The financial system is terminally broken, toast, kaput!

Anyone who doesn’t see what is happening will soon lose a major part of their assets either through bank failure, currency debasement or the collapse of all bubble assets like stocks, property and bonds by 75-100%. Many bonds will become worthless.

Wealth preservation in physical gold is now absolutely critical. Obviously it must be stored outside a broken financial system. More later in this article.

The solidity of the banking system is based on confidence. With the fractional banking system, highly leveraged banks only have a fraction of the money available if all depositors ask for their money back. So when confidence evaporates, so do the balance sheets of the banks and depositors realise that the whole system is just a black hole.

And this is exactly what is about to happen.

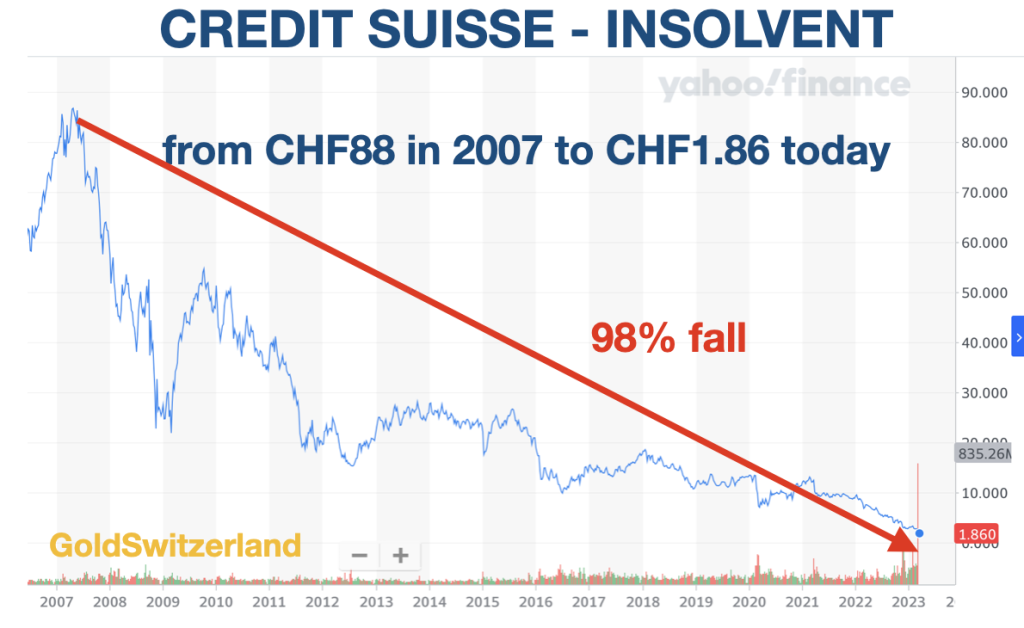

For anyone who believes that this is just a problem with a few smaller US banks and one big one (Credit Suisse), they must think again.

RE CREDIT SUISSE SEE ‘STOP PRESS’ AT THE END OF THE ARTICLE.

THE BANKS ARE FALLING LIKE DOMINOS, INCLUDING CREDIT SUISSE TONIGHT

Yes, Silicon Valley Bank (16th biggest US bank) is gone after an idiotic and irresponsible policy to invest short term customer deposits in long term US Treasuries at the bottom of the interest rate cycle. Even worse, they then valued the bonds at maturity rather than market, to avoid taking a loss. Clearly a management that didn’t have a clue about risk. SVB’s demise is the second biggest failure of a US bank.

Yes, Signature Bank (29th biggest) is gone due to a run on deposits.

And yes, First Republic Bank had to be supported by US lenders and the Fed by a $30 billion loan due to a run on deposits. But this won’t stop the rot as depositors attack the next bank and the next one and the next one……….

And yes, the Swiss second largest bank Credit Suisse (CS) is terminally ill after a number of poor investments over the years combined with poor management that has come and gone virtually every year.. I wrote an important article about the coming demise of CS 2 years ago here: “ARCHEGOS & CREDIT SUISSE – TIP OF THE ICEBERG.”

The situation at CS is so dire that a solution needs to be found before Monday’s (March 20) opening. The bank cannot survive in its present form. A failure for Credit Suisse would not just rock the Swiss financial system but have severe global repercussions. A merger with UBS is one solution. But UBS had to be bailed out in 2008 and doesn’t want to be weakened again by Credit Suisse without state guarantees and support from the Swiss National Bank (SNB). The SNB injected CHF50 billion into CS last week but the share price still went to a new low.

No one should believe that a state subsidised takeover of Credit Suisse by UBS will solve the problem. No, it will just be rearranging the deck chairs on the titanic and making the problem bigger rather than smaller. So rather than a lifebuoy, UBS will have a massive lead weight to carry which will guarantee its demise as the banking system collapses. And the Swiss government will take on assets which will be unrealisable.

Still, it is likely that by the end of the present weekend a deal will be announced with UBS being offered a deal they can’t refuse by taking over the good assets and the SNB/Government nurturing the bad assets of Credit Suisse in a rescue vehicle.

The SNB is of course in a mess itself, having lost $143 billion in 2022. The SNB balance sheet is bigger than Swiss GDP and consists of currency speculation and US tech stocks. This central bank is the world’s biggest hedge fund and the least successful.

Just to put a balanced view on Switzerland. It has the best political system in the world with direct democracy. It also has low Federal debt and normally no budget deficits. It is also the safest country in the world.

SWISS BANKING SYSTEM TOO BIG TO SAVE

But the Swiss banking system is very unsound, just like the rest of the world’s. A central bank which is bigger than the country’s GDP is extremely unsound. And a banking system which is 5x Swiss GDP makes it too big to save.

Although the Fed and ECB are much smaller in relation to their countries’ GDP than the SNB, these two central banks will soon discover that their assets of around $8 trillion each are grossly overvalued.

With a global banking system on the verge of a systemic failure, Central Bankers and bankers have been working around the clock this weekend to temporarily avoid the inevitable collapse of the bankrupt financial system.

BIGGEST MONEY PRINTING IN HISTORY COMING

As I pointed out above, the main Central Banks would also be bankrupt if they valued their assets honestly. But they have a wonderful source of money that they will tap to save the system.

Yes, I am of course talking about money printing.

We will in coming months and years see the most massive avalanche of money printing that has ever hit the world.

For anyone who believes that we are just seeing another bank run that will quickly evaporate, they will need to take a shower in ice cold Alpine water.

What we are witnessing is not just a temporary drama that will be sorted out by “the all powerful and resourceful” central banks.

THE DEATH OF MONEY

No, instead what we are seeing is the end phase of this financial era which started with the formation of the Fed in 1913 and in the next few years, or much sooner, will end with the death of money.

But the Death of Money doesn’t just mean that the dollar (and most currencies) will make their final move to ZERO, having already declined 98% since 1971.

Currency debasement is not the cause but the effect of the banking Cabal taking control of the money for their own benefit. As Mayer Amschel Rothschild said in the late 1700s: “Let me issue and control a nation’s money and I care not who makes the laws”.

Sadly, as this Cassandra (me) has written about since the beginning of the century, the Death of Money is not just all currencies going to ZERO as they have throughout history.

No, the Death of Money means a total and final collapse of this financial system.

Cassandra was a priestess in Greek mythology who was given the gift of predicting major events accurately but also given the curse that no one would believe her predictions.

No depositor must believe that the FDIC (Federal Deposit Insurance Corp) in the US or similar vehicles in other countries will save their deposits. All these organisations are massively undercapitalised and in the end it will be the governments in all countries which step in.

We know of course, that the government has no money. They just print whatever they need. That leaves ordinary people taking the final burden of all this money printing.

But ordinary people will have no money either. Yes a few rich people will be taxed heavily to cover bank deficits and losses. Still, that will be a drop in the ocean. Instead ordinary people will be impoverished with little income, no government handouts, no pension and money which is worthless.

The above is sadly the cycle that all economic eras go through. The issue this time is that the problem is global and of a magnitude never seen before in history.

Regrettably a rotten and bankrupt financial system needs to go through a cleansing period which the world will now experience. There cannot be sound growth and sound values until the current corrupt and debt infested system implodes. Only then can the world grow soundly again.

The transition will sadly be dramatic with a lot of suffering for most people. But there is no other way. We won’t just see poverty, famine but also many human tragedies. The risk of social unrest or civil war is very high plus the risk of a global war.

Central banks had of course hoped that their Digital Currencies (CBDC) would be ready to save them (but not the world) from the present debacle by totally controlling people’s spending. But in my view they will be too late. And since CBDCs are just another form of Fiat money, it would just exacerbate the problem with an even more severe outcome at the end. Still, it won’t prevent them from trying.

MARKET VALUE OF US BANKING ASSETS $2 TRILLION LOWER THAN BOOK VALUE

A paper issued by 4 US academics in finance, illustrates the $2 trillion black hole in the US banking system:

“Monetary Tightening and U.S. Bank Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs?”

March 13, 2023

Erica Jiang, Gregor Matvos, Tomasz Piskorski, and Amit Seru

CONCLUSION

“We provide a simple analysis of U.S. banks’ asset exposure to a recent rise in the interest rates with implications for financial stability. The U.S. banking system’s market value of assets is $2 trillion lower than suggested by their book value of assets. We show that these losses, combined with a large share of uninsured deposits at some U.S. banks can impair their stability. Even if only half of uninsured depositors decide to withdraw, almost 190 banks are at a potential risk of impairment to even insured depositors, with potentially $300 billion of insured deposits at risk. If uninsured deposit withdrawals cause even small fire sales, substantially more banks are at risk. Overall, these calculations suggest that recent declines in bank asset values significantly increased the fragility of the US banking system to uninsured depositors runs.”

What is crucial to understand is that the $2 trillion “loss” is only due to higher interest rates. When the US economy comes under pressure, the loan books of the banks will deteriorate dramatically and bad debts increase exponentially. With total assets of US commercial banks at $23 trillion, I would be surprised if 50% is repaid or recoverable in the coming crisis.

The above risks are just for the US financial system. The global system will be no better with the EU under massive pressure partly due to US led sanctions of Russia. Virtually every major economy in the world is in a dire position.

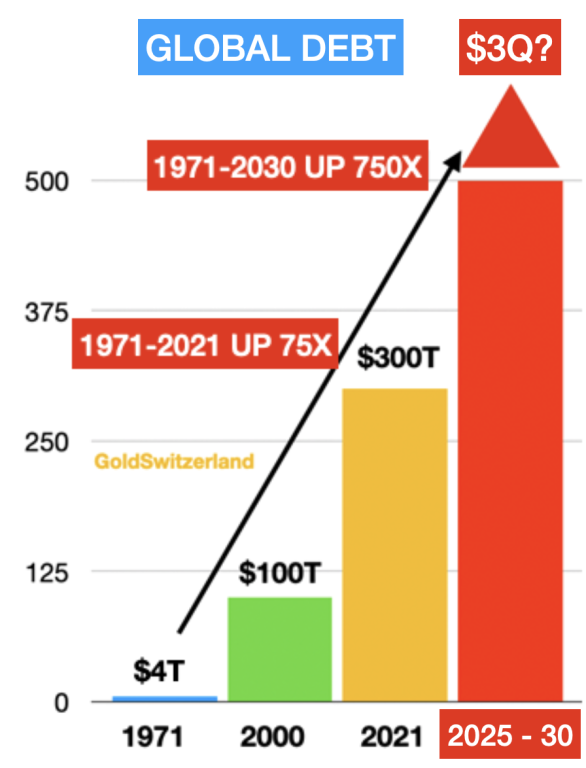

Let’s just look at the debt pyramid which I have discussed in many articles.

In 1971, when Nixon closed the gold window, global debt was $4 trillion. With gold backing no currency, this became a free for all to print unlimited amounts of money. And thus by 2000 debt had grown 25x to $100t. In 2006, when the Great Financial Crisis started, global debt was $120 trillion. By 2021 it had grown 75x from 1971 to $300 trillion.

The red column shows global debt at $3 quadrillion sometime between 2025 and 2030.

This assumes that the shadow banking system plus outstanding derivatives of currently probably around $2 quadrillion will need to be saved by central banks in a money printing bonanza. This will obviously lead to hyperinflation and thereafter to a depressionary implosion.

I know this sounds sensational but still a very likely scenario at the end of the biggest credit bubble in history.

GOLD – CRITICAL WEALTH PRESERVATION

I have been standing on a soapbox for over 20 years, warning the world about the coming financial crisis and the importance of physical gold for wealth preservation purposes. In 2002 we invested important funds into physical gold with the purpose of holding it for the foreseeable future.

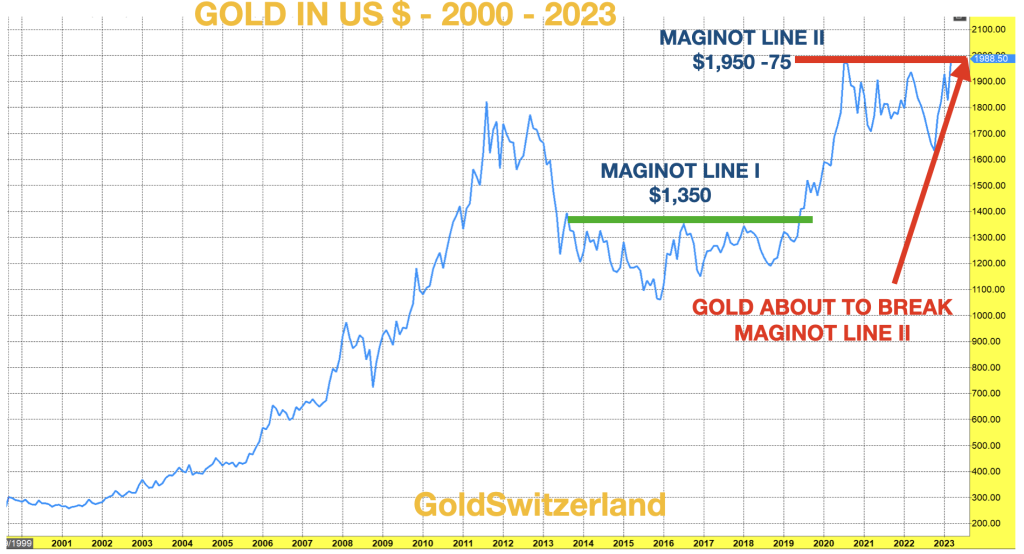

Between 2002 and 2011 gold went from $300 to $1,900. Since then gold corrected and then went sideways as stocks and the asset markets surged backed by massive credit expansion.

With gold currently around $1990, there is not much gain since 2011. Still since 2002 gold is up 7x. Due to the temporarily stronger dollar, gold’s gains measured in dollars are much smaller than in Euros, Pounds or Yen. But that will soon change.

In the final section of the article “WILL NUCLEAR WAR, DEBT COLLAPSE OR ENERGY DEPLETION FINISH THE WORLD?”, I outlined the importance of owning physical gold to store it in a safe jurisdiction away from kleptocratic governments.

“2023 is likely to be the year of gold. Both fundamentally and technically gold looks like it will make major up moves this year.”

And at the end of this article, I explain the importance of how and where gold should be held:“PREPARE FOR 10 YEARS OF GLOBAL DESTRUCTION.”

“So my own preference would be to own physical gold and silver that only I have direct control of and can withdraw or sell with very short notice.

It is also important to deal with a company that can move your metals at very short notice if the security or geopolitical situation would necessitate it.”

In February 2019 I wrote about what I called the Gold Maginot Line which had held for 6 years below $1,350. This is typical for gold. Having gone from $250 in 1999 to $1,900 in 2011, it then spent 8 years in a correction. At the time I forecast that the Maginot Line would soon break which it did and swiftly moved to $2,000 by August 2020. We have now had another period of consolidation since then and the next move above $2,000 and towards $3,000 is imminent.

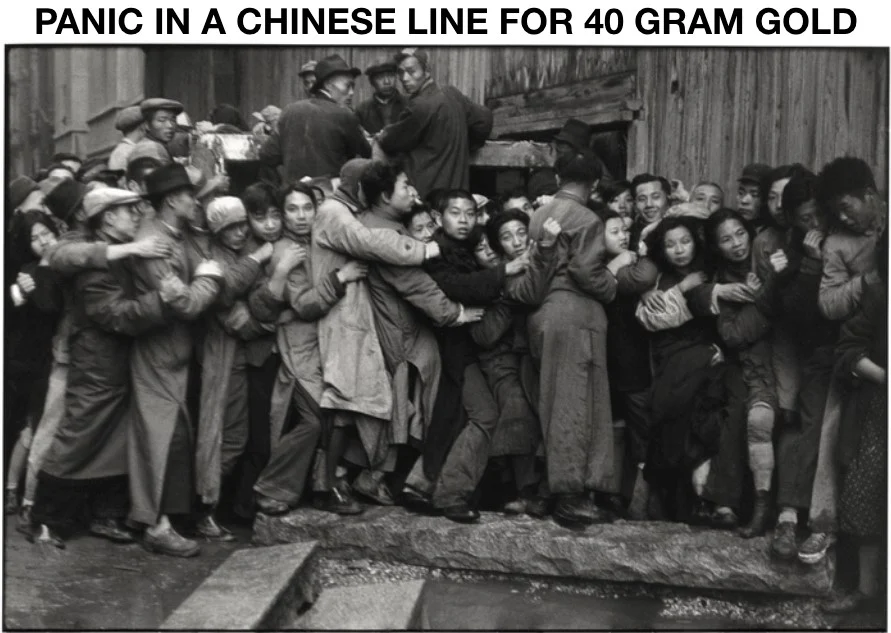

Just to remind ourselves what happens to your money and gold during a hyperinflationary period, here is a photo from China’s hyperinflation in 1949 as people try to get their 40 grammes (just over one ounce) that they were allocated by the government. At some point in the next few years, there will be a panic in the West to buy gold at any price.

So as I have been urging investors for over 20 years, please get your gold NOW while it is still available.

STOP PRESS

Intense discussions are right now going on here in Switzerland between UBS, Credit Suisse, the regulator FINMA, the Swiss National Bank – SNB – and the Swiss Government. The Fed, the Bank of England and the ECB are also involved.

The latest rumour is that UBS will buy Credit Suisse for CHF900 million ($1 billion). The shares of CS closed at a market cap of CHF8 billion on Friday. The deal would clearly involve backing from the SNB and the Swiss government which would have to take on major liabilities.

The December 2022 book value of CS was CHF42 billion, as with all banks massively overstated.

The deal isn’t done at this point, 5.30pm Swiss time, but the whole banking world knows that without a deal, there will be global contagion starting tomorrow Monday the 20th.

Even if a provisional deal will be done by Monday’s open, the financial system has now been permanently injured with an open wound which won’t heal.

The problem will just move on to the next bank, and the next and the next….