Japan just hit the “panic” button regarding inflation.

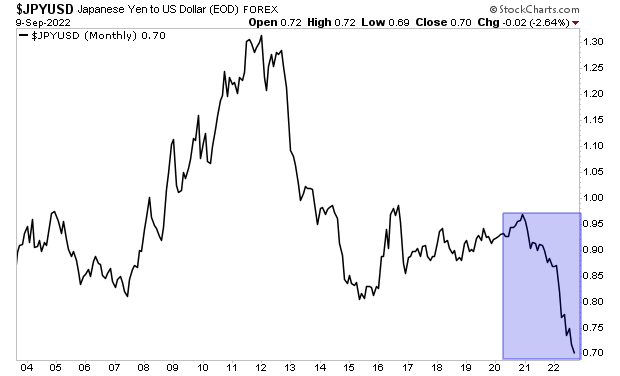

Over the last few two years, the Japanese Yen has imploded as the country’s central bank continued to print money. In contrast, the central banks in both Europe and the U.S. are tightening. As a result of this difference in policy (EU and US tightening, Japan still easing) Japan’s currency has collapsed to a 24 year low.

A currency collapse like this under any condition is bad for the country. However, for Japan the issue is particularly bad as it imports practically ALL of its energy and food.

Imagine trying to buy gas or food when your currency just collapsed to a24 year low relative to your primary trading partners (China and the U.S.).

And so, on Friday, the country’s central bank, the Bank of Japan (BoJ), announced it will begin intervening in the currency markets to support the yen.

What does this mean?

The great currency wars have begun. We have reached the point at which major central banks will begin intervening directly in the currency markets to fight inflation. And ironically, this in turn is only going to unleash MORE inflation.

Why?

Because the only way for a central bank to intervene in the currency markets is to print more money! Indeed, if the policy response from the pandemic has taught us one thing, it’s that printing money is all policymakers know how to do!