Authored by David Stockman via Contra Corner blog,

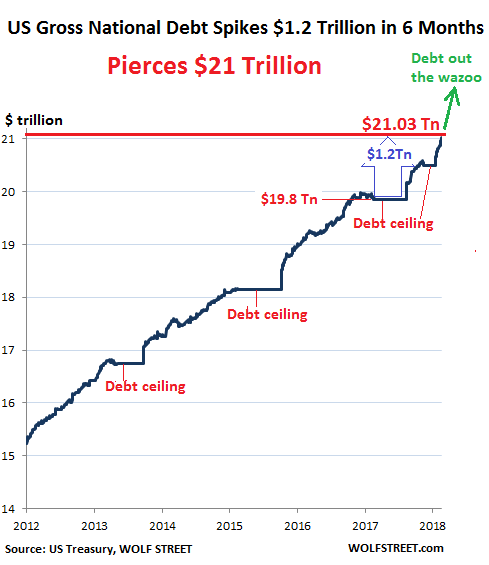

That didn’t take long. The $20 trillion national debt marker was crossed on September 8th, but it only took another 186 days to vault over the $21 trillion level last Thursday.

Then again, you haven’t seen nothin’ yet. The annual deficit will approach $1.2 trillion in the coming fiscal year; breach the $2.0 trillion market by the middle of the next decade at the latest; and pile a total of $17 trillion onto the national debt over the next 10 years.

Moreover, these numbers are about as locked-in as tomorrow’s sunrise. So it is fair to say that objectively the public debt is already $40 trillion and that’s just within the decade of the 2020s. And as we show below, that monstrous inflation of the public debt could not come at a worse time in the political, demographic and monetary cycle.

Still, we get slightly ahead of the story. What’s relevant in the near term is that every bit of political resistance to the growth of Federal deficits during the Obama era is now over and gone. The nation’s fiscal accounts are now actually in free fall—and for as far as the eye can see into the future.

We have been christening the Donald as the Great Disrupter all along—the political accident that will at last bring the destructive rule of the Wall Street/Washington establishment to a thundering demise. And nowhere is that more evident than with respect to the Donald’s pivotal position at the center of the fiscal calamity now unfolding.

Needless to say, Trump has finally locked-up the gears of fiscal policy tighter than a drum. That’s because he embodies a trifecta of fiscal impulses that amounts to pure madness. To wit, the Donald is pro-Warfare State, pro-Welfare State and has just slashed Uncle’s Sam’s tax take to 16.6% of GDP—-the lowest rate since 1950.

Accordingly, there is exactly zero chance of any legislative action to stem Washington’s exploding red ink (see below) until after the 2020 election, and it will be far too late by then.

That is to say, the Donald is not about to sign legislation that would raise taxes, cut Social Security/Medicare or sharply ratchet back defense spending. Nor is there any possible congressional majority to serve up even a down payment on this necessary fiscal fix in the first place.

Indeed, it is now evident that the Congressional GOP has thrown whatever vestige of fiscal rectitude it held onto during the Obama years to the winds.

In their desperation to show that they can govern apart from the mad man in the Oval Office, Congressional Republicans recently passed the most irresponsible, unfunded tax bill since the 1980s at the tail end of what is now nearly the longest business expansion in history; and then moved within weeks to blow the budget sequester caps sky high, thereby adding $300 billion to defense and domestic discretionary spending during the next two years alone—even as they shoveled-out another $120 billion of disaster relief spending with no honest offsets whatsoever.

Of course, the alternative of a bipartisan fiscal responsibility coalition emerging in the foreseeable future is about as likely as vows of chastity being taken in a whore house, and we do not employ that particular metaphor at random.

Indeed, Wolf Richter’s excellent chart below depicts the dismal fiscal cycle that is now operative in the Imperial City. To wit, what used to be called the debt ceiling has effectively become the debt floor.

That is, there is now a cycle in which the statutory borrowing limit remains temporarily in effect (flat areas marked “debt ceiling”) until the Treasury runs low on cash. Then the ceiling is “suspended” (rising squiggly line) as long as necessary for political convenience—during which time the Treasury borrows like crazy.

During the five weeks since the “ceiling” was lifted on February 9, for example, the US treasury borrowed a cool $535 billion; and during the two suspensions combined since last September it has issued a staggering $1.2 trillion in new debt obligations.

Never mind that computes to $6.5 billion per day. After all, as one talking head attempted to school your editor on CNBC last week, the Federal deficit is only 3.5% of GDP. What’s to worry?

Our short answer to this thirty-something hot shot, of course, is just about everything is to worry. That’s because Wall Street is way behind the curve in comprehending that the monstrous fiscal freight train coming down the tracks is no mere statistical factoid at 3.5% of GDP.

To the contrary, the current fiscal equation is sui generis. It embodies a freakish and incendiary confluence of politics, policy, demographics, the business cycle, central banking and global developments that is utterly different—and massively more dangerous—- than anything that has gone before.

So we commence this multi-part series not merely to rebuke the Halftime Report idiot who spoke for much of Wall Street when he averred it was all getting better on the fiscal front because current deficits are far smaller than Obama’s. It seems that the only rebuke perma-bulls like Joe Terranova and his ilk of day traders understand is getting hit upside the head by a 40% stock plunge, anyway.

Still, the Wall Street brokers are making another run at the retail mullets—even trotting out high powered and ordinarily sensible market technicians like JPMorgan’s Marko Kolanovic—to urge one last run at buying the dip.

The Donald’s contretemps to the contrary notwithstanding, the global economy is proceeding just fine, they insist. And besides, the chart points beckon: The 10% February dip–including two 1,000 point plunges on the Dow in the same week— is just August 2015 or February 2016 all over again. That is, a bullish pause that refreshes.

In a word, that is one giant load of Wall Street horse manure. And we are here to tell you that unlike the boy in Ronald Reagan’s favorite story, which we mentioned last week, there ain’t no damn pony anywhere in sight!

The world economy may bump along for a quarter or two, but structurally it’s a monumental mess because it all turns on a hideous freak of world economic history that we call the $40 trillion Red Ponzi. And in the jaws of the thundering monetary/fiscal clash looming just around the corner in the bond pits, there ain’t no stinkin’ trading charts that matter a whit, anyway.

What matters 1000X more than the daily stock charts are the following two epochal force vectors that we shall elaborate upon in the balance of this series. That is, (1) the explosion of giant structural deficits driven by demographics, political dysfunction and the ascendant Warfare State; and (2) the historically unprecedented pivot to quantitative tightening by the central banks or what amounts to a vast de-monetization of the public debt.

In combination, they guarantee a “yield shock” of biblical proportions, which will eventually eviscerate the cap rates upon which the entire towering bubble in the equity market is predicated.

The first vector, of course, is the exploding structural deficit, which will come as a huge shock to Wall Street. That’s because it has been house-trained for so long on the “deficits don’t matter” mantra owing to central bank monetization that it can no longer recognize or assess relevant scale.

To wit, the idea that the upcoming 6% of GDP deficit ($1.2 trillion in FY 2019) is at least not as bad as Obama’s deficits is just plain stupid. The largest Obama deficit was 9.8% of GDP and it occurred at the bottom of the worst US recessioin since the 1930s (FY 2009); it fell steadily from there t0 2.4% of GDP by FY 2015.

Bad as the Obama deficits were, what is materializing now is an altogether different kettle of fish. The huge Trump deficits will hit at the 10th year of what will be a record business expansion that will be 125 months-old by the end of FY 2019.

Stated differently, the Trump deficits stand squarely in harm’s way in front of the next recession; and, worse still, they are growing in size as a structural policy matter owing to the retirement time bomb otherwise known as the 80-million strong Baby Boom generation.

Wall Street’s inability to appreciate the cyclical and demographic context of these erupting deficits, of course, represents just one more case of the recency bias. The central banks have falsified bond yields so egregiously and for so long, that the unprecedented deficit magnitudes now baked into the cake are simply unrecognized.

For instance, the Fed did print the Obama Administration out of its giant deficits, but even then they set all time records. During Barry’s eight year term the Federal deficit averaged 5.8% of GDP, and one single fact points to the aberrational nature of the Obama record.

To wit, Obama’s 8-year deficit average of 5.8% of GDP exceeded the worst Reagan deficit (5.7%) at the very bottom of the deep 1982 recession.

Likewise, it was more than triple the 1.5% annual average during the George W. Bush years, and far above the 1% of GDP average during the Clinton years. It also far exceeded the 3.8% of GDP deficit average during the 12-year Reagan-Bush tenure, and also left big spending Jimmy Carter in the dust, whose average deficit amounted to 2.3% of GDP.

So here is the first chart that trumps (so to speak) anything in the short-term stock charts by a country mile. As will be detailed in further installments, the $2.4 trillion deficit projected for FY 2028 is hard-baked into the future, and represents the best case!

The actual deficit by the end of the 2020s will be far larger—once the next recession rips through the fiscal equation.

Still, the $2.4 trillion deficit projected below under Rosy Scenario amounts to 10% of GDP, and at a point that would be 230 months after the last recession!

So we’d say that what we are heading into ain’t no buyable dip. It’s a financial chasm like the world has never known, and one that the central bank pivot to QT (Part 2) will turn into an outright nightmare.