There’s never been a generation as influential, for good or ill, as today’s Baby Boomers. So our mass retirement over the next decade should, in theory, be a big deal.

One scenario has us selling our stocks and either spending the proceeds or moving them into less risky assets like bonds and cash. This reverses the past few decades’ upward pressure on stock prices and sends them down hard. At the same time, we downsize our living arrangements, swapping multi-story McMansions for smaller one-story homes conducive to aging in place. Large house prices, as a result, plunge.

Harry Dent is a well-known proponent of the demographics-as-destiny idea. Here’s his take:

Dent’s “demographic cliff” is both logical and ominous. But apparently it’s not the mainstream view. Yesterday’s Wall Street Journal ran a story on future inflation trends, and had this to say about retiring boomers:

The U.S., China and many large advanced economies now face a demographic squeeze that could contribute to inflation.

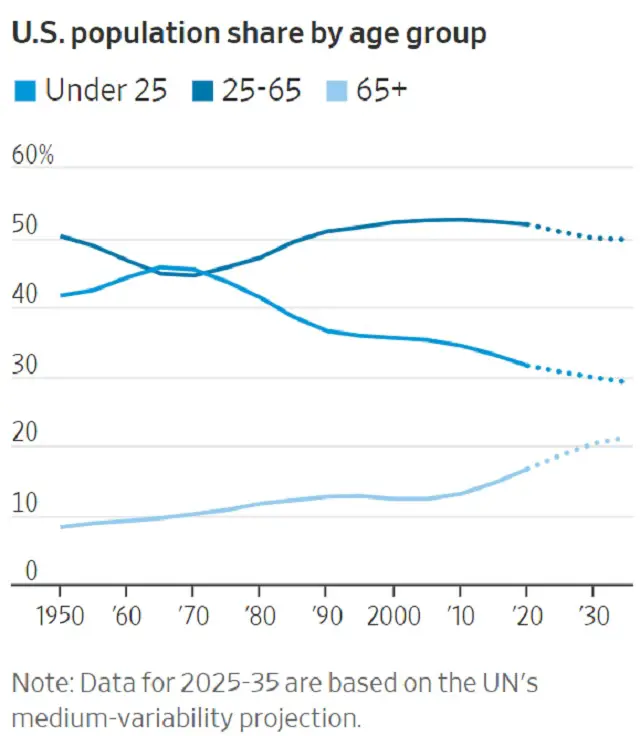

The larger the share of a country’s population that is working-age, the more the population tends to save, since workers in aggregate produce more than they consume. That restraint on demand tends to put downward pressure on prices. Dependents—children and retirees—have the reverse effect: They consume more than they produce.

As the U.S. population ages, the number of dependents grows more quickly than the number of people in the workforce, and inflation picks up, said Manoj Pradhan, founder of Talking Heads Macroeconomics, an independent macroeconomic research firm, and co-author of “The Great Demographic Reversal: Ageing Societies, Waning Inequality, and an Inflation Revival.”

Baby boomers wield disproportionate spending power, said Peter Berezin, chief global strategist at BCA Research, noting this generation holds a little more than half of all U.S. household wealth. “If you have a group that’s still spending but not producing you have an increase in consumption relative to production that’s more likely to give you an inflationary impulse.”

But with most baby boomers now retired, U.S. working-age population growth will slow to just 0.2% a year between 2020 and 2030, according to the United Nations, from 0.6% in the prior decade and 1.1% during the aughts. The pandemic boosted retirements by about 1.5 million, said Mr. Berezin. “At least for the next couple years, there will be this hit to the actual size of the labor force,” he said.

A paper by Mikael Juselius, a Bank of Finland economist, and Előd Takáts, of the Bank for International Settlements finds lengthening lifespans initially nudge inflation lower because they spur earners to save even more for their retirement. Eventually, though, a rising ratio of dependents to workers adds to inflationary pressures.

Hmmmm…the idea of an aging society being inflationary because of low saving rates seems to ignore the much-bigger forces now at work in the fiat currency world.

It’s more likely that the soaring cost of retiree healthcare would lead governments to run massive deficits and then lean on central banks to finance this debt tsunami with a commensurate amount of newly created currency. THAT would be inflationary.

And that’s exactly what is happening out there right now. So yes, Boomer financial behavior might eventually turn deflationary. But governments’ response to this change will be wildly inflationary. Which brings us back to the sound money community’s assumption that massive debt begets unrestrained currency creation begets financial instability.

Put another way, we’re screwed however it plays out.