The S&P 500 failed a breakthrough on Thursday and tucked its head back below its 4200 ceiling again, where it has remained rangebound for weeks. Job news on the economic front that many analysts toasted as great could not lift sentiment out of the doldrums on Thursday, nor could it stop Netflix from making its first death cross in more than two years. Falling below its 200-day moving average is generally regarded as a sign that a stock is trending down for the longer term.

The market’s response to Thursday’s employment news further reveals the degree to which inflation concerns are tugging downward on market sentiment. While the good news about jobs gave a jolt of lift to stocks in the opening hours, as it was digested, investors appeared to be figuring out that good news would be bad news for stock prices because a rebounding job market could add additional inflationary pressures as companies are being pressed to pay higher wages to attract people back to work. Inflationary pressures, in turn, will pressure the Fed to turn down its massive money-pumping engines, which have pressured a major flow of new cash into stocks and bonds at a rate of $120-billion a month for a year now.

The present employment situation is great for labor, thanks to the government stimulus checks, because the ease with which people can remain out of the workforce empowers them to press corporations to boost pay in order to attract them back in. For the past decade, labor has lost out to profits being shared solely with shareholders. Labor has seen little real gain in wages while shareholders have seen massive gains due to the almost direct flow of Fed money into stocks and bonds as the cheap debt has financed stock buybacks in record amounts for years. Finally, some of those profits are now being pressured toward labor as many in the labor force hold back until jobs pay more than they are making on unemployment.

The Fed throws a surprise monkey wrench

The biggest damper on the Thursday stock market was a surprise move by the Fed. Chairman Powell of the Us People’s Bank has been saying for months and said again as recently as a week or two ago that the Fed is not even beginning to start to think about talking about reducing its stimulus programs. However, rapidly rising inflation and a reverse repo crisis seem to have forced the Fed rather abruptly from not even thinking about starting to talk about tapering QE to having already decided to take a baby step.

This is the very scenario I laid out for both the reverse repo crisis and inflationary pressures in my last two articles:

The Fed announced it will start selling off some of the corporate bonds it has been buying. This sounds like a fairly harmless breath in the direction of financial tightening that avoids touching government bonds. As I recently argued, the Fed cannot stop funding the government directly:

The Fed’s absolutely massive reverse repo operations (used this month to extract half a trillion dollars in cash money out of the system!), done at the same time the Fed is creating money in the system, leave us with no question that the Fed is directly financing the government and monetizing its debt at whatever level the government demands (with almost no restraint on the government’s part for its role).

Since it does reduce the Fed’s balance sheet, it comes close to the Fed announcing it will be reversing its QE (bond buying) in what amounts to a small ongoing amount of QT (bond selling), but it doesn’t quite go there since it leaves the Fed’ government bond buying still fully in play. Still, the Fed wispered, and the market cringed a little.

Notice how the Fed is still not hinting it will stop soaking up government bonds, fitting with my earlier argument:

While all astute and honest people knew the Fed was financing the government debt for years, the Fed USED TO be able to somewhat reasonably argue it was not buying treasuries illegally to finance the government but that it only bought treasuries as a way of setting monetary policy.

It clearly does not need them for monetary policy now that it is selling off bonds and certainly not with interest rates plunging to the zero bound, and real rates creeping negative.

That argument vanished completely this month because the Fed’s purchases of treasures are now actually driving monetary reality totally out of whack from the Fed’s own stated policy goals.

As Wolf Richter wrote,

It’s a crazy situation the Fed backed into as tsunami of liquidity goes haywire, banking system strains under $4 trillion in reserves.… With these reverse repos, the Fed is selling Treasury securities to counterparties and is taking their cash, thereby massively draining liquidity from the market – the opposite effect of QE…. Even as liquidity is going haywire, and as the Fed trying to deal with it via reverse repos, the Fed is still buying about $120 billion per month in Treasury securities and mortgage-backed securities, thereby adding liquidity.… This liquidity-haywire situation appears to be an emergency that needs to be addressed now.

Well, maybe this seemingly rushed decision to start selling off its corporate bonds is the Fed’s is the Fed’s way of testing the waters for that kind of emergency action without touching what it is doing in government bonds. The Fed normally begins hinting at changes like this months in advance. It doesn’t just drop them out of the blue. So, the announcement does have an urgent look to it. The Fed claims it has nothing to do with monetary policy, and perhaps it doesn’t for it certainly would be inadequate to the task; yet, even the New York Times notes,

It was important for the Fed to signal that this was not a monetary policy action. The Fed’s policy-setting Open Market Committee is also buying huge amounts of government-backed bonds, but those purchases are different, meant to foster stronger economic conditions by keeping markets chugging and holding down borrowing costs. Markets are on edge as officials tiptoe toward thinking about when and how to slow that program.

Why was it so important for the Fed to make clear this announcement had nothing to do with monetary policy? Because, regardless of how small the amount of money is in the grand scheme of things, it unsettled markets on Thursday. The Fed even had to assure investors that the sale will be “gradual and orderly.” The Fed’s caution is evidence of just how much it realizes the stock market sits on a hair trigger when it comes to even a hint of tightening.

The central bank will aim to minimize the potential effect on markets by factoring in daily liquidity and trading conditions for exchange-traded funds and corporate bonds, it said in a statement.

Here is what I think is the takeaway on this: Patrick Leary, a senior trader at Incapital got it right when he noted that the Fed’s action, minor as it was, helped pave the way for the discussion about tapering out of its monetary policy “accommodation,” as they like to call it.

“This is one little step and a good way to test the waters in terms of what the market reaction is going to be,” said Leary.

The market shuddered enough to show its sensitivity in this area, carefully scripted as the message was to assuage all concern.

Elliott waves off inflation risks as Fed flinches

While the market shudders every time the Fed even brings up the fact that it is not yet talking about tightening, one particular Elliott wave theorist has been criticizing my claim that inflation will have the power this year to kill the bull market.

While more and more opinion pieces are being presented in the written and television media about how inflation is about to kill our stock market, I will tell you that I am quite unconcerned about the common refrains from the peanut gallery. In my humble opinion, this is a bull market which likely has much further to run in the coming year or two. And, I base my perspective on my objective, mathematically derived Elliott Wave analysis

Yet, Thursday’s announcement by the Fed and corresponding market response illustrates the first one of two likely pathways by which I said inflation will kill the market: 1) It will either force the Fed to tighten much earlier than it has said it would, or 2) it will tear the value out of the dollar and push up bond yields to compensate for inflation, which will change the equity-risk premium on stocks. (The amount by which stocks need to outperform the yields on government bonds in order to compensate for the higher risk of stocks.)

Inflation gets built into bond yields by the bond market, and stocks become less attractive as yields reprice upward to compensate for soaring inflation.

It looks like Fed flinched and jolted into a touch of QT, sending Thursday’s shiver through the stock market. So, the inflation story of mine that my self-appointed nemesis is criticizing has fledged and is starting to fly.

This same Elliott Wave theorist has finally admitted he was dead wrong on the S&P 500 (represented by the SPX) bounding off 4200 into a new rally:

My last public article on my short-term expectation in the SPX was clearly incorrect, and was our first “miss” in quite some time. But, as I said, it is simply impossible for me to be right 100% of the time.

In fact, the S&P held solidly below his prediction that 4200 would be the new floor off which the market would rally. Instead, 4200 became the S&P’s ceiling for a month and a half!

That doesn’t stop him from claiming his approach provides valuable

contrast to all the other articles you likely read which continue to warn you about the common “belief” that inflation is the boogie man that is about to kill our stock market:

And then he quotes one of my own comments about how he missed his prediction that claimed the S&P would bounce right off of 4200 into a new rally due to inflation concerns:

“[The S&P] keeps pounding its head against that barrier but not really busting through, because inflation concerns keep grabbing its butt like a junkyard dog pulling someone down off the fence he’s trying to scale.”

Though he believes my inflation argument is a boogieman, my claim about inflation holding the market down held true against his for a month and half during which the S&P got no lift. In spite of that fail on his part, the author is still striking out against my prediction that inflation will gnaw away at the market until it finally kills it with his new claim for a rally:

I am still looking for the market to rally up to the 4350-4440SPX region…. And, the manner in which we rally over the coming month will tell me where the ideal target resides within that next target region.

While I wouldn’t be too surprised if the market does rally that much, it doesn’t defeat the inflation argument at all. I don’t expect the bull won’t fight the bear, but I do doubt his upper target for this summer:

I think we will see another pullback, which we may want to now consider as a “June Swoon.” How long that swoon will last is something of which I am not yet certain, but I highly doubt it is going to last until November. Rather, the higher probability suggests that after that bout of weakness from the 4350+ region, we will likely continue to rally into the fall time-frame and attack the 4600SPX region I am still expecting to be struck in 2021.

That I doubt. I’ll note his now uncertain-sounding June beliefs have revised his view to look a lot more like mine than his original statement of a decisive rally off of 4200. While week’s Friday close may even make it look like his hope for hitting 4350 in June before the swoon is already proving right, I see it much different from a longer-term perspective.

Funky Friday

The market stalled overnight after Thursday’s flop back below 4200 with futures going down slightly more as investors waited with bated breath for the government’s Friday jobs report from which they would divine the risks of inflation. Many were expecting an excelling jobs report, and they wrote that such a report would increase pressure on the Fed to taper its QE even faster. In that case, the market was expected to fall further as it did upon Thursday’s strong employment report by ADP.

I didn’t join that bandwagon, even though I do believe inflation is the market’s linch pin at this point. What they got on Friday, however, was the best lackluster jobs report the market could hope for — one in that Goldilocks zone of contentment that says the economy isn’t cratering but that it is also not nearly strong enough to cause the Fed to start rolling trimming back on its all-out quantitative easing.

The report hit the market’s sweet spot, and so the S&P climbed back up above 4200 and may climb further until it gets the next big bad inflationary news.

That is exactly why I think this jobs report will will ultimately prove bad for the Fed by keeping inflationary pressures in the Fed’s blind spot. You see, the Fed and most economists are looking for full employment to be the sign of enduring inflationary pressures, but in reality inflation is being driven hot right now, as I’ve said would be the case for the past year, by serious shortages during a time of abundant cash — cash the Fed is creating and shortages the Fed is fostering.

I say that because low unemployment actually means the US will remain sub-par in production for longer. That will result in continuing shortages and maybe deeper shortages, but the Fed only sees stalling employment numbers right now as justification for pouring on the cash fuel for longer. That fuel, however is exactly the chemistry needed to keep heating the inflationary inferno, not just because, as many think, more money equals more inflation, but because more money via government aid enables the labor force to stay unemployed longer, which suppresses production and increases wage pressure to entice workers back into the job market! It is self-defeating.

The stock market believes along with the Fed low employment will keep inflation down by reducing spending power, but it won’t so long as the Fed and feds keep supplying goodly amounts of cash stimulus to the unemployed! It actually means inflation will burn hotter as shortages undercut the economy even more. What we have is STAGFLATION — inflation in the context of a totally stagnant (i.e., unproductive) economy.

Here you can see stagflation at work:

What you see is that, even with the Fed pouring on new money as fuel at a rate of 120-billion a month, which is 50% greater than QE3, business activity is now actually falling. Hugely diminished returns on that investment.

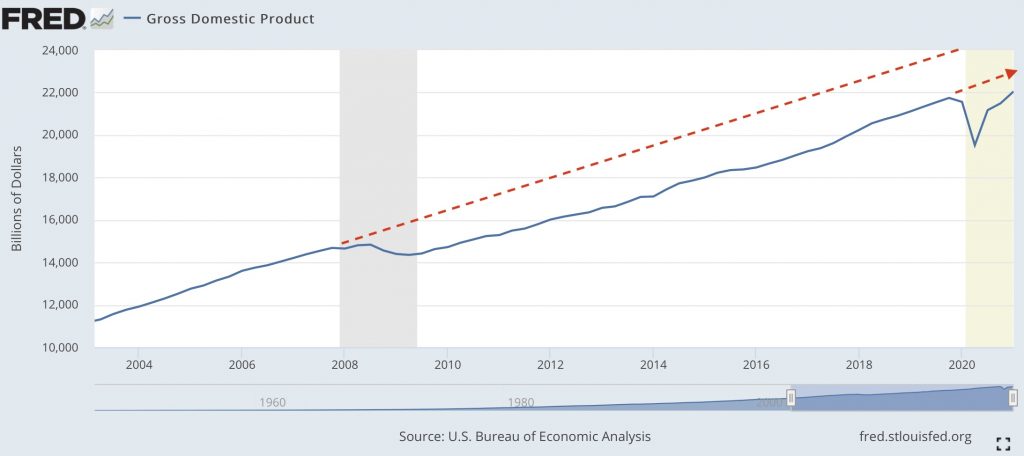

The economy as measured in gross domestic product, which I pointed out an article or two back, is not rising back to the level it would have been at without the COVIDcrisis; yet, population keeps growing. Investors and economists and market analysts are all focusing on how fast GDP has risen upward from the hole it fell into during the COVID closures, but production (the very thing GDP measures) still remains well below where it was headed pre-crisis. It takes a steady GDP rise just to keep up with population growth. Here’s a graph I shared earlier that shows where we are compared to where we had been heading prior to the latest crisis as well as the previous crisis.

We’ve taken two major steps down without recovering to our former trend, which means there is less for everyone, so prices are rising.

In this newly developing stagflation environment, the Fed will keep dumping on fuel even though it has shown signs that it is getting nervous about that in the chatter by Fed leaders and in its move this week to start selling off its corporate bonds (while it continues to buy up huge amounts of government bonds).

As Bloomberg’s Chris Antsey notes, the Fed’s leadership “is likely to see this report as a modest improvement but not near the “substantial further progress” on employment required to taper its bond-buying program. While inflation is now topping the central bank’s 2% goal, jobs remain not really close to the goal.”

That jobs obsession is the Fed’s Achilles heal. A strong jobs report on Friday would have strengthened the hand of those on the Fed who are now openly worrying that it may be time to start talking about tapering QE sooner than later, but the weak report will lead to overconfidence in their ability to keep pouring on the cash fuel.

A strong payroll report Friday would give more ammunition for folks calling for earlier QE tapering. In a sense, policy normalization has already started after the Fed announced plans to wind down its emergency corporate-credit facility. From that perspective, the peak of liquidity is near.

The longer the Fed waits to remove its “accommodation” to the market, the more it will have to pull a hard stop when it becomes clear inflation has the upper hand.

The Fed has faked itself out

Today’s jobs report makes it likely the Fed finds all the excuse it needs to stay in the dollar-dimishing game longer, believing inflation will keep its head down because the lower jobs will keep wages from rising.

The Fed has its eye on the wrong gauges. In real fact, the smaller-than-expected increase in payrolls is likely because those who are supported by Fed largesse are holding out for higher wages before they make the leap back into the economy. Companies, as a result, face more pressure to raise wages.

This won’t be the first time the Fed was blind to the trap it has put itself in. We all remember the Repocalypse where the Fed learned the hard way it can never rewind its QE without collapsing the QE-dependent recovery it spent years engineering. Now inflation is pressing in quickly due to too much QE in the face of severe shortages while continuing Fed support for the unemployed will only make keep production down with ample incentive not to work.

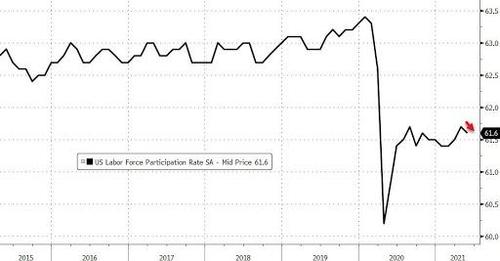

As you can see below, the labor-force participation rate never came close to recovering; and, with today’s numbers, it is falling back off again:

While only half of the pre-COVID work force that became unemployed has returned to work, the number of people looking for work has fallen off. These are people who either reported they were not looking for work or were unavailable to take a job if offered. Perhaps some simply want their old job back, but it is gone:

7.9 million persons reported that they had been unable to work because their employer closed or lost business due to the pandemic.

So, regardless of what happens to the stock market in June, inflation will rapidly gain the upper hand with the Fed’s full support because the Fed can’t see it coming. The Fed will keep throwing money to the masses via the federal government until it is too late, and that day may come sooner than you think. Inflation WILL kill this market — either by forcing the Fed to tighten sooner than the market has been led to expect or by ravaging everything — unless some asteroid of a black swan like COVID swoops down and takes it out first.

(More on how inflation has built just since my last article will be out shortly in my next article.)