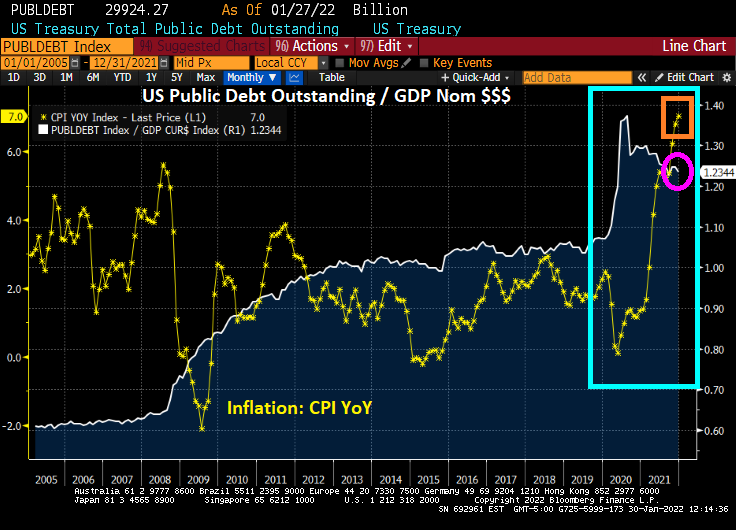

Nothing has been the same since the financial crisis of 2008 (except we still have insider-trading superstar Nancy Pelosi as US House Speaker). What has changed is that US Public Debt to GDP (nominal dollars) has doubled.

Has doubling Federal debt helped the hourly worker? Initially we saw a surge in REAL hourly wage growth in 2009 as the US began to recover from the housing bubble burst and ensuing financial crisis. Another surge in REAL wage growth occurred when Federal debt exploded as the COVID crisis took hold. BUT more recently we see that REAL wage growth is negative.

The other aspect of pain for hourly workers is inflation which has reached 7%, the highest rate in 40 years.

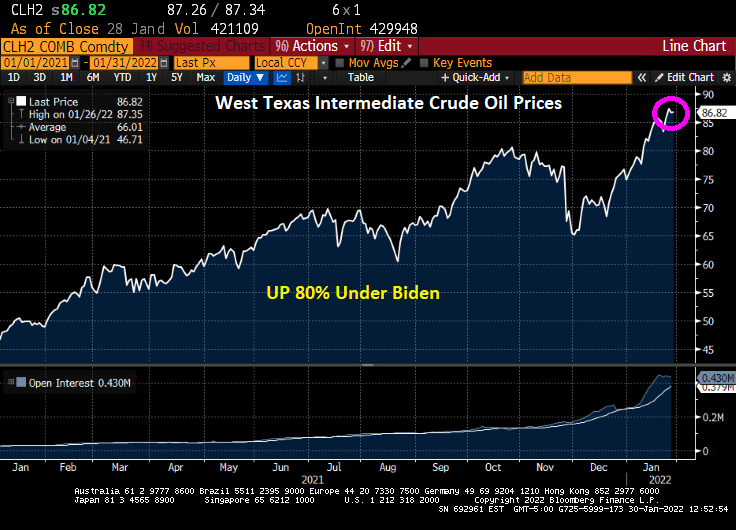

Adding to the frustration of hourly workers is energy prices rising 80% under President Biden’s reign of error.

Most hourly wage earners can’t buy a Tesla or a $100,000 electric Chevy Silverado to take advantage of Biden’s green energy policies.

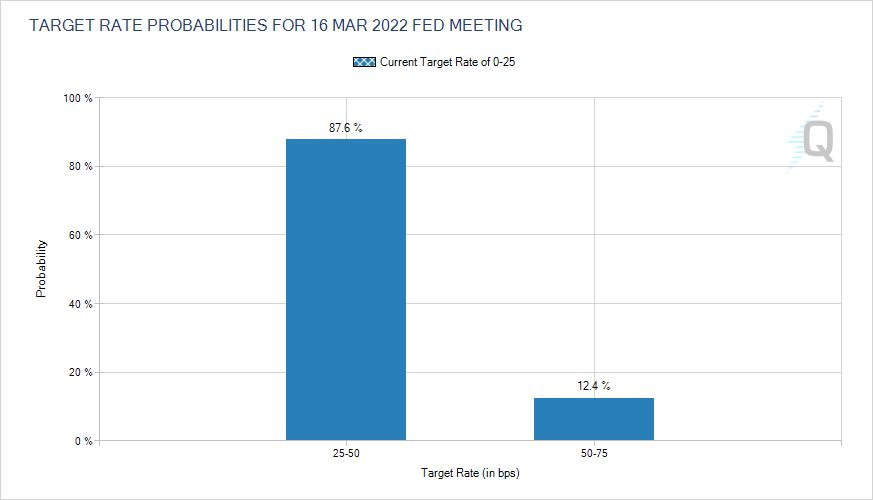

Will interest rates rise? Well, the Chicago Mercantile Exchange has Fed Watch tool. It is saying that there will likely be a 25 basis point increase at the March 2022 meeting.

As Ronald Reagan once said, “The most terrifying words in the English language are: I’m from the government and I’m here to help.”