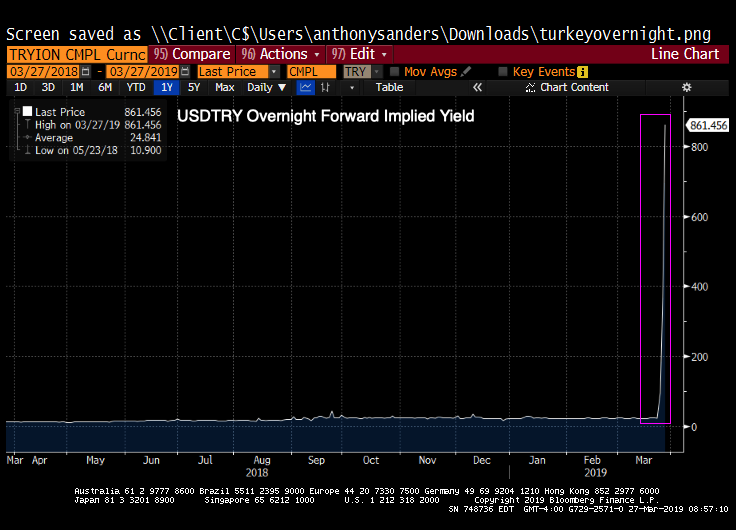

This week, Turkey further roiled markets by preventing foreign banks from accessing the liras they need to close out their swap positions. That’s made it almost impossible for bankers to short the lira or exit carry trades, and forced the overnight lira rate up to about 1,000 percent from 23 percent.

And the USDTRY overnight forward implied yield has risen to 861.

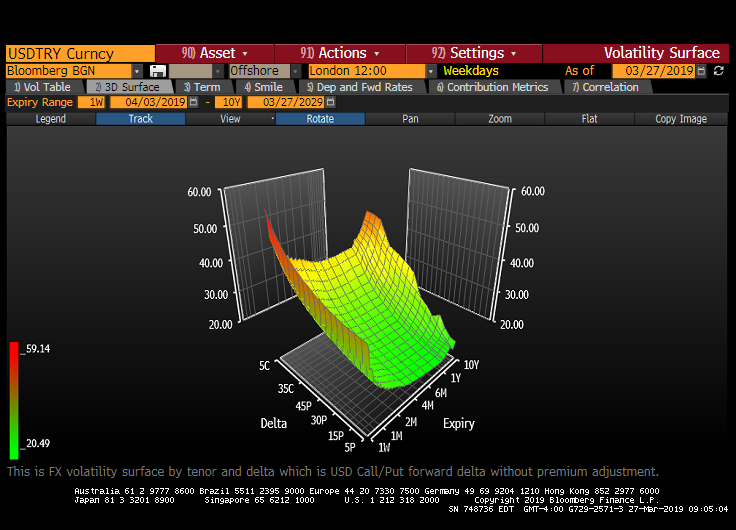

The volatility surface for the USDTRY is showing an unusual shape.

d

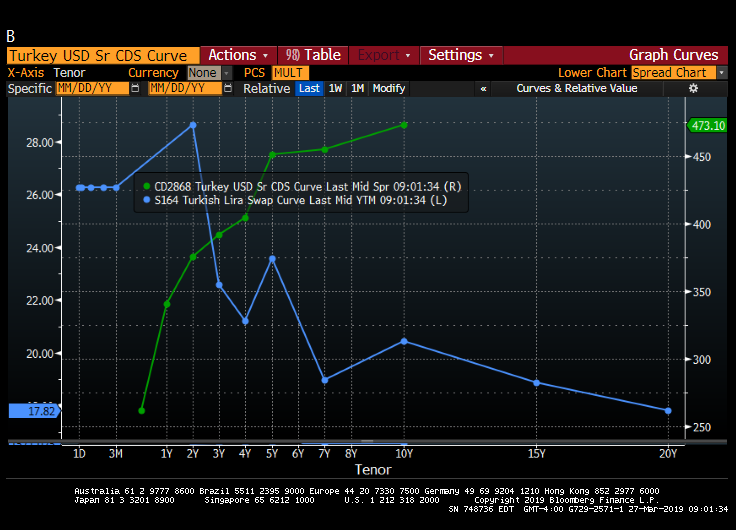

Turkey’s USD Sr Credit Default has blown out to 473 at 10 years while their 2-year Lira swap rate is 29.

From Zero Hedge: Just days after Turkish president Erdogan vowed to crackdown on currency speculators and launched a probe against JPMorgan for its Friday reco to short the country’s currency to 5.90 vs the dollar, on Tuesday Turkish authorities took their vendetta against short sellers to never before seen levels, when taking a page of the Chinese currency manipulation playbook, they made it virtually impossible for foreign investors to short the lira.

Turkey will not be mating with US banks like JP Morgan Chase in the near future.