Robert Kiyosaki recently tweeted, “The best time to prepare for a crash is before the crash. The biggest crash in world history is coming. The good news is the best time to get rich is during a crash. The bad news is the next crash will be a long one.”

Is Kiyosaki just being hyperbolic, or should investors prepare for the worst?

Importantly, I received Kiyosaki’s comment in an email that I could find out more by just clicking on the link to get a “free” report.

I can save you time, and future spam emails, by telling you that Kiyosaki will be correct.

Eventually.

However, the problem, as always, is “timing.”

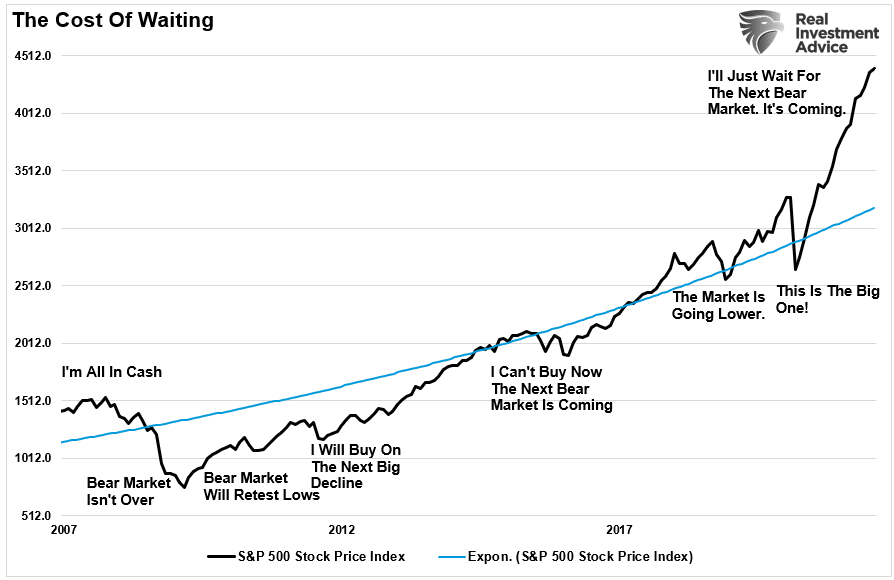

As discussed previously, going to cash too early can be as detrimental to your financial outcome as the crash itself.

Over the past decade, I have met with numerous individuals who “went to cash” in 2008 before the crash. They felt confident in their actions at the time. However, that “confidence” gave way to “confirmation bias” after the market bottomed in 2009. They remained convinced the “bear market” was not yet over, and sought out confirming information.

As a consequence, they remained in cash. The cost of “sitting out” on a market advance is evident.

As the market turned from “bearish” to “bullish,” many individuals remained in cash worrying they had missed the opportunity to get in. Even when there were decent pullbacks, the “fear of being wrong” outweighed the necessity of getting capital invested.

The email I received noted:

“If such a disaster could be in the making, your assets are at risk and this requires your immediate attention! And if you believe that now isn’t the time to protect yourself and your family, when will it be?”

Let’s start with that last sentence.

The Biggest Crash In History Is Coming

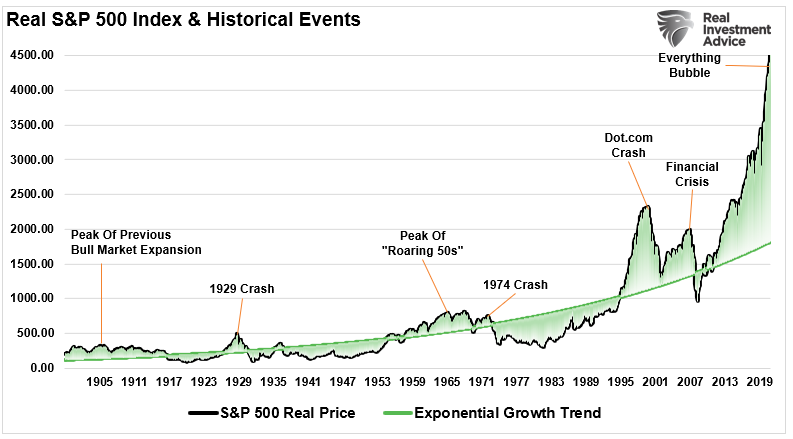

As I stated, Kiyosaki is right. The biggest crash in world history is coming, and it will be due to the most powerful financial force in the financial markets – mean reversions. The chart below shows the deviation of the inflation-adjusted S&P 500 index (using Shiller data) from its exponential growth trend.

Note that the market reverted to or beyond its exponential growth trend in every case, without exception.

(Usually, when charting long-term stock market prices, I would use a log-scale to minimize the impact of large numbers on the whole. However, in this instance, such is not appropriate as we examine the historical deviations from the underlying growth trend.)

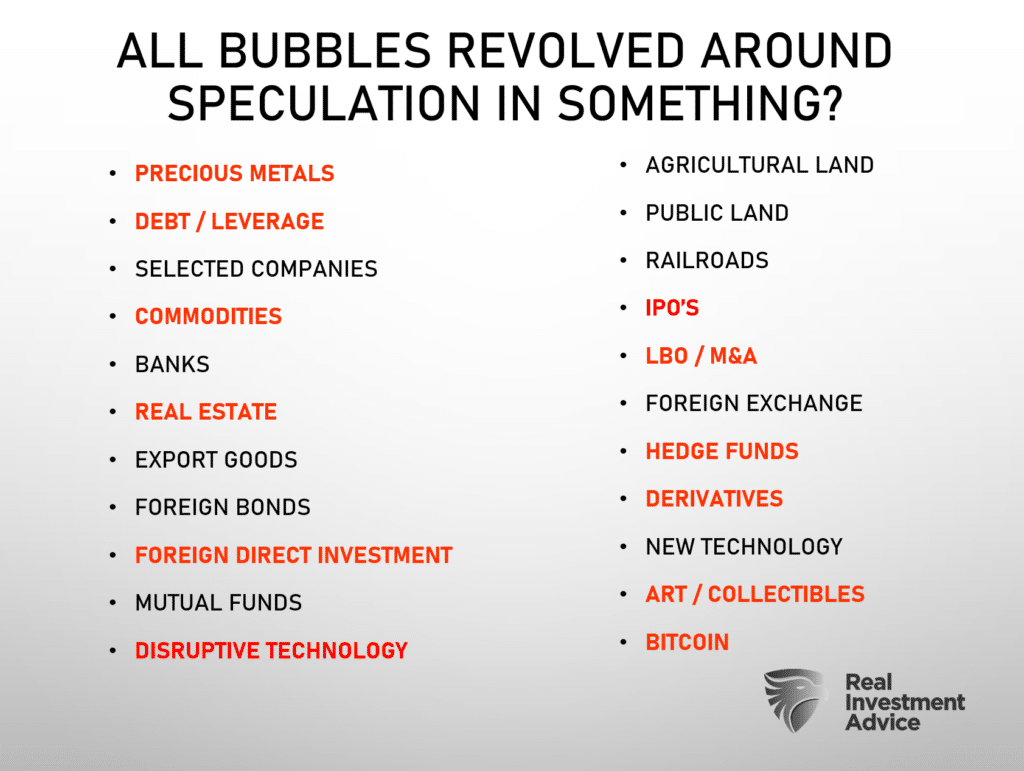

Importantly, this time is not different. There has always been some “new thing” that elicited speculative interest. Over the last 500 years, there have been speculative bubbles involving everything from Tulip Bulbs to Railways, Real Estate to Technology, Emerging Markets (5 times) to Automobiles, Commodities, and Bitcoin.

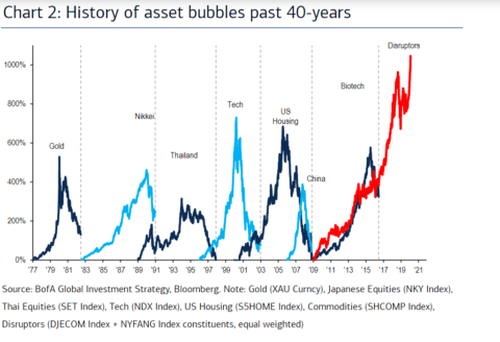

Jeremy Grantham posted the following chart of 40-years of price bubbles in the markets. During the inflation phase, each period got rationalized as “this time is different.”

Again, every financial bubble, regardless of the underlying drivers, had several things in common:

- Tremendous amounts of speculative interest by retail investors.

- A sincere belief “this time was different:” and,

- A tragic ending that devastated financial fortunes.

This time is likely no different.

Timing Is Everything

So, yes, a crash is coming.

However, the problem is the “when.”

A crash could come at any time, next month, next year, or another decade.

In the meantime, as noted, sitting in cash or some other asset that vastly underperforms either inflation or the market impedes the progress in achieving your financial goals.

Notably, crashes require an event that changes investor psychology from the “Fear Of Missing Out” to the “Fear Of Being In.” As noted previously,this is where the current lack of liquidity becomes extremely problematic.

The stock market is a function of buyers and sellers agreeing to a transaction at a specific price. Or rather, “for every seller, there must be a buyer.”

Such is an important point. Every transaction in the market requires both a buyer and a seller, with the only differentiating factor being at what PRICE the transaction occurs. When the selling begins in earnest, buyers will vanish, and prices will fall lower. Such is why the correction in March 2020 was so swift. There were indeed people willing to buy from panicking sellers. They were just 35% lower than the previous peak.

What could cause such a shift in psychology?

No one knows. However, historically speaking, crashes have always resulted from just a few issues.

- An unexpected, exogencous event that changes economic outlooks (Geopolitical Crisis, War, Pandemic)

- A rapid increase in interest rates.

- A sudden surge in inflation.

- Credit-related events that impact the financial system (Bankruptcies, Real Estate foreclosures, defaults)

- Monetary event (currency crisis)

Almost every financial crisis in history boils down ultimately to one of those five factors and mainly a credit-related event. Importantly, the event is always unexpected. Such is what causes the rapid change in sentiment from “greed” to “fear.”

Preparing For The Crash

As investors, we should never discount “risk” under the assumption some force, such as the Fed, has eliminated it.

Every era of speculation brings forth a crop of theories designed to justify the speculation, and the speculative slogans are easily seized upon. The term ‘new era’ was the slogan for the 1927-1929 period. We were in a new era in which old economic laws were suspended.” –Dr. Benjamin Anderson – Economics and the Public Welfare

So, we know two things with certainty:

- Robert Kiosaki will be correct about the next crash; and,

- We have no idea when it will happen.

Fortunately, we can take certain actions to protect portfolios from a crash without sacrificing financial goals. However, such actions are not “free” of cost.

- Properly sizing portfolio positions to mitigate the risk of concentrated positions.

- Rebalancing portfolio alllocations

- Take profits from extremely overbought and extended positions.

- Sell laggards

- When you are not sure what to do, do nothing. Cash is a great hedge against risk.

- Don’t dismiss the value of bonds in a portfolio.

- Look for non-correlated assets to mitigate risk.

As noted, there is a “cost.” Adding any strategy to a portfolio to mitigate or diversify risk will create underperformance relative to an all-equity benchmark index.

However, as investors, our job is not to beat some random benchmark index but to make sure our investments meet just two goals:

- Exceed the rate of inflation

- Meet the rate of return required to meet our long-term financial goals.

Any objective that exceeds those two goals requires an undertaking of increased risk and ultimately increases losses.

So, if you are afraid of the next crash, click here for a FREE REPORT.

Okay, I don’t actually have one.

However, you can certainly take some actions today to mitigate the risk of catastrophic losses tomorrow.