via Ksenia Galouchko

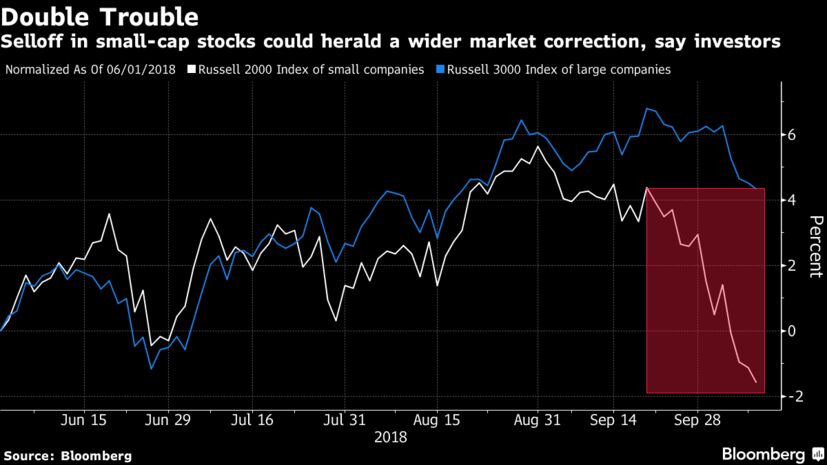

An outsize retreat in small and mid-cap stocks over recent weeks could be a possible sign of an upcoming deeper market correction, according to major asset managers, including London & Capital and JPMorgan Asset Management.

Both in the U.S. and Europe, declines in small-cap stock indexes have been more pronounced than for blue-chip equivalents since the end of August. History shows that to be a possible warning sign. Back in 2007, the small-cap Russell 2000 Index peaked three months ahead of the large-cap index, giving some investors ample time to prepare for the nearly 60 percent stock market plunge that followed during the financial crisis.

“There has been a change in equity market leadership with mid- and small-caps starting to underperform the S&P 500,” said Roger Jones, head of equities at London & Capital, which oversees $4 billion in assets. “If this emerging trend persists, then it could mean trouble for stock markets as historically this has often been a warning sign for a change in market direction.”

The Russell 2000 has lost 9.5 percent since Aug. 31, compared with a drop of 4 percent for the S&P 500 Index and a 4.8 percent decline for the Russell 3000 Index of large-caps. The picture is similar in Europe, where the Stoxx Europe Small 200 Index is down 7.2 percent, compared with a 3.7 percent drop for the Stoxx Europe 50 Index of blue chips.

A number of factors tend to make investors especially wary of smaller stocks during market corrections:

- Liquidity: When the stock market drops, mid- and small-cap equities suffer more and quicker due to their lower liquidity and the lack of buyers, according to Jones

- Volatility: Mid- and small caps tend to be more volatile as their profit swings can be much stronger than those of larger companies

- Growth: Smaller firms are often more dependent on strong economic growth and suffer more during periods of slowdown, according to London & Capital

Mid-cap growth stocks that have recently slumped in Europe include Fevertree Drinks Plc, which has retreated 27 percent in October to date, Asos Plc with a decline of 14 percent, and Ocado Group Plc, down 15 percent.

“Our belief is that we are in the later stages of the economic and stock market cycle, meaning growth could disappoint in the foreseeable future, which could mean liquidity and volatility moves to the forefront of investors’ minds,” Jones said.

Philipp Schweneke, head of European small and mid-cap equities at DWS, says investors shouldn’t be scared away from smaller companies, which tend to enjoy a quicker recovery when the market rebounds.

“The recent volatility has led to some undifferentiated sell-offs, creating a few very interesting buying opportunities,” he said.

JPMorgan Chase & Co. sell-side strategists also say avoiding smaller stocks around recessions may be a big error. However, the firm’s asset-management arm has a different view, recommending that investors who are turning more defensive rotate away from overweight positions in mid- and small-cap stocks.

“Historical evidence suggests that, particularly in Europe, small cap stocks tend to underperform in a downturn while large-cap stocks tend to perform better,” wrote Karen Ward, chief market strategist for EMEA at JPMorgan Asset Management in London.

***

You Are Here: