by John Ward

Insane stock market levels, artificial interest rates, manipulated commodity prices, gargantuan debt and the crushing of mass spending power simply cannot exist together. While the Draghis of this world suggest a monetarist symphony is in play, the majority of discerning observers know full well that a pack of Bali monkeys has hijacked the orchestra.

Consider: with almost no net global growth beyond direct or indirect stimulation, the Dow Jones Index is nudging 22,000. A lot of people have made a pile of money from that, and almost all of them know the rise has been manipulated by cheap borrowing that takes publicly-quoted turnover straight to the bottom line.

Consider: with borrowing rates at an all-time low, house prices are falling almost everywhere in the eurozone. Given that there are no returns from savings, that outcome is the diametric opposite of what one would expect – ie, asset bubbles….not asset values deflating like a flaccid penis after five pints of Stella Artois.

Consider: we are told that this is capitalism, but no institution anywhere that’s safe is offering anyone a return on capital savings.

Consider: although there have been “rallies” in commodity and raw materials prices, most business-related (ie non-food) prices are in the doldrums. Oil is ludicrously overbought, thanks to – it’s now official – “propping up of the price of oil by the producer groups” (CNBC). Australia is now starting to feel the chill as materials prices stutter and fall again.

Consider: historically one of the most aggressive growth tigers on the planet, Japan has tried everything (including asset purchases on a gargantuan scale) to break free from a decade of deflation. Nothing has worked: and now the effect of online shopping (the so-called Amazon effect) is worsening the situation further. Japan’s national debt stands at 239% of gdp.

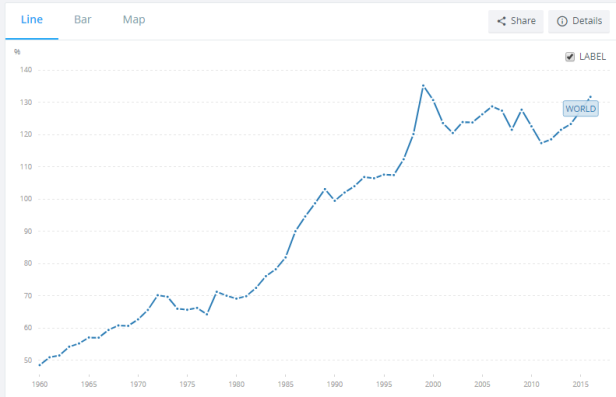

Debt among global consumers, however, is a far greater threat: it cannot be simply written off by one press of a central bank button. The simple chart below of household debt as a percentage of gdp makes the point very simply: 55 years ago, credit was only 50% of all purchases: now we spend 30% more than we’ve got:

Consider: despite all these signs that the world is on the wrong side of Alice’s looking glass – and with its own deficit ceiling rising like a soufflé on steroids each and every year – Yellin’ Janet and her fellow space cadets at the Fed still claim they intend to raise borrowing rates “progressively” (lerrrve that word) over the next two years.

Consider: we are told endlessly that the Chinese economy is in the midst of an extraordinary structural transformation — with a manufacturing-led producer model giving way to an increasingly powerful services-led consumer model. But we have yet to hear what these services are, and where these “consumers” are hiding. Headline growth rates of 6.7% are all very well, but since 2008, the share of wealth for the bottom 50% by population fell from 27% to 15%. Income inequality in China is now approaching a level that is almost comparable with the US.

Meanwhile, corporate debt in China is out of control: corporate debt alone is 170% of gdp, but while its leaders insist that new, wealthier consumers will drive demand internally, the politburo insists that it is hastening to ‘….integrate artificial intelligence, robotics, and social media into manufacturing processes, and to digitize China’s economy and society’. Or in short, throw millions of people out of work….as we have in the West. Clearly, Beijing can’t have it both ways: unemployed folks do not drive demand, they become a sovereign oncost.

There is an overall point to the Seven Samurai above: economics, financialised globalism and sovereign fiscality are not only in uncharted waters – there is no plimsoll line in operation…..so when the ship sinks under its own weight, there’ll be no rescue service for the passengers. Thunderbirds will not be Go. (And by the way, we the citizens are the passengers, not them)

But to be more pointedly specific, the core problem – the fatal flaw – is this:

Automation – and the general shift from physical to digital – is NOT being effected in order to solve demand problems and improve service: it is being applied to increase margins, boost profits, and thus make the 3% élite even richer than they are already. This reduces mass demand further and further, until the entire model of automated mass production produces two outcomes. First, enormous gluts and inevitable depression; and second, further dilution of spending power among the 70% mass of ordinary people.

It’s not good for one’s mental wellbeing to ponder the consequences of this too much….but somebody has to. As I pointed out last night, the migration problems are already apparent. There are also the health threats in nations where the social care infrastructure is falling apart (for example, Greece) and the violence that is inevitable once the neoliberal economic model starts to eat itself visibly. My view is still – despite all his idiocies – that if Trump isn’t allowed to get anywhere in defending Americans against Jihadists and globalist pauperisation, the US is where we will see the greatest violence, between an armed populace.

Even here in France – the one country most likely to reject inhuman forms of capitalism – the ethics and compassion are fast disappearing. Promises of auto-service turn out to be empty, and even “confirmations” of delivery are lies. Reductions in retail bank staff lead to the same queues there were forty years ago when syndicats and fonctionnaires ruled supreme. Every other robot service is hors de service, demotivated staff close shops early, and yet bubble-dwelling service providers continue to ask “what customers are moaning about”.

But my bourgeois common sense frustration with après vente bullshit is but a minor issue; the major fan/solids collision, once set off, is going to present a much larger problem for everyone from the most vulnerable pensioner to the most pompous autocrat.

Anything could set it off. The storming of the Bastille began after an aristocratic coach ran over a sans culotte child. There will be that straw moment when the back of tolerance is broken, and then – as with the USSR – copycat epidemiology will create an example quickly morphing into a pandemic of resistance.