Cracks Emerge in Corporate Debt Confidence

Investors are starting to get worried about the $7.2 trillion U.S. investment-grade bond market.

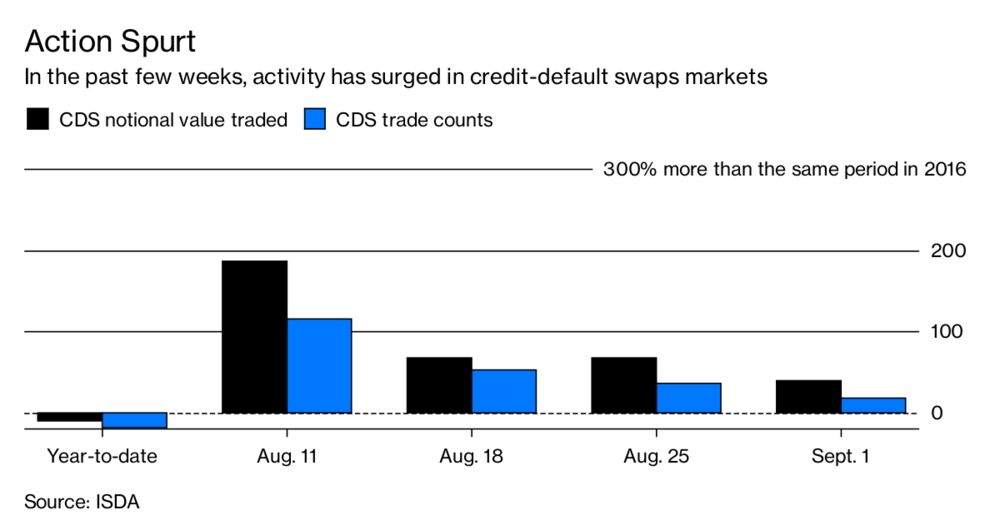

Yes, they are still pouring money into this debt and accepting near-record low yields to own it. But look a little closer and it’s clear these bond buyers are starting to show some signs of unease. Traders are increasingly turning to derivatives to hedge against potential losses. This is a marked shift from earlier in the year, when many bond investors seemed unwilling to give up any returns for such protection. During most of 2017, trading volumes in credit-default swaps sagged well below recent years’ averages.

Now, however, activity in the derivatives has risen sharply, with volumes surging more than 110 percent in the week ended Aug. 11 compared with the same week in 2016. That contrasts with a more than 10 percent decline in volumes on average throughout 2017 compared with the period last year.

While volumes alone don’t determine whether traders are actually becoming more bearish, analysts are interpreting this surge as a sign of investor caution.

“This is often a leading indicator of potential weakness,” Peter Tchir, head of macro strategy at Brean Capital LLC, said on Bloomberg Radio on Tuesday. Investors don’t want to sell their corporate-bond holdings because they know it could be difficult to buy them back in the future. But they are are feeling less secure owning the debt, especially at such high valuations. So they’re either getting exposure to the securities in a way that’s easy to exit quickly in a pinch, or they’re paying a premium to cover any losses incurred during a selloff.

Indeed, investors are earning yields of less than 3 percent on average to own investment-grade corporate bonds compared with nearly 5 percent yields over the past two decades. Not only that, but the debt has become riskier in some respects. It is more vulnerable to losses if benchmark borrowing costs rise, its average maturity has been lengthening and lower-rated bonds account for a growing proportion of the market.

NYC Commercial Real Estate Sales Plunge Over 50%

As Owners Lever Up In The Absence Of Buyers. it just might be a “red flag” that buyers have completely abandoned the commercial real estate market…

So what do you do when the bubbly market for your exorbitantly priced New York City commercial real estate collapses by over 50% in two years? Well, you lever up, of course.

As Bloomberg [4] notes this morning, the ‘smart money’ at U.S. banking institutions are tripping over themselves to throw money at commercial real estate projects all while ‘dumb money’ buyers have completely dried up.

A growing chasm between what buyers are willing to pay and what sellers think their properties are worth has put the brakes on deals. In New York City, the largest U.S. market for offices, apartments and other commercial buildings, transactions in the first half of the year tumbled about 50 percent from the same period in 2016, to $15.4 billion, the slowest start since 2012, according to research firm Real Capital Analytics Inc.

At the same time, the market for debt on commercial properties is booming. Investors of all stripes — from banks and insurance companies to hedge funds and private equity firms — are plowing into real estate loans as an alternative to lower-yielding bonds. That’s giving building owners another option to cash in if their plans to sell don’t work out.

“Sellers have a number in mind, and the market is not there right now,” said Aaron Appel, a managing director at brokerage Jones Lang LaSalle Inc. who arranges commercial real estate debt. “Owners are pulling out capital” by refinancing loans instead of finding buyers, he said.

But don’t concern yourself with talk of bubbles because Scott Rechler of RXR would like for you to rest assured that the lack of buyers is not at all concerning…they’ve just “hit the pause button” while they wander out in search of the ever elusive “price discovery.”

Hartford, Connecticut Warns It Could File for Bankruptcy – Update

Hartford officials said Thursday it will likely file for bankruptcy in 60 days unless Connecticut provides help for the cash-strapped capital city in the midst of a fiscal emergency.

The World’s Most Powerful Bank Issues a Major Warning

Goldman Sachs has been at the heart of nearly every major banking scandal in recent history.

Rickards: The Era of Complacency Is Ending

Physicists say a “subcritical” system that’s waiting to “go critical” is in a “phase transition.” A system that is subcritical actually appears stable, but it is capable of wild instability based on a small change in initial conditions.