Noticing an influx of banking related news with multiple countries involved.

Chinese bank on verge of collapse after sudden BANK RUN

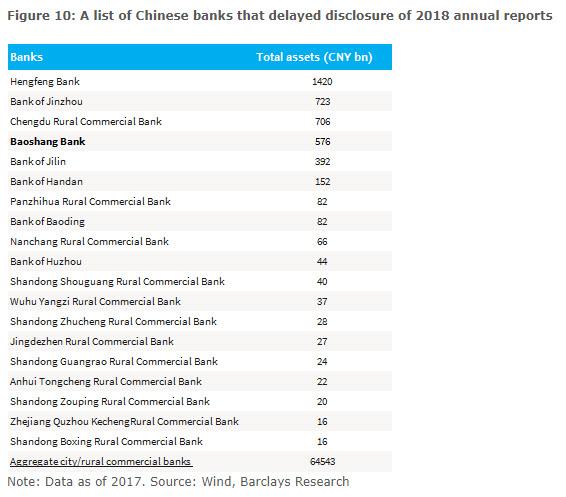

First it was Baoshang Bank , then it was Bank of Jinzhou, then, two months ago, China’s Heng Feng Bank with 1.4 trillion yuan in assets, quietly failed and was just as quietly nationalized. Today, a fourth prominent Chinese bank was on the verge of collapse under the weight of its bad loans, only this time the failure was far less quiet, as depositors of the rural lender swarmed the bank’s retail outlets, demanding their money in an angry demonstration of what Beijing is terrified of the most: a bank run.

Local business leaders, political cadres and banking executives rallied Thursday at the main branch of Henan Yichuan Rural Commercial Bank, just outside the central Chinese city of Luoyang, where they stood one by one before a microphone to pledge their backing for the bank, as smiling employees brandished wads of cash before television cameras to demonstrate just how much cash, literally, the bank had.

It was China’s latest, and most desperate attempt yet to project stability and reassure the public that all is well after rumors spread that the bank’s chairman was in trouble and the bank was on the brink of insolvency. However, as the WSJ reports, it wasn’t enough for 31-year-old Li Xue, who showed up for the third day Thursday to withdraw thousands of yuan of her mother’s life savings after hearing from fellow villagers that Yichuan Bank – which is the largest lender in Yichuan county by the number of branches and capital, and it is also a member of PBOC’s deposit insurance system, according to the local government – was going under.

…

…

Lebanese banks shut for 5th straight day as anti-government protests grow

BEIRUT — Lebanon’s banks will remain closed for a fifth working day amid uncertainty over how Prime Minister Saad al-Hariri plans to extract billions of dollars from the financial sector to help ease an economic crisis that has ignited national protests.

A day after Hariri unveiled a set of measures aimed partly at addressing protester demands, people poured into the streets once again on Tuesday, sustaining the historic wave of dissent against politicians blamed for leading Lebanon into crisis.

A source close to Hariri, who heads a cabinet grouping all Lebanon’s main parties, denied rumors on social media that he was resigning.

The moves he announced on Monday included the symbolic halving of the salaries of ministers and lawmakers, as well as steps toward implementing long-delayed measures vital to fixing the finances of the heavily indebted state.

Under pressure to convince foreign donors he can slash next year’s budget deficit, Hariri has said the central bank and commercial banks would contribute $3.4 billion to help plug the gap, including through an increase in taxes on bank profits.

BREAKING: Lebanon’s central bank gov. says the country is “days away” from economic collapse

— Joseph Haboush (@jhaboush) October 28, 2019

For the second time in a fortnight, the Commonwealth Bank of Australia’s Internet banking service is unavailable due to “technical difficulties”.Customers attempting to log into the CBA service on Thursday are being greeted with an “important message from NetBank”, which states that some customers are being affected by the problem and services should be resumed later this afternoon.

For the second time in a fortnight, the Commonwealth Bank of Australia’s Internet banking service is unavailable due to “technical difficulties”.

Customers attempting to log into the CBA service on Thursday are being greeted with an “important message from NetBank”, which states that some customers are being affected by the problem and services should be resumed later this afternoon.

A Commonwealth Bank spokesperson told ZDNet Australia that around half of NetBank’s customers are affected.

“We have had some problems with NetBank this morning. Technical difficulties resulted in just over 50 percent of users trying to log on being unable to access the site. We expect that the site will be fully accessible mid afternoon,” the spokesperson said.

The repo markets that are going on here in the US. But there are major red flags that haven’t appeared since right before the ‘08 financial crisis. They are finally starting to acknowledge something is going on. Plus we are overdue for a recession. They are having to come up with radical new policies to try and stimulate the economy by using methods such as negative interest rates.

Moreover, Sweden central bank indicates a higher level of risk than their EWI would display previous to 08.

Financial fragility is currently as high in Sweden as it was at the time of the 2008 financial crisis, according to a new early warning indicator (EWI) developed by economists at Sveriges Riksbank.

Half The World’s Banks Won’t Survive The Next Crisis, McKinsey Finds

Half The World’s Banks Won’t Survive The Next Crisis, McKinsey Finds

More than half of the world’s banks are at risk of collapse in the next global downturn if they don’t start preparing for late-cycle shocks, McKinsey & Company warned in its latest global banking outlook.

The consultancy firm warned on Monday, in a 55-page report titled The last pit stop? Time for bold late-cycle moves, that 35% of banks globally are “subscale” and will have to merge or sell to larger firms if they want to survive the next crisis.

“A decade on from the global financial crisis, signs that the banking industry has entered the late phase of the economic cycle are clear: growth in volumes and top-line revenues is slowing, with loan growth of just 4% in 2018—the lowest in the past five years and a good 150 basis points (bps) below nominal GDP growth. Yield curves are also flattening. And, although valuations fluctuate, investor confidence in banks is weakening once again,” McKinsey said.