EXPLAIN MONETARY POLICY TO A CHILD

twitter.com/OccupyWisdom/status/993609657024475136

Fed balance sheet pic.twitter.com/lJopxYhyny

— zerohedge (@zerohedge) May 7, 2018

International High Yield sounds warning… pic.twitter.com/WhujksVRpA

— Alastair Williamson (@StockBoardAsset) May 6, 2018

— Alastair Williamson (@StockBoardAsset) May 7, 2018

#QE REALITY AND FANTASY pic.twitter.com/xafsOlplkH

— OW (@OccupyWisdom) May 7, 2018

Today on CNBC Warren Buffett said: "stocks are not in a bubble." Remember this, just prior to the 2008 stock market crash he said the exact same thing… pic.twitter.com/MruqUDy49d

— Gregory Mannarino (@GregMannarino) May 7, 2018

Today on CNBC Warren Buffett said: "stocks are not in a bubble." Remember this, just prior to the 2008 stock market crash he said the exact same thing… pic.twitter.com/MruqUDy49d

— Gregory Mannarino (@GregMannarino) May 7, 2018

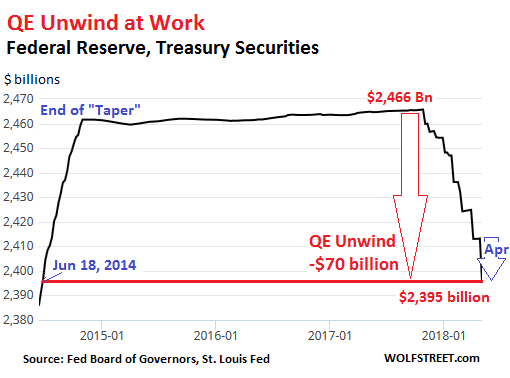

Fed’s QE Unwind Accelerates Sharply

These are getting to be serious amounts.

The QE Unwind is ramping up toward cruising speed. The Fed’s balance sheetfor the week ending May 2, released this afternoon, shows a total drop of $104 billion since the beginning of the QE Unwind in October – to the lowest level since June 11, 2014.

During the years and iterations of QE, the Fed acquired $3.4 trillion in Treasury securities and mortgage-backed securities. The mortgages underlying those MBS are guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. The “balance sheet normalization,” as the Fed calls it, was nudged into motion last October. But the pace accelerates every quarter until it reaches up to $50 billion a month in Q4 this year.

This would trim the balance sheet by up to $420 billion this year, and by up to $600 billion in 2019 and every year going forward, until the Fed considers the balance sheet to be adequately “normalized” — or until something big breaks, whichever comes first.

In April, the scheduled maximum pace was $30 billion (up from $20 billion in January, February, and March): $20 billion in Treasuries and $10 billion in MBS.

Treasury securities

The balance of Treasury securities fell by $17.6 billion in April. This is up 60% from March, when $11 billion “rolled off.” Since the beginning of the QE-Unwind, $70 billion in Treasuries “rolled off.” Now at $2,395 billion, the balance of Treasuries has hit the lowest level since June 18, 2014.