Bitcoin Hodlers: Time is Running Out to Convert Nothing into Something

Three key takeaways:

- For weeks, the Bitcoin market has looked propped up by the whales, especially after the recent FTX disaster.

- Bitcoin hodlers should strongly consider moving into gold, silver, or at least Ether.

- Full disclosure, I have a complicated relationship with Crypto.

An Artificial Market

I have specifically avoided writing about Bitcoin despite having strong opinions on the subject. Bitcoin is a very hot topic, and most people have already made up their minds. In short, I think it has zero value but that argument has been made many times before so I couldn’t add anything new to the conversation.

Full disclosure, I have been in the Crypto market since 2013 and am net positive. That said, given recent market events, I cannot sit by in good conscience without giving fair warning. This is not a Bitcoin is worthless analysis, this is a wake-up call to push people to ask what is keeping this market from imploding. FTX isn’t the canary in the coal mine (that was Celsius, or one of the other firms that crashed this year). FTX is the coal mine, and it just collapsed.

I think the data shows that this market is being propped up by whales. If the dam breaks it could send markets crashing. Back on Oct 31, before anything happened with FTX, I texted a close friend:

My new theory is that the whales are not trying to pump the price anymore. Instead, they are trying to stabilize the price to win back institutional investors. I have never seen bitcoin price volatility so low over a 6 month stretch in 10 years. It just totally stopped moving after an epic collapse back in June. No bounce, no continuation, no nothing. Just super tight price range even while the stock market has continued falling.

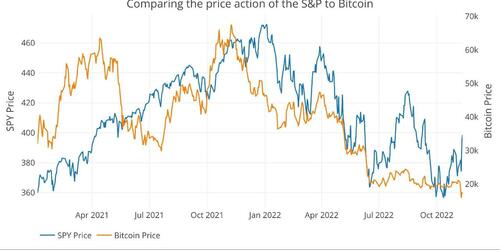

I was led to this thinking after watching Bitcoin crash in June to ~19k and then just hold. It spent the next few months consolidating while the bond and stock markets went into turmoil. See the chart below with the simple price of SPY overlaid on top of Bitcoin since 2021. You may notice how steady the orange line has been since June 21, directly after the Bitcoin crash below $20k.

Figure: 1 SPY vs BTC

Let’s compare the 30-day rolling annualized standard deviation between Bitcoin and the SPY. This chart shows the difference in volatility between Bitcoin and SPY. Notice how it has been collapsing in recent months, and Bitcoin was actually less volatile than the S&P for a brief period in October. Since when is Bitcoin less volatile than the S&P 500? That has quickly reversed since the FTX fiasco.

Figure: 2 Volatility/Standard Deviation

However, while price volatility is falling, trade volume is not. The next chart is the 30-day rolling average trade volume of Bitcoin compared to the price. Once again you can notice a misalignment. As volume was steadily increasing over the last several months, the price stayed in a tight range.

Figure: 3 Price and Volume

Usually, large changes in volume are accompanied by large moves in price. But in this case, volume was moving up steadily while the price stayed nearly flat. How and why was this happening?

As I alluded to above in my text to a friend, this looked like an artificial market. The market nearly collapsed back in June and then just flatlined near 20k. That doesn’t happen, especially in Bitcoin. After this past week though, I am now convinced this market is being artificially propped up. After all, 27% of the market is dominated by a super minority of less than 0.01%. They have a major vested interest in keeping this market inflated. I think the increased volume against stable price action is from whales defending the price and painting the tape.

I won’t rehash what happened with FTX this week (there are 1,000s of articles explaining the epic collapse). Instead, I will just highlight that this is a MAJOR event in the Crypto space. To Crypto, this would be like 3 Enron happenings all at once, or Enron and Madoff happening in the same weekend. This is catastrophic on every level, but the price of Bitcoin only fell by about 20%. What?!?

In the stock market over the past several weeks, companies have been reporting disappointing earnings at a frequent clip. Each company has been absolutely punished for it. Some have fallen 20% or more in a single day which is extremely rare. These are bad earnings for major corporations that still have revenue. Yet Bitcoin has its Enron + Madoff moment and the price of Bitcoin drops by the same ~20%?

No way! I am not buying it!

Step back and think about this for just a moment. Take another look at the charts above that show how the price volatility collapsed despite steadily increasing trade volume. Most importantly, look at the recent massive spike in trade volume from FTX and the relatively minor price drop. For any mathematicians who might be claiming scale and relative impact are not properly reflected, take a look at the same chart on log scale below.

Figure: 4 Price and Volume on Log Scale

Okay, this looks a little bit more reasonable… until you remember that this was Enron + Madoff! No. I am sorry, but no. The price should be down 50-70% after this event. I am convinced it will be. Think about how much Crypto money just went up in smoke. Think about the confidence lost.

Everyone keeps saying that Crypto winters come and go, and so will this one. But will the summer ever be as bright for Bitcoin? Each winter has been followed by a bigger hype train than the last one. How can the next hype train be bigger than the last one? You had EVERYTHING going for it last year. The price was screaming higher, hype was at a fever pitch, Superbowl ads, celebrity endorsements. Everything!

When this Crypto winter breaks, Bitcoin won’t recover to new all-time highs without being artificially pumped up. Who is entering the market on the next rebound that wasn’t already in the market? Institutional investors have abandoned ship and the whales are left trying to stem the tide.

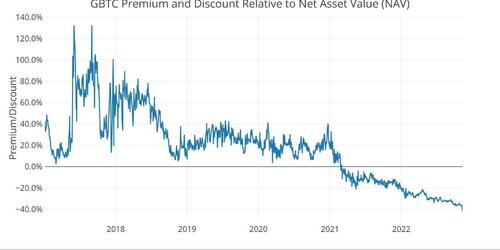

Want more proof that institutional investors have left? Take a look at the GBTC Premium/Discount chart.

Figure: 5 GBTC Premium and Discount

This is easy money for institutions. If you want Bitcoin exposure, you can get exposure at a 42% discount. Why is this arbitrage not closing? Let’s make this a little fancier and adjust the price of Bitcoin by the premium/discount of GBTC.

Figure: 6 GBTC Implied Price

Notice something? Right now, GBTC is implying that the fair market price of Bitcoin is under $10k. So, who is right here? I am betting on the smart money that is unwilling to buy GBTC at a whopping 47% discount.

I get it. Bitcoin is like a religion for some people. HODL, laser eyes, Michael Saylor, blah blah. But sometimes something is just so obvious you have to get your head out of the sand. If you want true independence from the banking system and you want to reduce counterparty risk, then buy physical gold and silver. Unlike GBTC, the smart money is pillaging the Comex vaults right now while institutional investors are also paying a hefty premium for silver.

Let me guess, you still want Crypto exposure to maybe get the moonshot event. Triple up or more. Okay fine, at least buy something of value like Ether. It at least has some value. Probably not $1,200, but definitely greater than $0. It also has potential and versatility.

If it’s me, I still think about value. I wouldn’t pay $500 for a gallon of gas and I wouldn’t pay $10,000 for an ounce of gold (unless hyperinflation hits). So, at $1,200 Ether is probably overpriced. But again, at least it has value. I personally bought in the $150 range and sold too early at around $700.

Ether is far from perfect or a value investment, but it’s a better option than Bitcoin. Still, anyone who wants to exit the banking system and get value… look at physical precious metals!

My complicated history with Crypto

Full disclosure. I have a complex relationship with Crypto. I have made more money in Crypto than gold and silver for sure. I have been bullish and bearish at different times in my life.

As a Libertarian, I heard about Bitcoin back in 2012 and told myself to spend $2,000 and buy 1,000 BTC, toss half into cold storage, and then trade the other half. Whoops. I forgot to do this because it looked complicated. Then Cyprus happened and Bitcoin shot up to $50. I didn’t want to miss the next move, so I started buying. Had a decent stack at one point. Rode it up to $1,100 and then MtGox crashed and poof went my Bitcoins. I eventually sold the bankruptcy claim to an opportunistic buyer.

I decided I needed to understand the tech to see if I should buy back in. I read everything. The Bitcoin white paper, articles, wiki pages about hashing, and how blocks are linked together. How computers compete to solve for the nonce with the correct amount of preceding 0s (this is how the algo gets harder). I looked at transactions on the actual Bitcoin blockchain to try and understand it. It started to make sense to me, so when prices came down, I would buy and then sell the rebound. Doesn’t mean I was all-in though. Back in 2020, I wrote:

I think Blockchain is a vastly overhyped technology. Blockchain removes the need for trust and eliminates counterparty risk, but the cost is enormous. Blockchain is really just a super expensive low-performance database. Not to mention, that there is nothing truly unique in the [Bitcoin] blockchain code, Bitcoin simply has first mover advantage.

I still stand by this. Blockchain is a database, just really expensive. What makes Bitcoin any different than Litecoin or Bitcoin Cash? Maybe different hashing algos or transaction speeds. But structurally, very little. I bet if you ask most Crypto fanatics, they actually understand very little about the underlying tech. There is nothing about Bitcoin that makes it special except that it came first. When you factor in the cost to mine, Bitcoin actually has a negative value.

Ethereum is different. It wants to be Web 3.0 and wants to be the world computer. Maybe it will get there, maybe it won’t. But it has a lot better chance of being worth more than $0 in 10 years. Do you know what will definitely be worth more than $0 in 10 years, 100 years, and 1,000 years? Physical gold and silver. Not a futures contract or an ETF necessarily, but physical metal you can hold in your hand.

If you are still in Bitcoin, then you are betting and hoping for the whales to continue propping up this market. But there is an avalanche of selling coming. As I said, FTX isn’t the canary in the coal mine (that was Celsius, or one of the other firms that crashed this year). FTX is the coal mine, and it just collapsed. Somehow you can still trade BTC for almost $17,000. That’s an extraordinary amount given what just happened.

If you are still hodling, I encourage you to reconsider. Buy something of actual value with that money like physical gold and silver.

There is no counterparty risk, no concern over trust, and no risk of a hacker or losing your keys. It is the best form of insurance against the turmoil that lies ahead.

If you really want Crypto exposure, at least consider Ether. Even if it is overpriced, it is worth something greater than $0.

Bitcoin is worth whatever the whales can force it to be worth, but one day soon, they might lose the capital needed to manipulate the price higher or even just keep it from crashing.

As we learned with FTX, things look fine up until the very moment they are not. And then billions can be lost in a very short time.

How much do you trust the Bitcoin whales to keep this market afloat?