Former Fed Chair (and current Treasury Secretary) Janet Yellen protected President Obama by raising The Fed’s target rate only once while Obama was in office. Then raised rates 8 times after Donald Trump was elected in November 2016. Well, Fed Chair Jerome Powell was following Yellen’s TLFTL (Too Low For Too Long) playbook by delaying raising rates once inflation hit 2% in March 2021. Unlike Yellen and he zero interest rate policies (ZIRP or ZORP for zero OUTRAGEOUS rate policy).

One of the safe assets that Federal regulators encouraged banks to hold was agency mortgage-backed securities. The orange circle denotes when headline inflation YoY hit 2% (March 2021). Powell and the gang waited over a year (remember, they said inflation was “transitory”). But another Democrat, Biden, was now President and Powell (like Yellen) didn’t want to rock the boat. So, Powell and the gang waited until headline inflation hit 7% before they took action. Like Yellen, Powell waited too long .

The result? Agency mortgage-backed securities (MBS) got clobbered (white line) as MBS duration (purple line) rose dramatically. Duration is the weighted-average life of MBS and is a measure of risk.

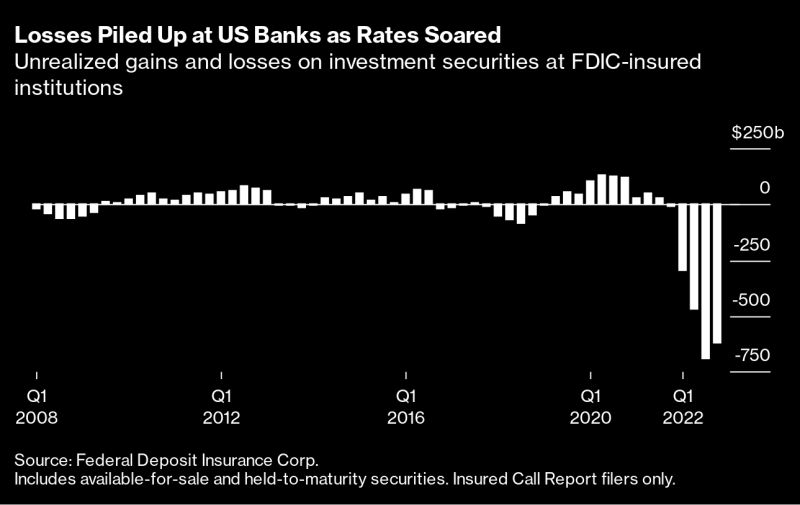

Any surprise that unrealized losses have been piling up at US banks? Not really, only some regional banks weren’t paying attention and got crushed.

Yellen and Powell praising ZORP (Zero OUTRAGEOUS rate policies).