by Dana Lyons

This week has seen yet more examples of poor internals despite new highs in the major averages.

Last week, we highlighted 2 recent potential examples of a weakening in the “internals” of the stock market rally. Again, by internals, we are referring to the amount of participation in the rally as measured by statistics such as advancing vs. declining stocks, advancing vs. declining volume and new 52-week highs vs. 52-week lows. The broader the participation, the stronger the foundation in the rally. Last week’s posts demonstrated some possible cracks in what has been a pretty solid foundation.

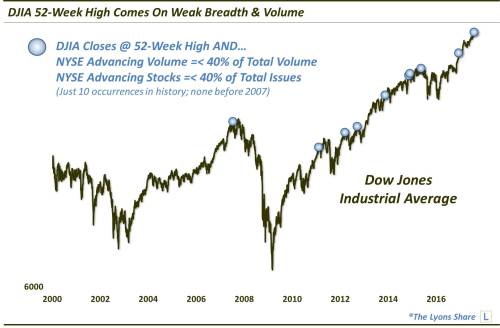

Today, we highlight another example of potential internal cracks, similar to those mentioned last week. This one involves the Dow Jones Industrial Average (DJIA), which has been on a roll of late, setting now 7 consecutive all-time highs. Yesterday’s new high was interesting in its lack of participation from the rest of the market.

Specifically, the DJIA hit a 52-week high, yet amazingly just 40% of issues on the NYSE advanced and just 40% of volume went towards advancing stocks. That was just the 10th time ever that we have seen such weak internals occurring with a new high in the DJIA (FYI, today’s new high might mark the 11th such day, pending official breadth stats).

As we queried last week, is this simply a 1-day coincidence, or is it a genuine warning sign regarding a weakening rally foundation? Certainly, it is easier for a 30-stock index, especially a price-weighted one, to generate these types of divergences or distortions. There just needs to be a few stocks, e.g., AAPL, that happen to be up big on the day (due to earnings or whatever) in order to overcome a weak day in the overall market.

However, when we begin to see clusters of these types of days, it starts to become less of a coincidence and more of a concerning trend. Are we at that point of warranted concern now? In a premium post at The Lyons Share, we’ll address that question by studying those historical occurrences above and the DJIA’s aggregate subsequent performance. We will also look at some additional, perhaps more alarming, angles to this recent phenomenon, all in an attempt to come to an informed, quantitatively-backed conclusion.