via Sven Carlin:

Summary

- Most analysts see Apple as a hold or buy, I prefer to be a contrarian.

- Apple is priced for perfection but given its history, it is very unlikely it will keep growing linearly.

- A high valuation, high recent growth and profitability, make the stock very risky for a limited reward.

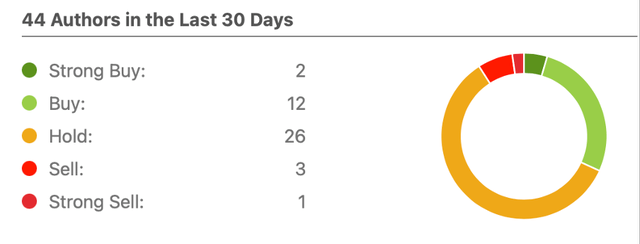

I recently looked at Apple (NASDAQ:AAPL) and was surprised that most articles rated the stock as a hold or buy, with only 4 sell ratings out of 44, of which just one as a strong sell.

Apple stock SA authors rating breakdown (Seeking Alpha)

I see Apple as a strong sell and overvalued for 2 very simple reasons: A high valuation and slower than expected growth ahead.

Let me start by discussing what is currently priced in the stock, elaborate on how it is unlikely those expectations will be met and conclude by showing how the risk of investing in Apple is high while the reward is low. Not a situation I like to be in when it comes to investing.

What Is Priced In

A look at EPS estimates is a straightforward way to see what are the expectations priced in a stock. My issue with EPS estimates is that those are usually linear in nature and too short-term for investing purposes. Most analysts make only two-year estimations because those are Wall Street’s standards and even when they make those, it is usually based on past trends.

Apple stock EPS estimates (Seeking Alpha)

The consensus is that Apple will see flat earnings for 2023 as we have seen a slower quarter, but going forward analysts expect Apple will simply continue to grow at approximately 10% per year. Of course, if 2023 is just a pause growth year and growth resumes onward, Apple deserves the current valuation of 25. If so, earnings are expected to double over the next 7 years, and the stock should follow, all else equal.

However, I’ve been following Apple for a while and I know that linearity is not how Apple’s business works. In 2016 I considered Apple a buy because Wall Street’s expectations were of no growth ahead based on just one year with declining revenues and stagnant iPhone sales (2015). The P/E ratio was 10 and few liked Apple’s outlook. Now in 2023, after two great years of strong growth, Wall Street might be too exuberant.