One of the most difficult things to learn about the stock market is the fact that it has little, if anything, to do with the real economy.

This is a fact borne out by both statistical studies and real-world analysis. And yet I would argue that over 95% of investors don’t understand this.

For whatever reason, most investors believe that the stock market is effectively a derivative of economic growth.

The reality is that the people thinking this haven’t really thought their arguments through to their logical conclusions.

Indeed, if you think I’m being naive with my views of the weak correlation between stocks and the economy, consider that the mutual fund giant Vanguard performed a study analyzing the correlation between stock market returns and various items (dividend yield, stock market valuations, etc.), from 1926 to 2011.

They found that the correlation between stock market returns and the direction or trend of GDP growth was 0.05, or about 5%. Put another way, the trend of the economy only explained roughly 1/20th of the stock market’s returns.

To put this into perspective, it’s lower than the correlation between rain and stock market returns. Yes, rain, as in whether or not it’s raining outside on a given day.

If you still find this hard to believe, let’s take a real-world example.

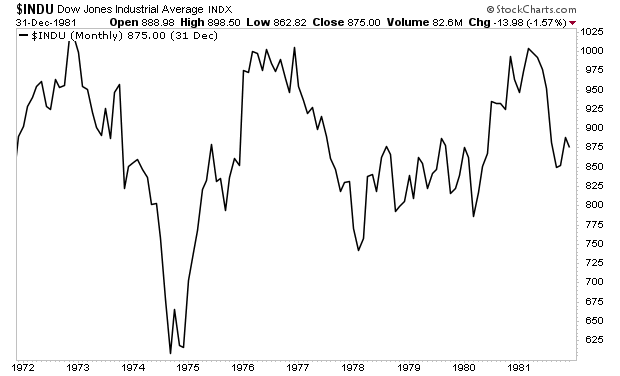

Between 1972 and 1982, the US economy nearly tripled in size from $1.2 trillion to $3.2 trillion. And yet, throughout that entire period the stock market traded sideways for ZERO GAINS!

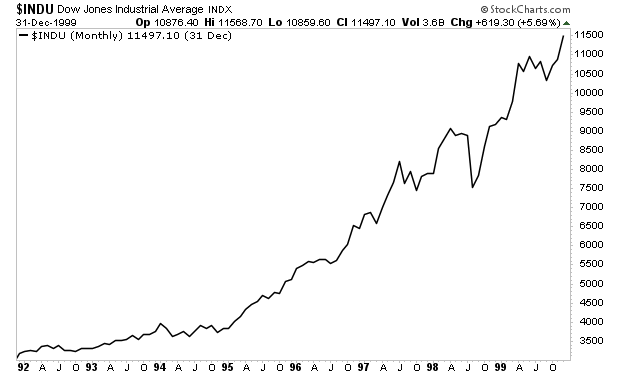

In contrast, from 1982 to 2000, the US economy again nearly tripled in size from $3.2 trillion to $10 trillion. But during this particular time, the stock market exploded higher rising nearly 1,500%!

So, we have two time periods in which the economy nearly tripled in size. During one of them, the stock market went nowhere. During the other, the stock market rose nearly 1,500%.

Again, stocks have little if any correlation to the economy. This is especially true during asset bubbles like the one we’re in today.

So how do you determine when a bubble has burst and a crisis is about to begin?

To do that, I rely on certain key signals that flash before every market crash.

I detail them, along with what they’re currently saying about the market today in a Special Investment Report How to Predict a Crash.

To pick up a free copy, swing by:

https://phoenixcapitalmarketing.com/predictcrash.html

Best Regards