via Interest.co.nz:

The warnings from the bond market are getting serious.

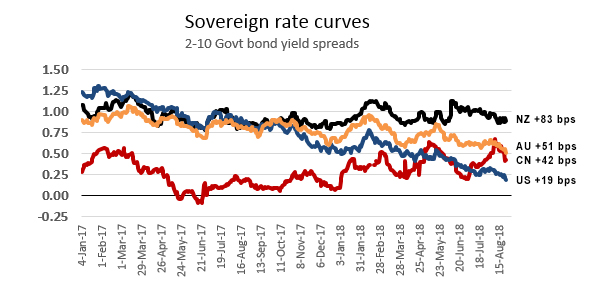

Today, the US 2-10 yield curve dropped below +20 bps for the first time in more than a decade. In fact they didn’t just drop, they fell sharply.

The 2 year UST yield ended the week at 2.624%. The UST 10 year yield ended at 2.813%. The difference is a positive yield curve of only +18.9 bps. That is low, but more importantly, it is falling fast. At the start of August this curve was +33 bps. At the start of 2018 it was +52 bps. At the start of 2017 it was +123 bps. You get the idea.

If it keeps falling at this rate, the positive yield curve will be gone by mid October.

But well before that, investors will wake up to this signal. It may not result in a pleasant realisation, with reactions becoming self-fulfilling.

Back in May 2018 we assessed these same trends. Back then we observed:

When longer-term interest rates fall below short-term rates, investors may be signaling a lack of confidence in future growth. The phenomenon often precedes a recession. We are not there yet, but in less than eighteen months the 2-10 difference has gone from about 120 bps to just over 40 bps; that is not only a big move, it has been a steady and relentless one. It is the bond market sending a powerful, consistent signal.

Since then the pace seems to have piced up.

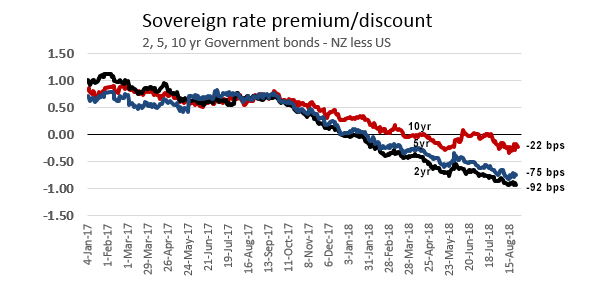

Bank in May, we also looked at the shift from where New Zealand rates moved from a premium to the US ones, to a discount. That is important too.

New Zealand rates are a model of stability, not only compared to the US, but to China and Australia as well.

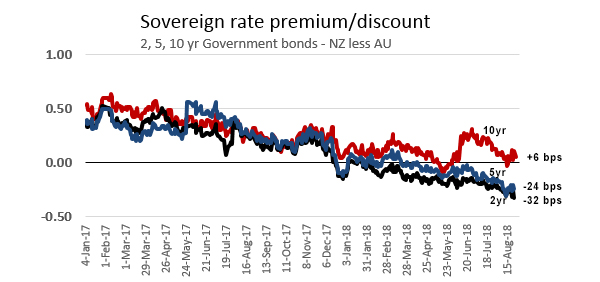

New Zealand rates are now generally lower that all equivalent US and Australian rates for the same terms, the exception being the Aussie ten year and there we are more or less equivalent.

But while they are now lower, they still show a much more positive curve.

Here is the recent track of how the curves for three key countries compare with New Zealand

Notice how stable the Kiwi curve is compared to the others, especially the US.

And here is the recent track of the rate premiums for New Zealand, forsly vs the US …

and then vs Australia.

In less than one year, both relationships have moved dramatically – and are still in motion.

You can make your own assessment about what is being signaled here (and for an alternate view, see this), but for me this is a major indication that investors don’t think the US is on the right path. And I think quite soon (when the premium drops below +10 bps) there could be a general market epiphany. It is not unreasonable to assume that the fall from there will be quite substantial and sudden, pushing the curves into negative territory until a change of policy direction in the US is evident.

Be thankful we are tucked away in a calmer pocket of the world, with policy makers who are professional and who actually do have some ammunition available to lean against the worst excesses that may come. But we won’t be immune to blowback.