Despite tax revenue to the state’s General Fund rebounding to more than $2 billion above pre-pandemic levels[i] and a surge of more than $65 billion in federal funds to Colorado, the 2021 legislative session, which ended June 8th, resulted in an additional net tax burden of $302 million (in FY23) on individuals and businesses. New fee-based revenue from the 2021 session is projected to be over $255 million annually. This figure is relevant to two ballot measures passed in 2020.

- These revenues more than offset the .08 percentage reduction in the state income tax just approved by voters last year under Proposition 116; raising $255 million through the state income tax would require a rate increase of .14 percentage points. As shown by Figure 3, the state income tax rate would need to increase by 1.23 percentage points to raise the same amount of revenue ($2.2 billion[1]) that pending fees from the last four years are projected to raise.

- In addition, each of the 6 new enterprises created during the 2021 session are estimated to generate less than $100 million individually over their first five years. This evades the need for approval by Colorado voters which 2020 Proposition 117 now requires.

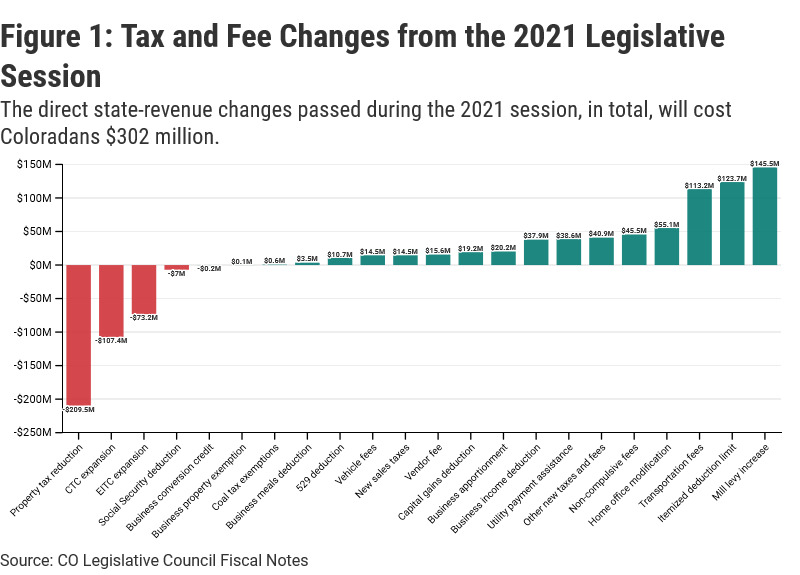

Overall, the 2021 legislative session resulted in an additional $699 million dollars in new taxes and fees, but, through both an increase in income tax deductions and a temporary 2-year property tax cut, there is also a projected $397 million in tax cuts in FY23.

Direct Taxes and Fees are Just the Tip of the Iceberg of New Costs

New net direct costs, which will exceed $2.1 billion in 2023, comprise only part of the financial burden facing Coloradans and Colorado businesses—they do not include the indirect costs of numerous new laws and regulations. While the impact of each new regulation has not been fully valued yet, efforts to comply with them will cost many individuals and businesses billions of dollars in total, likely even more than the $2.1 billion in direct costs. Though any single new regulation may not change the outcome of a firm’s decision to expand in Colorado or to relocate to our state, at some point the cumulative regulatory burden could.

The full cost of each piece of legislation is not quantified, but here is a summary of some of the most impactful changes:

- Through HB-1232, Colorado’s healthcare sector now faces the mandate to implement a new standardized health insurance plan with benefits yet to be determined at prices 15% below current rates.

- Owners and operators of large commercial buildings and their tenants will have to navigate the costs associated with forcing large reductions in energy use imposed by HB-1286.

- More regulatory authorizations were granted to the Air Quality Control Commission (AQCC), through HB-1266, even as major regulations authorized in previous legislation are working their way through the formal rulemaking process.

- According to a recent state cost/benefit analysis, the pending “Employee Trip Reduction Program” regulation before the AQCC is estimated to cost up to $350 million annually and provide a benefit of $34 million based on the social cost of carbon applied to estimated emission reductions.

- Several recent regulations are together estimated to cost the oil and gas industry at least $200 million annually according to aggregation of state public reports by COGA.

- Colorado recently made national headlines as large national companies now explicitly omit Colorado applicants from their remote work job postings due to a recently enacted law requiring pay disclosures for new postings.

…

WELCOME BACK, CARTER: White House quietly signals inflationary run could last years.