via mybudget360:

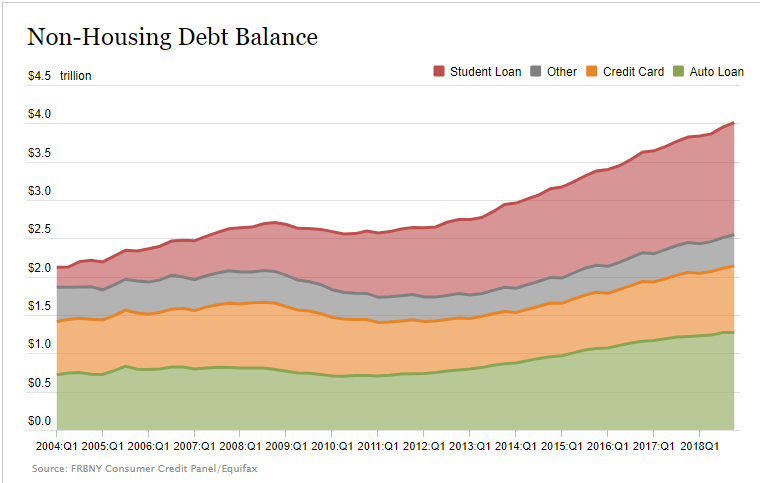

Millennials continue to face the struggles of living in a world where they are deep in debt and the idea of buying a home is becoming more of a farfetched pipe dream. As recently as 2009 non-housing debt stood at $2.5 trillion. Today it is over $4 trillion, a 60 percent increase in 10 years. Of course, it is no surprise that 2009 is the official end of the Great Recession and much of the recovery has come at the expense of going into massive debt. Millennials continue to face struggles in purchasing homes because they are saddled with $1.46 trillion in student debt. Non-housing debt is already creating deep pressures on the balance books of Millennial households.

Toxic debt

There is a big problem with the amount of non-housing debt floating in the economy. Much of this is tied to non-wealth building areas:

-Student Loans

-Credit Cards

-Auto Loans

-Other (e.g., personal loans, etc.)

There has been an explosive growth in this segment of debt in our economy:

What is interesting is that from 2004 to 2012 this figure stayed relatively stable despite the housing bubble expanding then popping. However, during this economic recovery it would appear that people have been borrowing from their future to go to college, purchase (on loans) cars, and finance purchases on plastic. We are already seeing major problems with auto loans going bad.

The chart above continues to highlight a story of where the middle class continues to be squeezed. Why did non-housing debt go up by $1.5 trillion from 2009 to 2019 but remained stagnant from 2004 to 2009? The reality is, younger households are having to go into large amounts of debt to finance college degrees, buy cars, and spend on daily living. Buying a home just doesn’t fit into this equation for many.

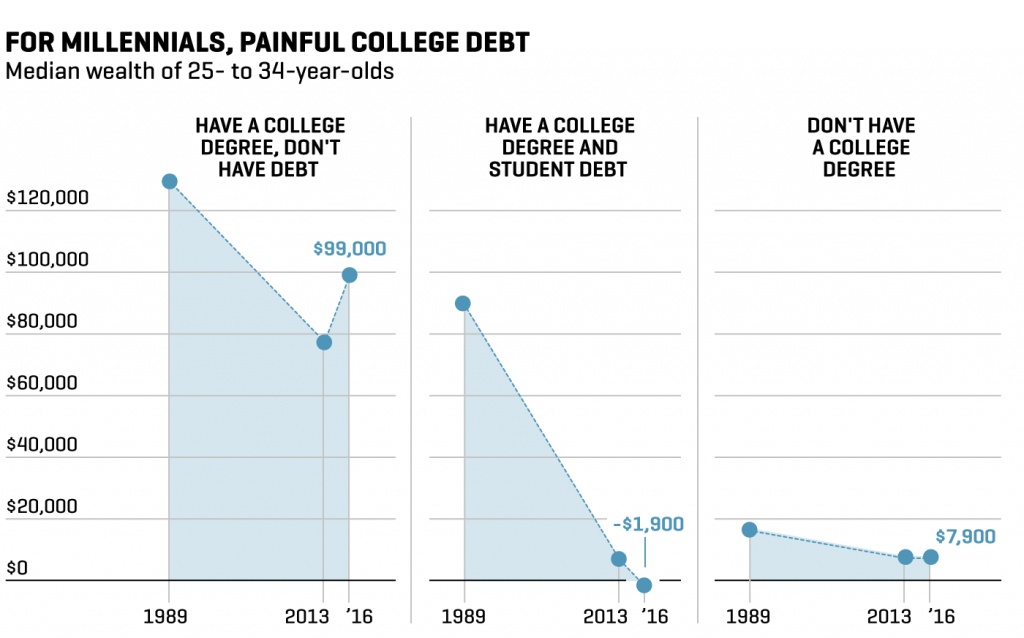

You can see how this debt hurts Millennials when it comes to wealth building:

[From the chart above, most Millennials that do have student debt have a negative net worth (and most college educated Millennials do have student loans). From looking at the above the biggest hit Millennials take when building out their net worth is with having student debt. And this makes sense since once you start earning income, a sizable portion of your money is going to service debt that would otherwise be used on buying goods in our economy or stashing away for a down payment on a home.

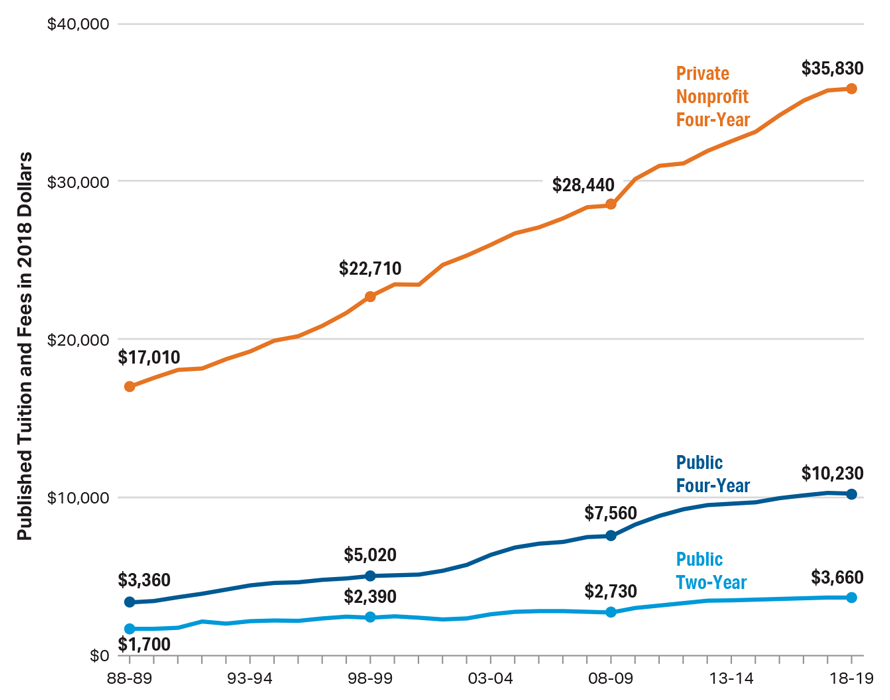

While we hear the baby boomer stories of “I worked delivering papers to pay for college” it is hard to deliver enough papers when the cost of tuition has gone haywire. This might have been doable a generation ago but with many colleges costing $40,000 to $50,000 a year in tuition, good luck with that. Take a look at this chart:

[tuition]

So yes, maybe a generation ago it was a feasible to pay your way through college with a part-time entry level job, those days are now non-existent. Hence we now have $1.46 trillion in student debt outstanding.

Now we hear about proposals to wipe student debt out and to make public higher education free. We also have $22 trillion in U.S. National Debt but who is counting. We are going to have some tough choices moving forward but creating a system entirely addicted to debt is going to cause some major withdrawal symptoms when the inevitable day of reckoning hits.