Inflation-adjusted return of Treasuries fell to lowest since the 1980s. For bond investors, this is their version of Kevin’s Famous Chili from The Office! Or The Fed’s Famous Chili!

(Bloomberg) — Treasury investors are losing more money than they have in four decades, once inflation is taken into account. And if markets are right, they’re unlikely to come out ahead for years.

The federal government’s debt has already lost about 2% outright over the past year as the Federal Reserve started removing pandemic-era stimulus from the economy and inched closer toward raising interest rates. But on top of that, the consumer price index has surged 6.8%, putting investors even deeper in the hole.

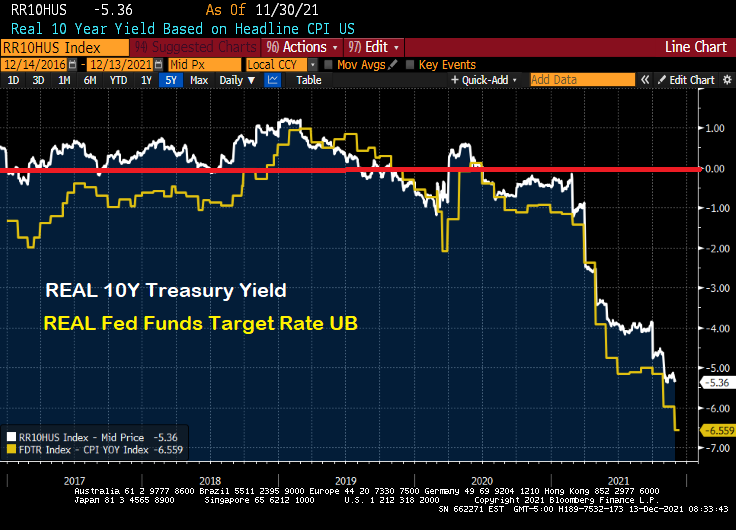

Taken together, that’s resulting in the worst real returns — or those adjusted for inflation — since the early 1980s, when then Fed Chair Paul Volcker was in the midst of fighting a wage-price spiral. What’s more, the dynamic isn’t expected to change: The bond market is projecting that 10-year Treasury yields will hold below the inflation rate for the next decade, meaning any investment income will be more than wiped out by the rising cost of living.

If we look at the REAL 10-year Treasury yield and REAL Fed Funds Target Rate, they are both negative.

Let’s see if Powell spills his famous chili on Wednesday at 2:00PM EST. The Fed keeps saying they are serious about controlling inflation, just like Kevin Malone.