Wolf Richter wolfstreet.com, www.amazon.com/author/wolfrichter

No super-wealthy individual or household is going to pay billions in additional taxes when $10 to $20 million will purchase political adjustments.

The 2020 election cycle has begun, and a popular campaign promise is “free everything” paid for by new taxes on the super-wealthy. Who doesn’t like free stuff? Who will vote for whomever offers them free stuff? No wonder it’s a popular campaign promise.

As even the most self-absorbed American voter has a latent street-savvy awareness that nothing is truly free, the other popular campaign promise is to “tax the rich” to pay for the proposed “free” programs. Proposals to “Tax the rich” feed off the growing awareness that the financial wealth created since 2000 has largely flowed to the very top of the wealth-power pyramid, and so it’s payback time: tax those who have pocketed the lion’s share of income and wealth gains.

Fair enough, right? Even the super-rich publicly affirm that the super-wealthy should pay at least the same percentage of federal tax as their employees.

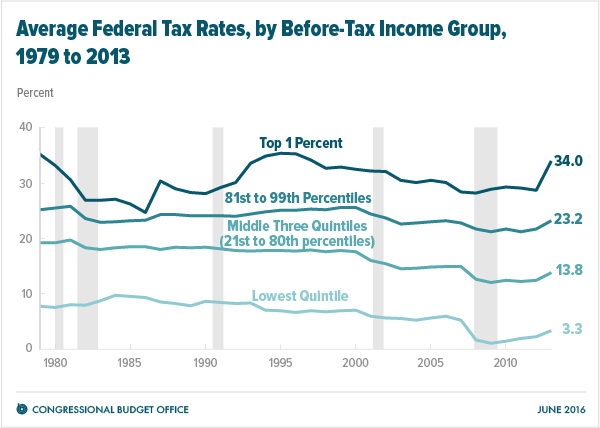

Public pronouncements are of course good PR, but the real issue is what will the super-wealthy do behind closed doors to protect their wealth from additional taxation. There are two issues here: one is that the wealthy already pay most of the federal income taxes, and the second is the compelling cost-benefit of funding political adjustments to the new taxes.

If one has a taste for facts, it turns out the U.S. federal tax system is highly progressive: the top 1% pay the highest tax rates (see CBO chart below) and about 37% of all federal income tax. The top 5% pay almost 60% of all federal income taxes. (Note Social Security payroll taxes are not income taxes; most wage earners pay more payroll taxes than they do income taxes.)

A good source for this sort of data is the Congressional Budget Office reports (scroll down to Distribution of Household Income and Federal Taxes).

The CBO data is noteworthy for including all income, not just wages: capital gains, business income and government transfers (Social Security, social welfare programs, etc.)

The new idea in current “tax the rich” proposals is to increase taxes on the super-wealthy: mega-millionaires and billionaires. Given the outsized gains secured by these mega-wealthy folks, it makes sense to nail them for the tax revenues needed to pay for more free stuff.

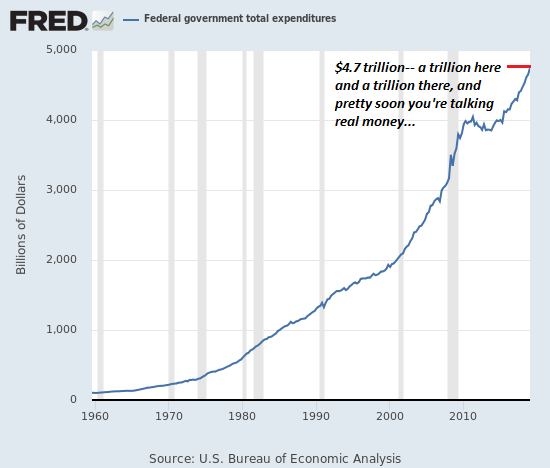

At this point let’s reacquaint ourselves with the enormous size of federal expenditures: roughly $4.75 trillion annually out of a GDP of about $20 trillion. State and local governments spend another $3.25 trillion, for total government expenditures of about $8 trillion.

Total personal income is around $10 trillion a year, with the top 1% (about 1.4 million people) getting about $2 trillion of this personal income. Out of this, they pay $538 billion in federal income tax. (Source: Summary of the Latest Federal Income Tax Data, 2018 Update)

According to this excellent overview of the top 1%, Never mind the 1 percent: Let’s talk about the 0.01 percent, the super-wealthy (top .01%) earn about 5% of all income, or about $500 billion.

So say some new tax law was actually able to capture 50% (half) of all this income: that would total $250 billion, a nice chunk of change but hardly enough to fund a trillion or two in additional “free” programs.

Since this income is already being taxed at a 34% rate according to the non-partisan CBO, jacking the rate from 34% to 50% is only 16% more, or an additional $80 billion in tax revenues. Look at the chart of current federal expenditures ($4.75 trillion) and then reckon the impact of an additional $80 billion. It’s a drop in the bucket, Baby.

Jacking the top tax rate to 70% on the super-wealthy would only raise a total of $180 billion, a nice boost but hardly enough to fund trillion dollar increases in federal spending.

This brings us to the second reality: it’s much cheaper to buy political adjustments to the new taxes via lobbying and campaign contributions than paying the extra $180 billion. A mere $10 million will buy a great deal of political adjustments, and $100 million will get pretty much whatever you need in the way of political adjustments.

The list of special dispensations and obscure tax code loopholes is endless: the wealth can be protected in a philanthro-capitalist family trust, or an overseas holding company, or taxed at a much lower rate for creating jobs in America (or equivalent political cover)– the ways to escape a 70% tax rate via political adjustments is truly infinite.

No super-wealthy individual or household is going to pay billions in additional taxes when a fraction of that will purchase political adjustments. From the point of view of the super-wealthy, 2/3 of whom are self-made via building businesses, they already pay enough taxes, and they have the wherewithal to get politicos to agree with them.

Here are the two little problems with “taxing the rich” to pay for trillions of dollars in new freebies:

1. Taxing the super-rich won’t really move the needle much when the federal government spends $4.7 trillion annually.

2. Trying to double the taxes they pay from 35% to 70% will only push them to increase their their spending on political adjustments that cost a fraction of the proposed taxes they will pay if they do nothing.

Tax Rates (CBO):

Federal Expenditures (current fiscal year):