by WARREN MOSLER

Unemployment benefits are harder to get, as previously discussed:

The Next Recession Is Gonna Really Suck

As a result, the rate at which unemployed Americans receive layoff compensation overall has fallen from about 36 percent in 2007 to about 28 percent in 2017, according to data from The Department of Labor. Wayne Vroman, an associate with the Urban Institute, said a big reason for the decline is that states are finding ways to kick unemployed people off benefits after they’ve already been deemed eligible. His research shows a big increase in “nonseparation determinations.” These are instances of states investigating whether someone is continuing to meet eligibility requirements by doing things like writing down the names and addresses of businesses where they’ve applied for work on forms to state work agencies.

In Florida, it’s not an easy process. The state overhauled its unemployment system in 2011, requiring layoff victims to file claims online and even (for a time) take a math and reading test. Since 2007, before the last recession started, the percentage of unemployed Floridians who receive compensation plunged from 32 percent to 9 percent, almost the lowest rate of coverage in the nation.

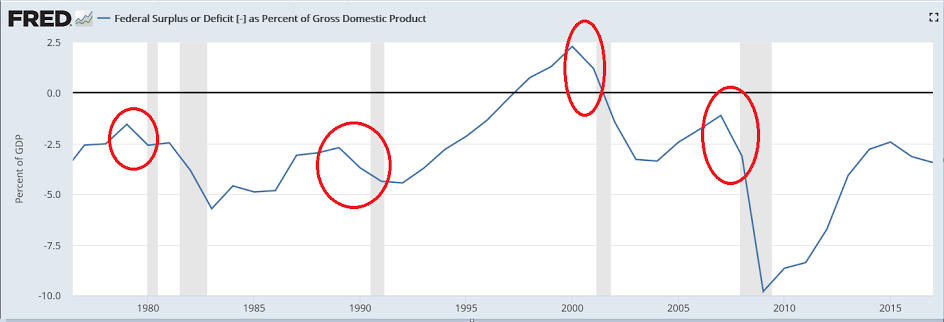

While the annual deficit to gdp ratio is higher than the last two cycles, it’s been looking to me that the ‘neutral’ deficit to gdp ratio has been going up as well. This is likely because the unspent income (pension fund and other retirement accounts, corporate reserves including insurance reserves, cash in circulation, $US foreign central bank holdings and other non resident ‘savings’, etc.) is growing at ever higher rates, while private sector deficit spending has been subdued. Consequently, even with what may seem to be what historically has been a sufficiently high Federal deficit, GDP can retreat:

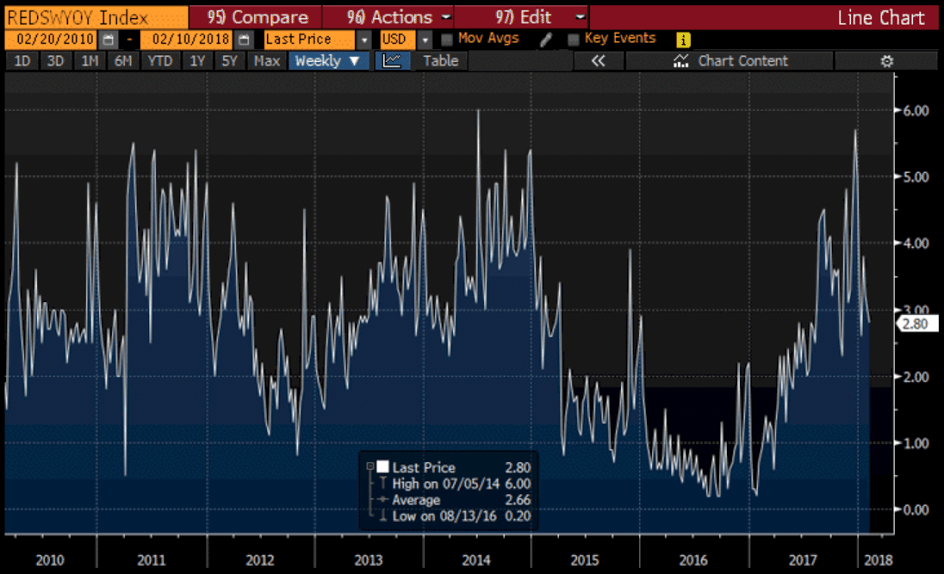

Redbook same store retail sales (not inflation adjusted) fell several years ago, and as stores were closed, same store sales growth eventually resumed, but has been softening lately and is still shy of earlier levels: