“US private sector firms signalled a sharper fall in business

activity during August, according to latest ‘flash’ PMI™ data

from S&P Global. The decrease in output was the fastest

seen since May 2020 and solid overall. The rate of

contraction also outpaced anything recorded outside of the

initial pandemic outbreak since the series began nearly 13-

years ago.”

www.pmi.spglobal.com/Public/Home/PressRelease/060c0e13d7fe45bfa897a470dff44fbb

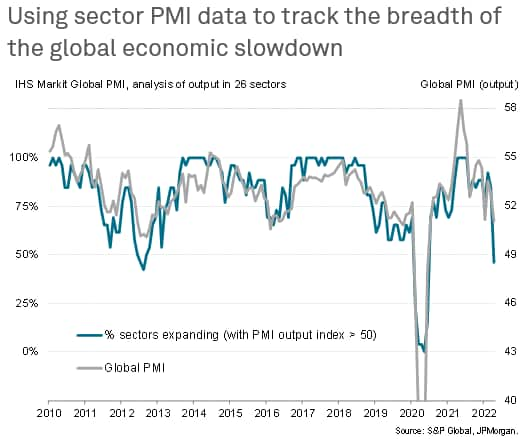

etail sector PMI data compiled by S&P Global, derived from information provided by panels of over 30,000 companies in 45 countries, revealed a broadening of the global economic slowdown in April. With the exception of the downturn seen in early 2020 during the initial phase of the pandemic, April saw more sectors reporting falling output than at any time since 2012.

With the Ukraine war ongoing and mainland China locking down some of its major cities to fight the Omicron variant of COVID-19, supply chain disruptions have increased, damaging vast swathes of the global manufacturing economy, while price pressures have intensified, eroding spending power.

While growth outside of China has shown some encouraging resilience, losing only marginal momentum in April on average, this can be linked to resurgent spending on consumer services amid to loosened COVID-19 restrictions. However, demand for consumer goods has almost stalled as household spending is diverted to services, suggesting there is a risk that the global economy is reliant on a potentially short-lived rebound in consumer service spending to support sustained growth in the coming months.

Prices are meanwhile rising for all goods and services, though of particular concern is a record rise in food prices amid falling food production, which is likely to add to the global cost of living crisis.

“The latest, from the Bureau of Labor Statistics, showed unit labor costs in the nonfarm business sector rose 10.8% in the second quarter, following a revised 12.7% jump in the first quarter. (See chart, Labor Costs Jump, Add to Price Pressures.)

What drives up the unit labor cost number, besides higher hourly compensation, is lower employee output per hour. The jump in labor costs reflected a 5.7% increase in hourly compensation and a 4.6% decrease in productivity.”

Labor cost per input is rise sharply, as private sector output is falling at breakneck speeds. Not a good recipe.

AC