Early 2019 looked like a great set-up for gold, but failed to live up to its billing. A nice December-through-March run took the price back to the $1,350 resistance that had repelled it four times in the past five years. And that was that. No penetration and fast spike into the $1,500s. Just another failed attempt.

source: tradingeconomics.com

Now comes the “sell in May and go away” part of the annual cycle, as Asia’s wedding season ends and demand for gold jewelry dries up.

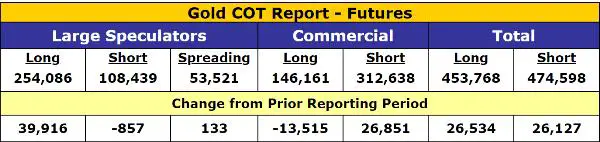

But the news is not all boring. Futures are saying something a bit more positive. The story, in a nutshell, is that speculators bought into the early 2019 “great set-up” thesis and piled into long contracts. Here’s a late-March commitment of traders (COT) report showing speculators more than 2:1 long and commercials (who take the other side of speculators’ trades and tend to be right at big turning points) more than 2:1 short. This kind of structure usually ends badly, and the latest episode was no exception.

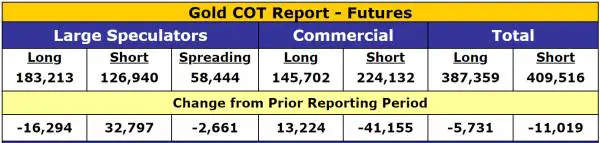

But as gold has fallen this month, speculators have fled and the futures structure has turned more positive. The most recent COT report shows speculators cutting their net long position by a huge 49,000 contracts and the commercials cutting their net shorts just as dramatically.

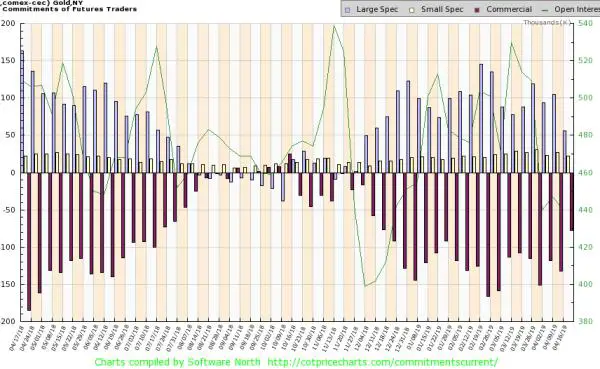

Here’s the same process in graphical form. See how the speculators – the gray bars pointing upward – were actually a bit short (meaning the gray bars drop below the middle dividing line) in late 2018. That’s both unusual and extremely bullish (because remember, speculators are usually wrong when they’re most certain). Then, with gold rising in early 2019, the speculators shifted gears aggressively, going extremely long, which is bearish.

Now, with gold falling again, the speculator longs are shrinking back towards zero. One more week like the last one (very possible since gold is still dropping, which should further spook the speculators), and the structure of the futures market will be bullish once again.

Will it be enough to offset weak seasonality? Maybe. In any event it’s a bit of good news in a stretch that frequently needs it.