Traders are the most bearish on Nasdaq 100 futures in 12 years. Chart via @gregorhunter @theterminal pic.twitter.com/NPv4U2Nih9

— Lisa Abramowicz (@lisaabramowicz1) September 21, 2020

— M/I_Investments (@MI_Investments) September 21, 2020

JPMORGAN: "The odds of no stimulus pre-election continue to increase. If the package fails to materialize, it is unclear what would happen during the lame duck session. Dems are said to be anchored around $2T, Trump $1.5T, Senate

Republicans in the $500bn – $700bn range."— James Pethokoukis (@JimPethokoukis) September 21, 2020

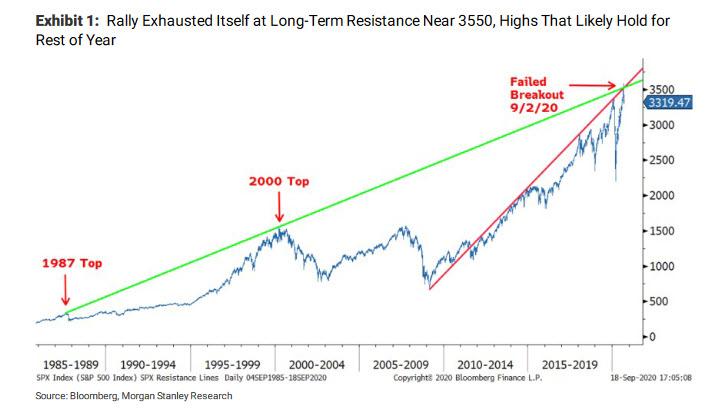

MORGAN STANLEY: Ginsburg’s death “adds another element of risk .. and could weigh on the market overall in the near term. .. We believe the S&P 500 and Nasdaq 100 remain vulnerable to a test of their 200-day moving averages, which are 7% and 14% lower, respectively.” [Wilson] pic.twitter.com/DytFpBt7jB

— Carl Quintanilla (@carlquintanilla) September 21, 2020

Morgan Stanley Turns Bearish, Sees Tech Plunge Accelerating As Investors Dump Most QQQs In 20 Years

“Fiscal Cliff +Peak Fed = Second Leg of Correction”

Morgan Stanley

Back in March, just after the Fed nationalized the bond market, Morgan Stanley’s Michael Wilson quickly emerged as the biggest cheerleader for risk assets, correctly predicting that stocks would soar on the back of the biggest surge in global fiscal and monetary stimulus which according to BofA estimates is now well over $20 trillion.

Well, the party is now over.

As Wilson writes this morning, over the past few weeks US equity markets have experienced their largest correction since the new bull market began, and according to Morgan Stanley – which still sees the bull market continuing albeit at a slower pace – not only is this “correction due to the rally simply exhausting itself into long-term resistance” but the second leg of the correction has arrived.

Strategists’ Mood Darkens on U.S. Stocks as Headwinds Swirl

As investors fret over the presidential election, a Congress deadlocked over the next stimulus package and extended lockdowns around the world, S&P stock futures are extending three weeks of losses.

Ex Fed Governor: Coronavirus Impact ‘More Fundamental and Long Run’ Than 9/11, 2008 Crisis

The COVID-19 crisis “is going to have a more fundamental and long-run impact on the structure” of the economy, Randall Kroszner explained.

US Banks Trim Expectations in Era of Low Interest Rates

US banks are preparing investors for a prolonged period in which low interest rates are a drag on their profits.

What’s going on?

Only 1% of all mortgage backed securities that the Fed has been buying are commercial.

If the residential market “booming”, why does it need so much hand holding?

They just bought another $50B of MBS this past week.

2nd largest purchase since June. pic.twitter.com/T2FbKvj2Tl

— Otavio (Tavi) Costa (@TaviCosta) September 20, 2020