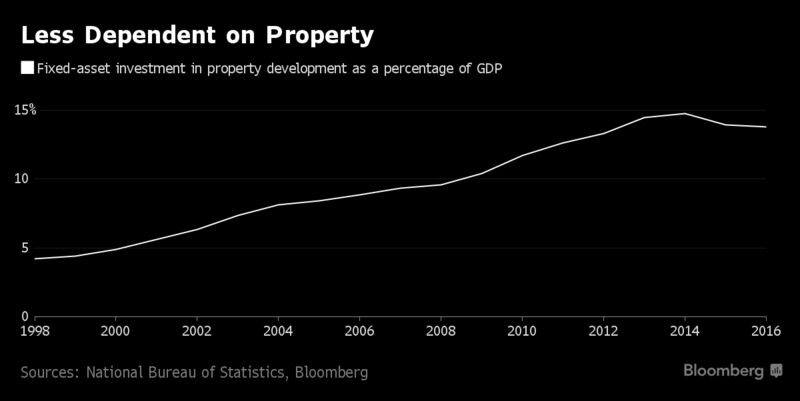

3.Less dependent on Property

Despite the housing market boom, the world’s second-largest economy actually became less dependent on real estate moguls. Fixed-asset investment in property development relative to GDP edged down for a second year after a 2014 peak

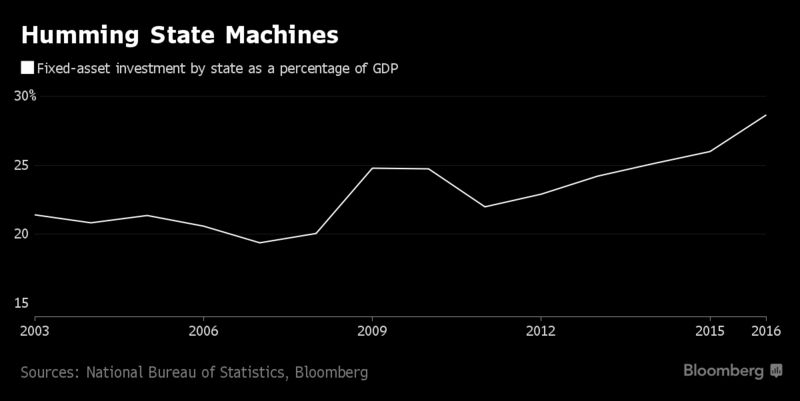

4.Fixed-asset investment by state-owned companies

Fixed-asset investment by state-owned companies increased to 28.6 percent of GDP last year, the highest since at least 2003. That spending rose 18.7 percent in 2016 from a year earlier, the fastest pace since 2009, when the nation rolled out a massive stimulus package in the wake of the global financial crisis.

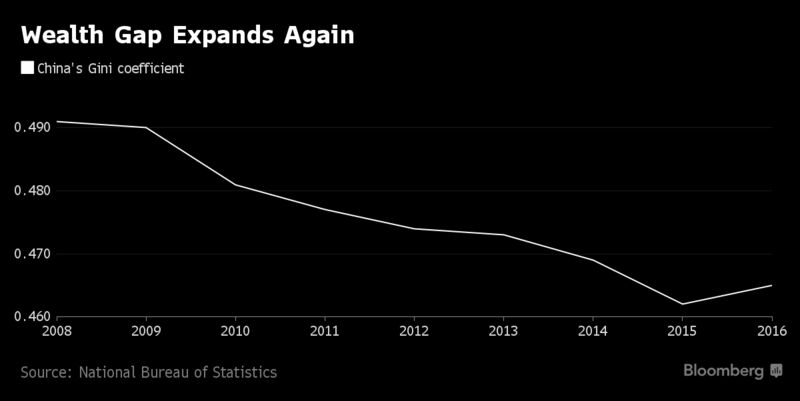

5.Wealth Gap expanding:

China’s Gini coefficient, an internationally-recognized gauge of wealth disparity, edged up in 2016, snapping declines since 2008. That’s due to slower pension increases of low-income residents and declining receipts of rural residents who rely solely on farming, according to the head of the statistics bureau.