by Usman Salis

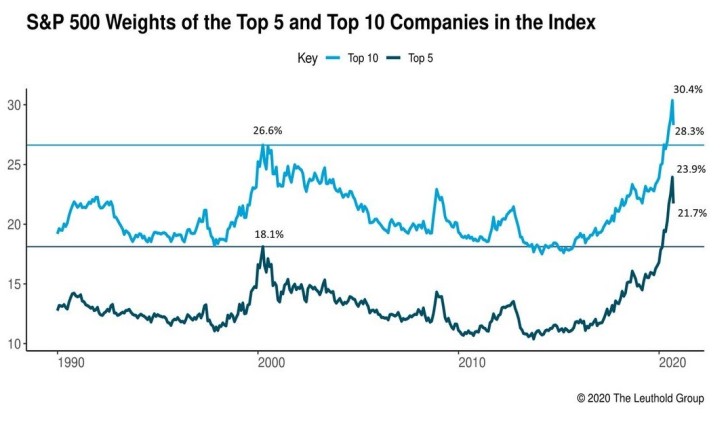

And the share of the 5 largest companies is the highest ever in 2020.

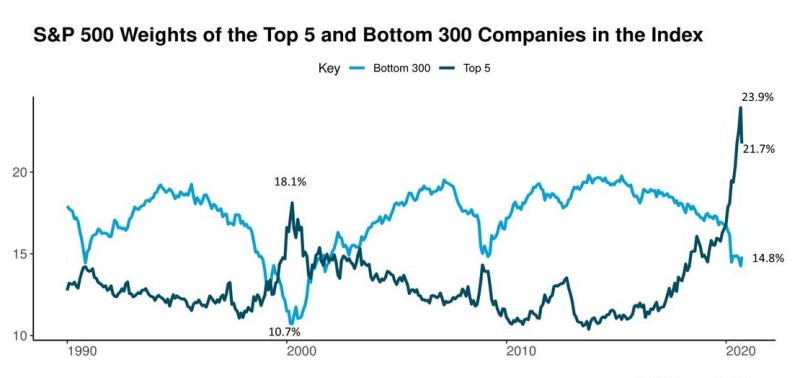

Image Source: Twitter @LeutholdGroup

The top 5 companies in the S&P 500 have nearly mirrored the stock prices of the 300 cheapest companies in the index for decades, according to The Leuthold Group Analysis.

S&P 500 Is Dominated by Giants

Among other things, the analysis also shows that at the moment the 5 largest companies account for almost 22% of the index, and the 10 largest companies occupy about 28%. It is the largest consolidation in history, surpassing even the heyday of the dot-com bubble.

The Nasdaq 100 has also been dominated by the giants. It is reported that 42% of the index’s capitalization is occupied by just 4 of the largest technology companies, Apple, Microsoft, Amazon and Alphabet.

The September Correction Slightly Shaken the Positions of the Largest Companies

In early September, the share of the largest companies in the S&P 500 Index was even higher, however, due to the past correction, the largest companies have lost a significant share of their capitalization.