Wolf Richter wolfstreet.com, http://www.amazon.com/author/wolfrichter

There are a lot of them. It’s called “crisis” for a reason.

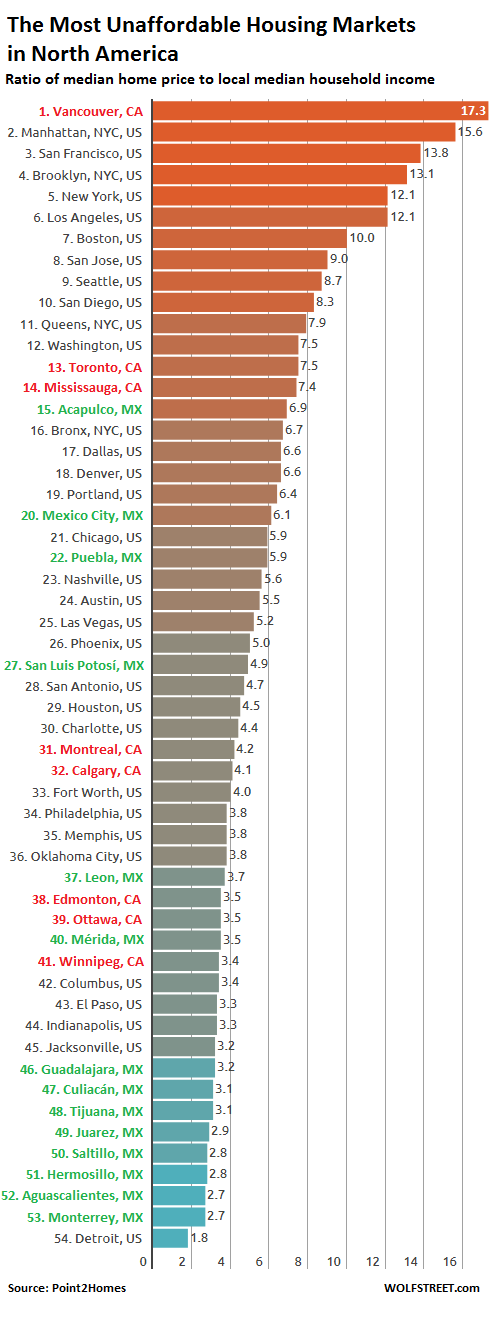

What is the most severely unaffordable housing market in North America as measured by local household incomes in relationship to local home prices?

By this measure, I’m happy to report that San Francisco, which sports the highest median home price in the US at about four times the national median, is off the hook. It’s off the hook because median household income is $92,100. It’s only in third place of the most severely unaffordable housing markets. California has four cities in the top 10 — San Francisco, Los Angeles, San Jose, and San Diego — but none is number one on that honor roll.

Number one is Vancouver, Canada, with a median home price of $1.11 million and a median household income of $64,000 (all amounts in US dollars at the exchange rate effective at the time of the study).

Toronto, whose formidable housing bubble is now under pressure, is the second most unaffordable market in Canada with a median home price of $471,600 and a median household income of $62,600. But it’s only in 13th place overall.

In second place overall? New York City’s borough of Manhattan, with a median home price of $1.27 million and a median household income of $77,600. Brooklyn is in fourth place, Queens in 11th place, and the Bronx in 16th place.

By comparison, the US median home price is $258,300 and the median household income is $56,500.

This according to a study by Point2Homes. The study used the affordability ratio, or “median multiple” – a metric for evaluating urban markets – to determine the rankings. This “median multiple” is the local median home price divided by the local median annual household income before taxes. A higher ratio means that the market is more unaffordable.

These are the housing affordability ratings and the “median multiples” from the International Housing Affordability Survey 2017:

- Severely Unaffordable: 5.1 and over

- Seriously Unaffordable: 4.1 – 5.0

- Moderately Unaffordable: 3.1 to 4.0

- Affordable: 3.0 and under.

Of the 54 major markets on this chart by Point2Homes, 32 are either “seriously unaffordable” or “severely unaffordable.” I color-coded the names of the Canadian markets in red and of the Mexican markets in green:

Note that the most unaffordable Mexican city is Acapulco, due to its low annual household income of only $6,170 – about half of the national average of $12,810 – compared to a home price of $42,800, a notch higher than the national average. In this market, as the report points out, home prices are “artificially pushed up by the prevalence of vacation homes.” This puts Acapulco in 15th place overall.

The second most unaffordable city in Mexico, and in 20th position overall, is Mexico City, with an average home price of $83,900 and an average household income of $13,800.

But there are a few housing markets left in North America that are considered “affordable,” meaning that they have a median multiple of 3.0 or below. Most of them are in Mexico. But the most affordable major market in North America is in the US at the bottom of the list: Detroit – with a median home price of $48,000 and a median household income of $26,000.

In the broader sense, even in the most unaffordable markets, households are still buying homes, but many of them are stretching to extremes and spend an extraordinary portion of their income on housing. Record low mortgage rates have helped in the past few years, but they’ve also pushed these home prices further up without pushing up household incomes at the same rate. This has produced a sharp disconnect.

The end result is that households spend a greater portion of their income on paying the bank, property taxes, and insurance just for a roof over their heads, and have less money to spend on other things. For households in the lower 80% of the income spectrum, housing costs in the most expensive markets have turned into what is now called the “affordability crisis.” This is the result of rampant asset price inflation – including in the housing market. It’s not a free gift to the economy. It comes with a price: over-indebted consumers whose spending in the real economy is being strangled.