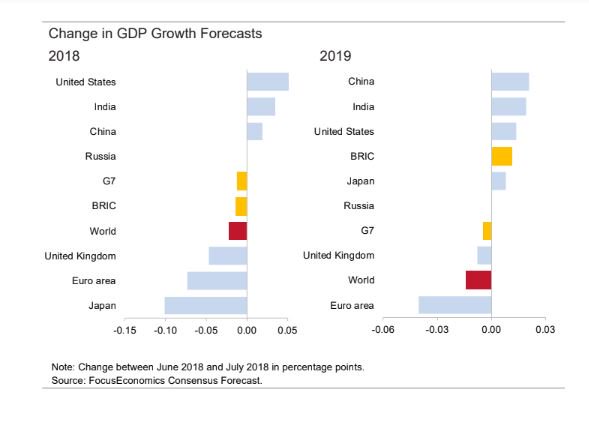

Banks’ consensus warned about a 2017 -then 2018, then 2019- US recession.

. The wide majority predicted stronger growth in Europe and Japan for 2018 and 2019.

. US Growth estimates up

. Japan and Europe down

Fundamentals matter.

@FocusEconomics

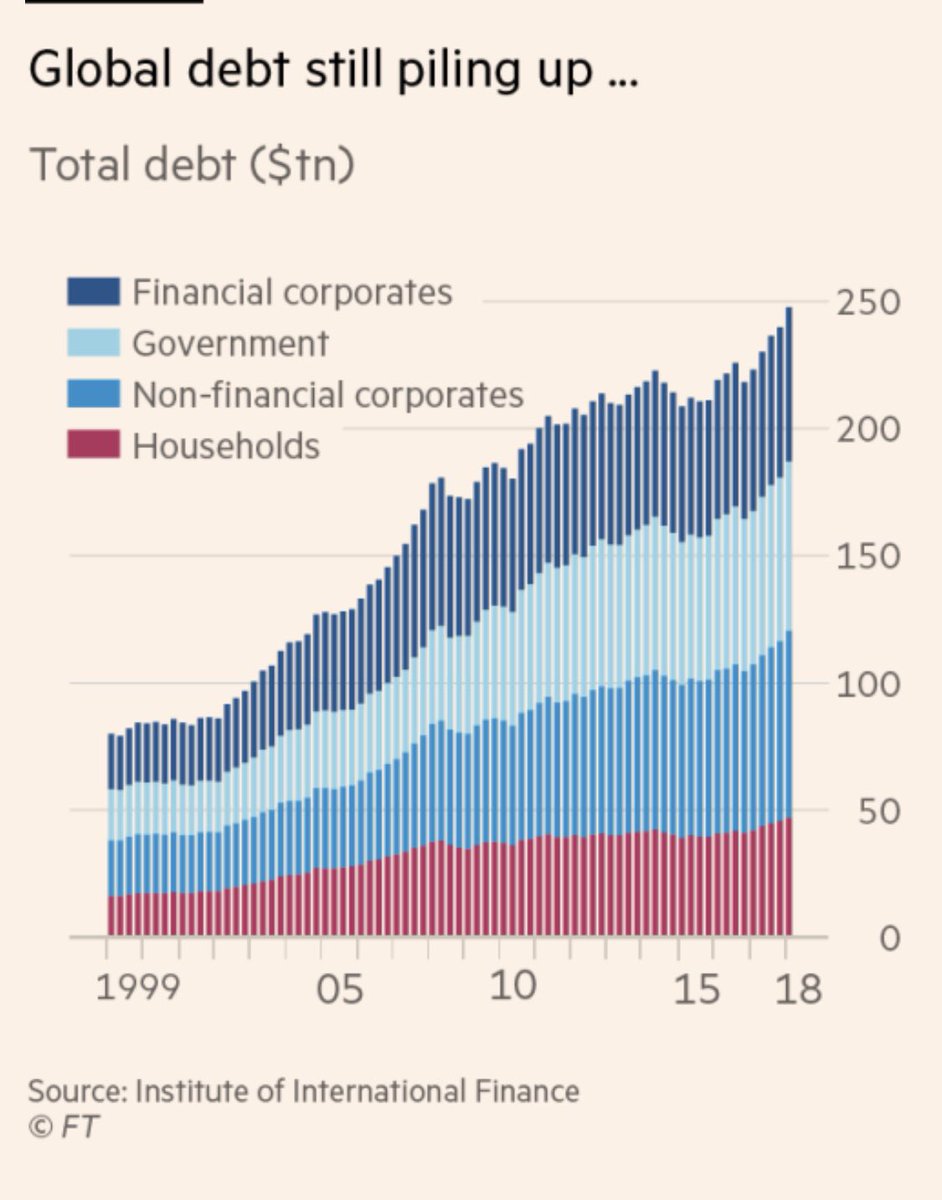

IMF says the global economic expansion has ‘plateaued’

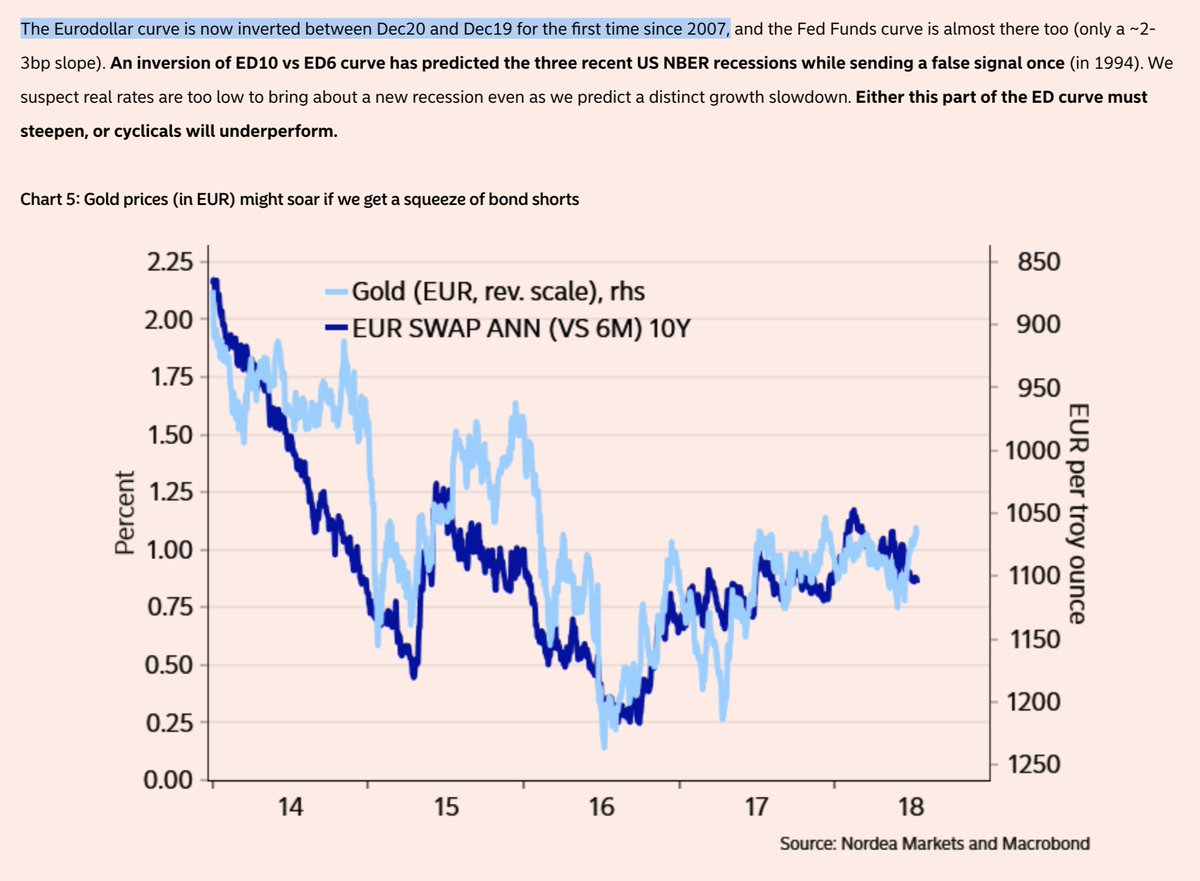

“The Eurodollar curve is now inverted between Dec20 and Dec19 for the first time since 2007,” h/t @Nordea

central banks will never get blamed on the next downturn — they got Trump as the scapegoat

12mo Libor at new high yield last seen in late 2008

— Dividend Master (@DividendMaster) July 16, 2018

yields surge on session w/ 2s10s .261 pic.twitter.com/vjSadUc2aU

— Alastair Williamson (@StockBoardAsset) July 16, 2018

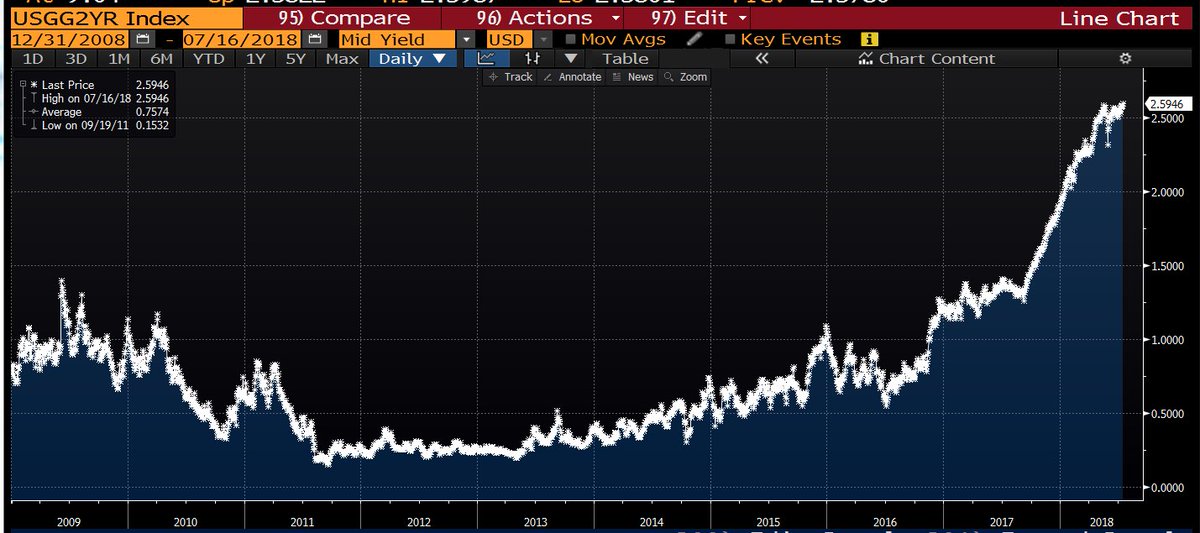

2-year Treasury yields are at a new post-crisis high today.

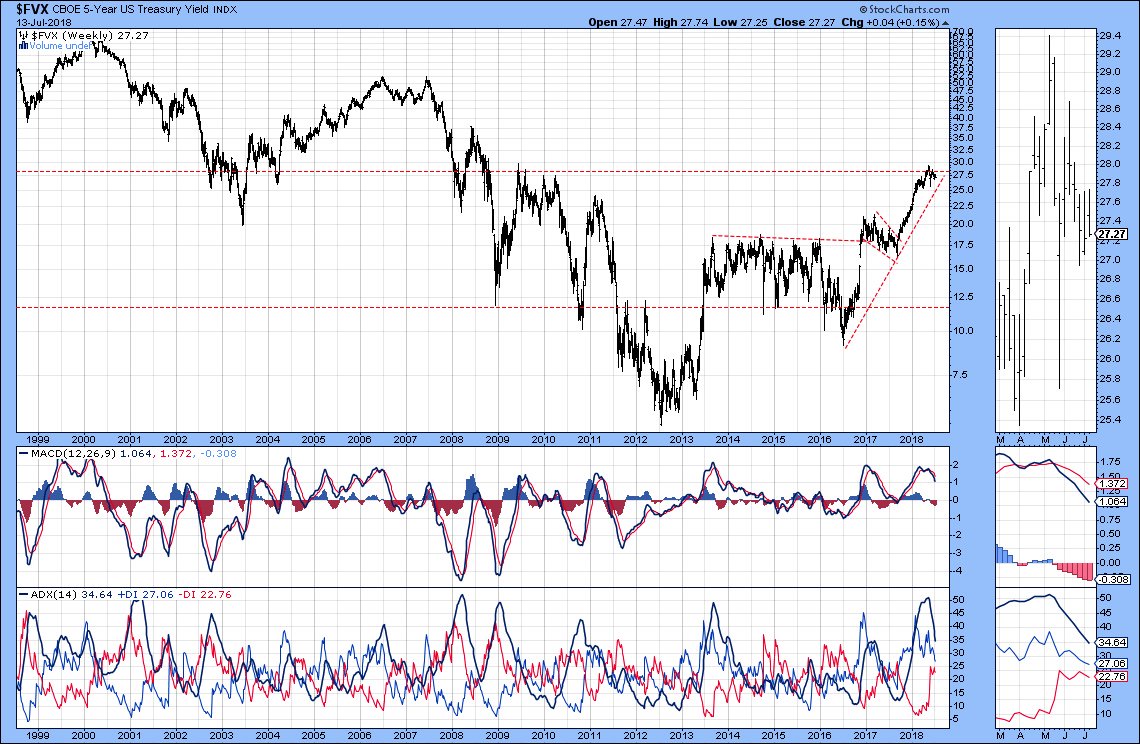

5 year Yields

Resistance ✔︎

Corrective ✔︎

Reversal ✖︎

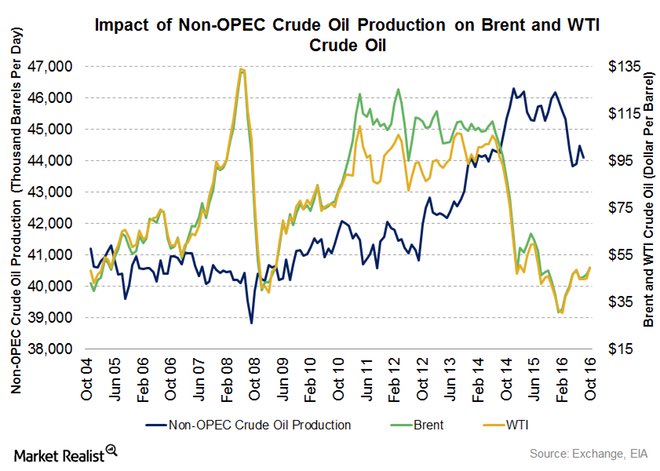

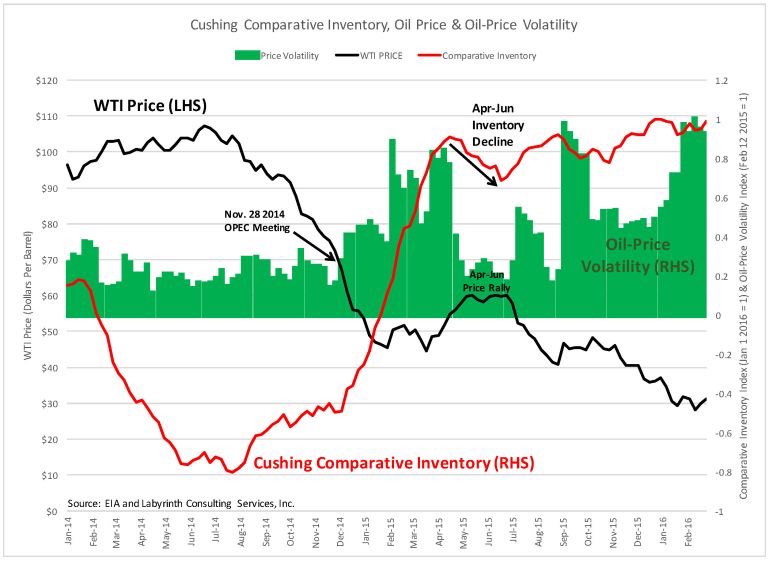

Despite good inventory data.

– China slowing

– Global growth estimates trimmed

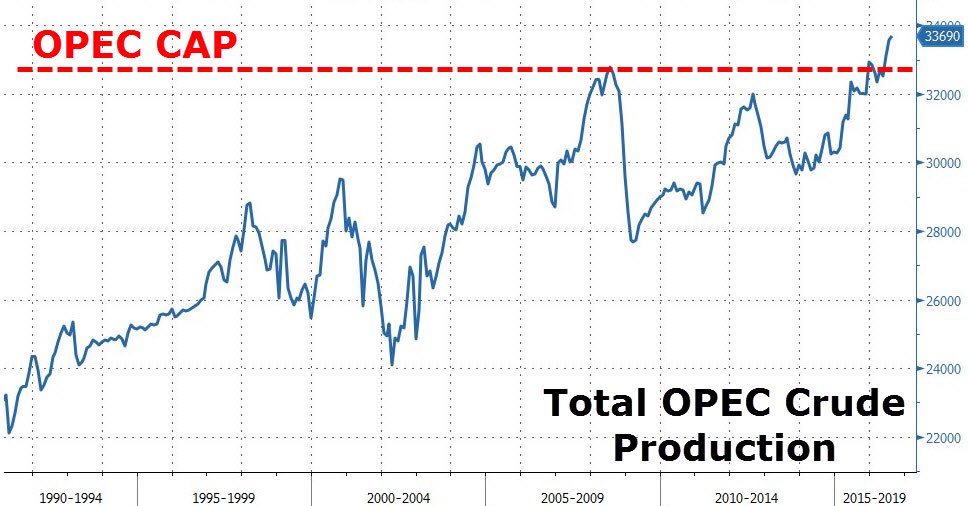

– Rising Saudi output

Oil was artificially high

#OOTT