The Fed’s god-like powers will be revealed for what they really are: artifice and illusion.

The Fed will be proven catastrophically wrong about inflation for the simple reason that inflation isn’t transitory, it’s sticky: when prices rise due to real-world scarcities and higher costs, they stay high and then move higher as expectations catch up with reality.

Consider the dynamic of Fed-inflated bubbles raising rents. The house that once sold for $200,000 is sold to a pool of investors for $800,000, and the property taxes, insurance and debt service rise accordingly: even though the house didn’t change, thanks to the Fed’s bubble, the entire cost structure is higher.

So what happens next? The investors jack the rent up to cover the higher costs. As for refinancing to lower the monthly mortgage payment–that trend has reached the end of the line. As inflation gathers steam, mortgage rates can only go up, not down.

As for getting the county assessment office to lower the valuation on the house–good luck with that. The Ratchet Effect is in full force: assessed values rise easily and decline with great resistance.

So rents stay high even as real estate values decline. Landlords can’t drop rents without triggering panic in their lenders, and so they leave units empty and try gimmicks such as “free month rent when you sign a lease,” gimmicks which leave the skyhigh rent skyhigh so lenders look at the numbers and are assured that rents are high enough to cover their mortgage payments and other expenses.

Consider the orchard left to die during the drought. The farmer won’t be replanting that orchard–it’s simply too risky to assume there will be sufficient water in the future and prices will stay high enough to compensate for the heightened risk. So supply drops as marginal producers drop out and survivors avoid risk by not expanding production. Prices stay high.

Consider deglobalization. Having outsourced essential components, U.S. corporations are at the mercy of factors beyond their control: currency arbitrage, suppliers taking advantage of scarcity, other nations tightening the screws on exports of essentials, and so on.

Consider the pool of local restaurants. many have closed, some new ones are opening, but the reality is all those who can’t raise prices enough to cover expenses and make a profit will burn through their cash and close. The survivors will raise prices because they have no choice: there is no alternative (TINA) to raising prices except closing down.

85% of local government expenditures are for labor, and labor costs never go down, they only go up: the ratchet Effect. Public unions are under pressure to secure higher wages and benefits, and the inexorable rise in healthcare costs is squeezing local government budgets. What to do? Raise taxes and fees–there is no alternative (TINA). Jack up parking fees and tickets, double or triple fines, slap on new junk fees, raise sales taxes, property taxes, taxes on mobile phone service–raise them all because TINA.

People are awakening to the Federal Reserve’s Big Lie, which the Fed assumes will become “truth” if they repeat it often enough: inflation is transitory, blah, blah, blah: wrong, wrong, wrong. People are awakening to the embedded dynamics of inflation and their expectations have already started changing. Those who can’t raise prices will close down, those who can will raise prices.

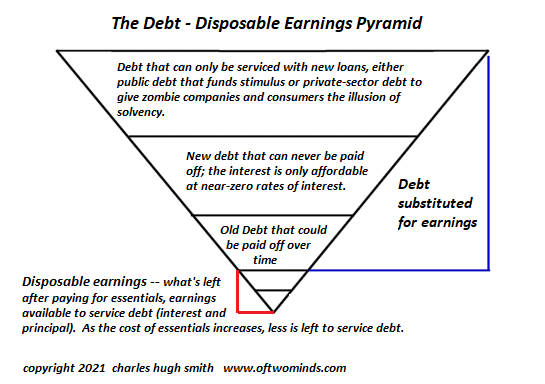

The Fed’s trick of substituting debt for income has also reached the end of the line. As the chart below depicts, America has built an illusory castle of “prosperity” by borrowing trillions of dollars as a substitute for earnings from being productive. The costs of all these layers of debt can only rise now that interest rates are near-zero while inflation is at 5% officially and 10% or more by any real-world measure.

There’s only so much disposable income left after servicing debt, and the more debt you pile on, the less income there is to spend on goods and services.

This is a longstanding cycle of civilization. As productivity rises, the human population expands up to the carrying capacity of the biosphere. Labor’s earnings rise as producers expand production to meet rising demand. Human population and appetites for goodies keep expanding, overshooting sustainable supply while labor expands to the point that it is in oversupply. Wages decline and labor thus loses purchasing power just as prices of essentials soar. Discontent and disorder increase and states and economies fall.

The Fed’s god-like powers will be revealed for what they really are: artifice and illusion. The Fed is wrong: inflation isn’t transitory, it’s sticky, and there’s nothing the Fed can do about it. They might as well stand on the shore and order the tide to reverse.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

My new book is available! A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet 20% and 15% discounts (Kindle $7, print $17, audiobook now available $17.46)

Read excerpts of the book for free (PDF).

The Story Behind the Book and the Introduction.

Recent Podcasts:

Charles Hugh Smith on the Era of Accelerating Expropriations (38 min) (FRA Roundtable Insight)