Can capitalism continue without consumption of goods and services? The rate at which money exchanges hands is collapsing

fred.stlouisfed.org/series/M2V

SPY/VIX Ratio pushing extremes pic.twitter.com/tdr7jrYPW5

— Alastair Williamson (@StockBoardAsset) October 31, 2017

rent ate up more disposable income than at any prior time in history.

Which unfortunately means that while US housing has never been more unaffordable, renting in the US has… well, also never been more unaffordable.

stockboardasset.com/insights-and-research/renting-us-never-unaffordable/

— Alastair Williamson (@StockBoardAsset) October 31, 2017

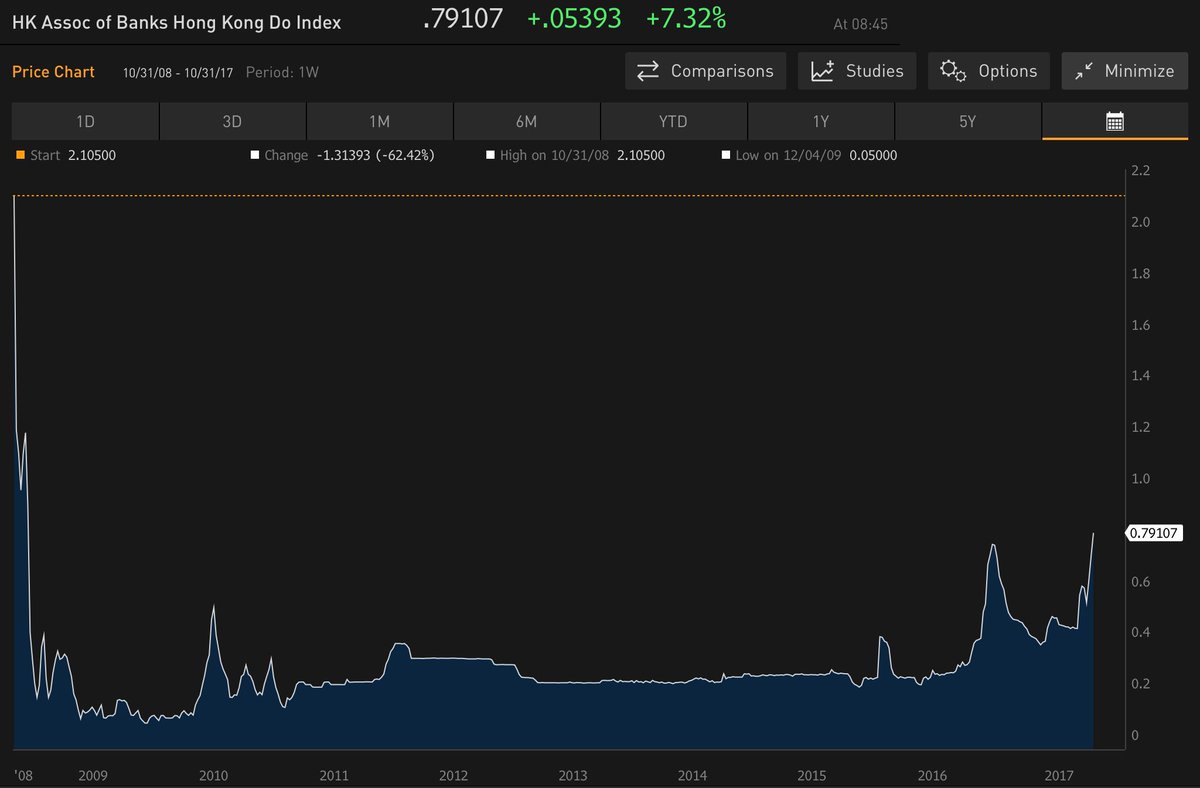

One Month HIBOR (used to benchmark mortgages) to highest level since December 2008

Weird: Lunisolar Gravitational Tidal Forcing 9-yr cycles lines up to 2 stock market tops $SPX $VIX pic.twitter.com/fHWvRepCbm

— Alastair Williamson (@StockBoardAsset) October 31, 2017

MSCI China Post Party Congress seasonality $MCHI pic.twitter.com/Plrnxe41S6

— Teddy Vallee (@TeddyVallee) October 31, 2017

We Are Witnessing the Controlled Collapse of the Financial & Media Edifice | Rob Kirby

Another China Company Defaults on Bond Payment as Borrowing Costs Jump

www.bloomberg.com/news/articles/2017-10-31/another-china-company-defaults-on-bonds-as-borrowing-costs-jump

Here Are A Bunch Of Scary Charts For Halloween.

Scary things happen when policy is too loose for too long. In the most recent cycles, the pursuit of low unemployment was associated with unsustainable increases in asset prices. What scares me is that we may be repeating past mistakes. Are we generating asset price bubbles in support of maximum employment?

BofAML’s Michael Hartnett notes that flows into risk assets are inexorable:

Forever flowing bubbles: The pace of inflows into corporate bonds & equities accelerating, up $534bn YTD (Chart 1) on course for record risk asset inflow year (prior was $281bn in 2013).

And cash levels are at all-time lows:

Increasingly, it’s on the shoulders of passive:

(Wells)

And the robots will murder you in your sleep:

Valuations matter despite what you might have heard on Twitter:

“No price is too high” when it comes to investing in “the future” – or so the narrative goes:

Tell me again about how there are bargains out there if you just know where to look…

Nothing could go wrong with this (obviously):

And this should be fine:

So fear not, because “the only thing to fear is fear itself.”

heisenbergreport.com/2017/10/31/here-are-a-bunch-of-scary-charts-for-halloween/

I doubt the prediction of “unsustainable debt”. Fiat currency is similar to religion: it is backed by paper, and is merely an artificial life support system requiring blind faith in its value.

The Central Banks have been able to collapse the US-Dollar at any time since 1933.

http://www.expose1933.com/1-us-1933-bankruptcy.html

IMHO, the Central Banks can sustain World Debt as long as they desire or, until their usurious ambition of creating their One World Government comes into fruition.