via Katherine Greifeld and Emily Barrett

As bond traders scale back Federal Reserve rate-hike expectations, one section of the U.S. yield curve is on a fast track to inversion.

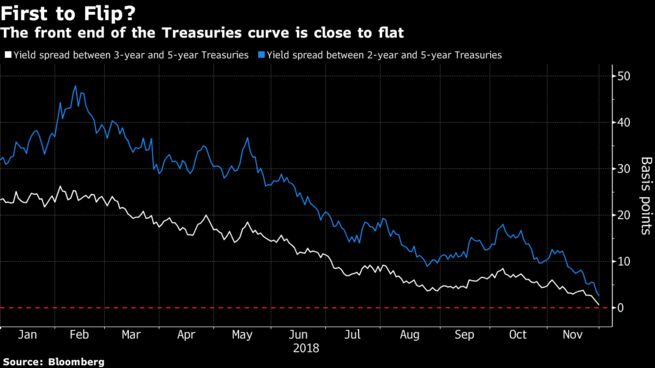

The spread between 3-year and 5-year Treasury yields shrank to less than 0.1 basis point on Friday, the smallest gap in more than a decade. It may turn negative by the end of the day, BMO Capital Markets says, as investors anticipate the end of the central bank’s tightening path.

“If you were increasing the probability that the FOMC will not only finish its hiking cycle but potentially have to cut rates in the next five years, you might anticipate the belly to outperform,” BMO interest-rate strategist Jon Hill said. “Whereas the front-end remains relatively anchored by the expectation of additional Fed rate hikes in the coming quarters.”

Treasury curve flattening over the past two years is stoking concern that rising interest rates, against a backdrop of slowing global growth, could harm the U.S. economy. Inversion — where yields at the short end of the curve rise above those at the long end — has been a reliable indicator of recessions.

Recent Fed communications suggest the central bank is increasingly concerned about risks to growth. While a December rate increase is still seen as a done deal, Fed Chairman Jerome Powell’s comments that interest rates are “just below” the so-called neutral range changed the 2019 outlook. The spread between December 2018 and December 2019 eurodollar futures — a measure of how much tightening traders expect next year — is currently just 23 basis points, the equivalent of less than one Fed hike.

The 3-year to 5-year is only a small segment, but it’s not the only one on the verge of disappearing. The spread between 2-year and 5-year Treasury yields reached its narrowest point in 11 years on Friday, at just 1.9 basis points, as 5-year Treasuries extended their gains.

To be sure, that rally in the 5-year — which has outperformed both the 3- and 7-year maturities — has enticed sellers. A series of futures block trades Thursday reflected heavy bets that the five-year will cheapen versus the 10- and 30-year sectors.

Flows into the 5-year sector have been driven in part by safe-haven flows out of stocks, said Subadra Rajappa, head of U.S. rates strategy at Societe Generale. The curve is only one indicator among the still-healthy economic measures she’s watching, but Rajappa notes the recent uptick in jobless claims, and is watching for deterioration in ISM manufacturing surveys.

SocGen still expects a Fed rate increase in December and two in 2019, though not necessarily in March and June, and a recession in early 2020.

“The signal you’re getting from the curve seems to be consistent with that sort of trajectory,” Rajappa said. “Even if those hikes come, they’re going to be a little bit more spread out.”