As I noted yesterday, the bond market is telling us that a recession is just around the corner.

By quick way of review, the U.S. treasury market is comprised of 12 bonds, with durations ranging from four weeks to 30 years.

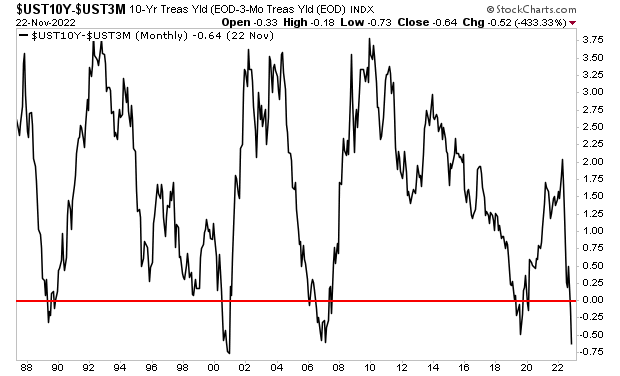

When you plot the yield on all of these bonds, you get the “yield curve.” And the difference in yield between the 10-Year U.S. Treasury and the 3-month U.S. Treasury is one of the best predictors of recessions in the world.

Put simply, anytime this difference becomes negative (meaning the 3-month yield is actually higher than the 10-year yield) this indicates a recession is about to hit.

It happened in 1989, 2001, 2007, and 2019 and today.

This alone is bad news, but we get additional confirmation of a recession from oil.

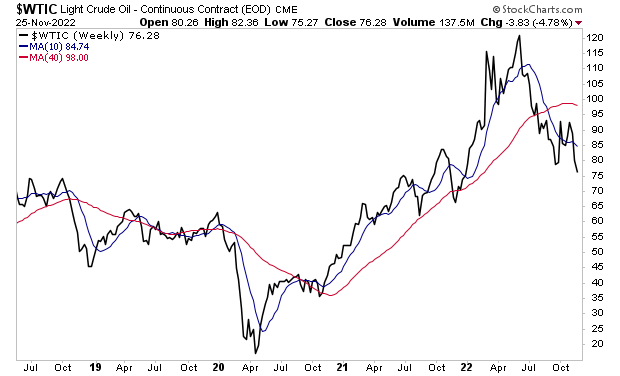

As you know, oil is extremely closely linked to economic growth. And oil is collapsing, having fallen from $120+ per barrel to the mid-$70s per barrel.

There is only one reason for oil to fall like this during a period of high inflation: demand destruction.

Demand destruction is when the economy rolls over and there is less demand for oil. It only happens during recessions.

And what do you think a recession will do to stocks?

It’s called a crash.

This is going to force stocks to new lows. I’ll explain why in Friday’s article. Until then… know this: it is highly likely that a recession is going to trigger a major crash in stocks. It’s not a question of “if,” it’s a question of “when.”