The US Producer Price Index (Final Demand) printed at a higher than expected 8.5% YoY, throwing cold water on the notion that inflation is “transitory.”

A key US inflation measure due Thursday is set to return to a four-decade high, underscoring broad and elevated price pressures that are pushing the Federal Reserve toward yet another large interest-rate hike next month.

The so-called core consumer price index that excludes food and energy is projected to rise 0.4% in September from the prior month and 6.5% from a year earlier, matching the rate seen in March that was the highest since 1982.

The overall CPI, however, is expected to decelerate to a still-rapid 8.1% annual pace, restrained by a decline in gasoline prices, based on the median estimate.

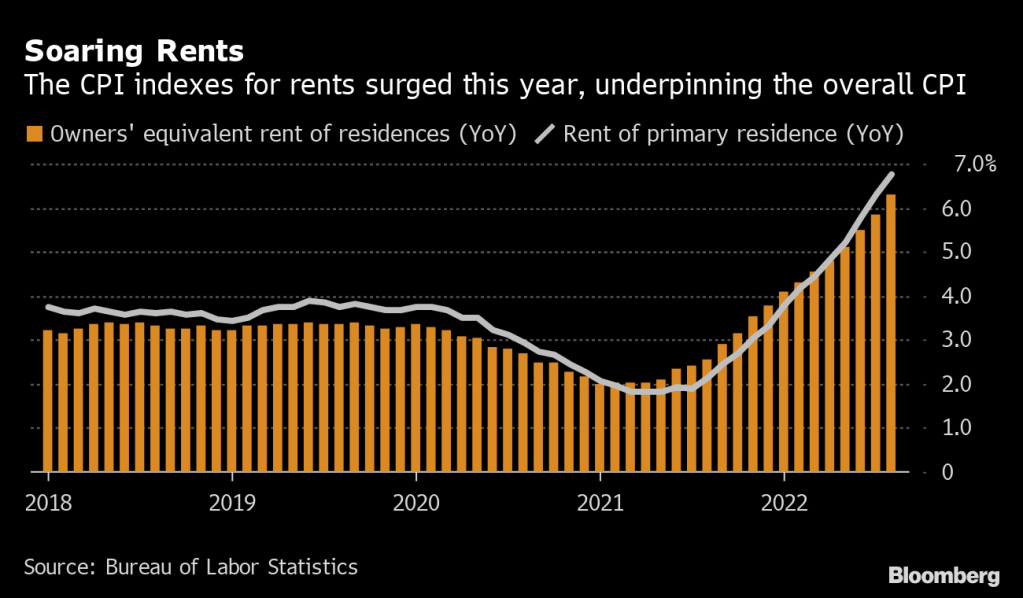

Meanwhile, rents are soaring.

Biden’s policies are sending me to the poorhouse with killer inflation.