The Fed released its meeting minutes from March yesterday.

The highlights are:

1) The Fed will likely begin raising rates by 0.5%, instead of 0.25% sometime this year.

2) The Fed will begin shrinking its balance sheet by $95 billion per month, sometime in the next three months.

Anyone who tells you this is NOT bearish is out of their mind. The Fed is announcing publicly that it needs to tighten financial conditions as rapidly as possible. This is akin to the Fed screaming, “we want stocks lower and soon.”

If you don’t believe me, perhaps you’ll listen to Bill Dudley.

Bill Dudley is the ex-President of the New York Fed: the branch of the Fed in charge of financial markets. He is also the ex-chief economist for Goldman Sachs. He is the ultimate insider’s insider, a man who not only knows how the Fed controls things, but who actually ran the programs through which the Fed did it.

Mr. Dudley published an article in Bloomberg earlier this week that was truly jaw-dropping. The title?

If Stocks Don’t Fall, the Fed Needs to Force Them

In his piece, Mr. Dudley makes it clear that the Fed believes it can control the economy via the stock market, not the other way around. In his own words, he writes, “

“Equity prices [stocks] influence how wealthy [Americans] feel, and how willing they are to spend rather than save…”

In simple terms, the American consumer is 75% of GDP. When the stock market is up a lot, Americans feel wealthier and spend more. When the stock market collapses, they feel poorer and spend less.

Mr. Dudley then states that the Fed needs to COLLAPSE the markets to force Americans to spend less… which will end inflation. He writes…

“The Fed will have to shock markets to achieve the desired response.”

This is not the ramblings of some doom and gloom blogger… this is THE man who ran the Fed’s QE programs during from 2009-2018, when the Fed was literally attempting to save the financial system from the Great Financial Crisis.

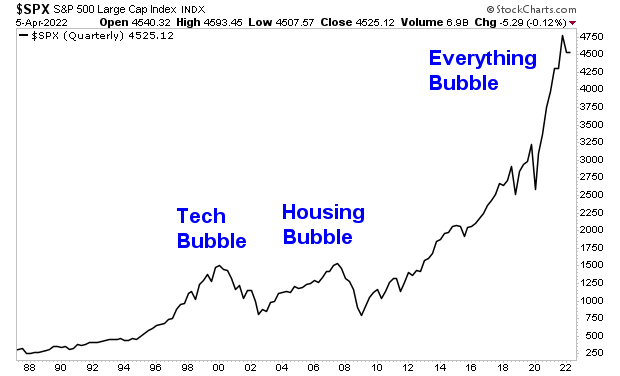

And he is calling on the Fed to crash the markets. And don’t forget where stock prices are right now relative to the last two crashes.